The number of Bitcoin addresses containing more than 0.01 BTC has increased substantially in the past two months. The question remains if the reason behind it is the upcoming Halving in May, the economic uncertainty caused by the COVID-19 pandemic, or both.

BTC Addresses Go Up

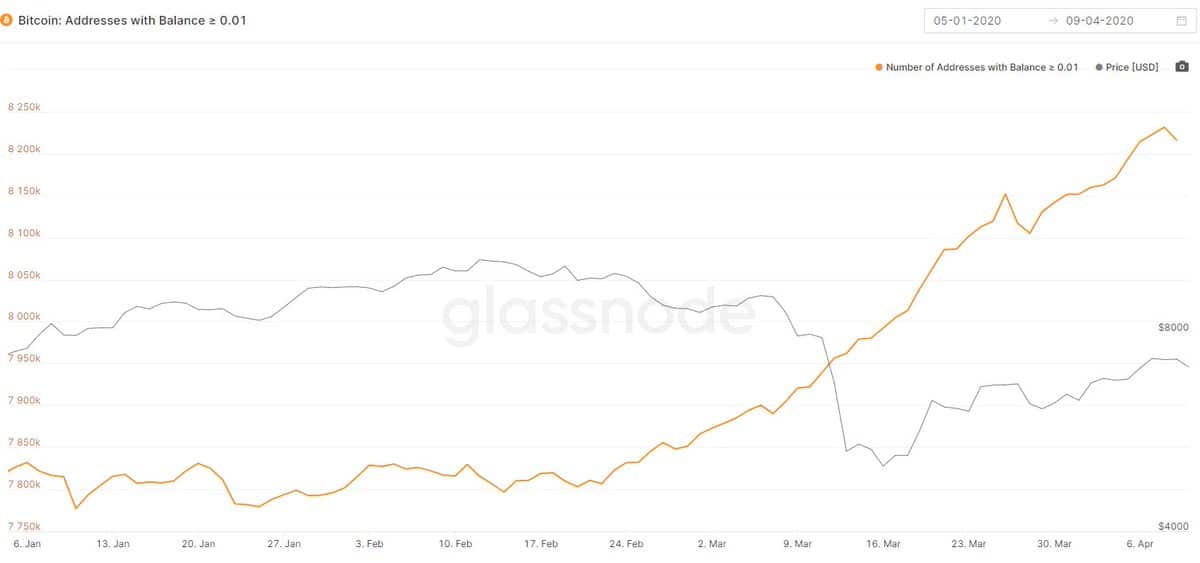

The popular cryptocurrency monitoring resource, Glassnode Insights, provided a chart regarding the number of Bitcoin addresses with at least 0.01 BTC in holdings (worth approximately $69 at the time of this writing.)

Slightly over 7,800,000 such addresses existed at the start of the year, as the graph indicates. The number was relatively steady in January and most of February, but then it started picking up speed.

Although the price of the largest cryptocurrency experienced a violent decline in mid-March, the number of addresses reached its peak a few days ago at over 8,200,000. This represents more than 400,000 new addresses or a 5% increase in a month.

Another compelling report from a few days ago also hinted that the interest in Bitcoin has been spiking up lately. The number of whales (having more than 1,000 BTC) has been surging in the past few months.

Halving, COVID-19, Or Both?

The data regarding the rising number of Bitcoin whales suggested that something similar occurred in 2016 – before the previous Halving. As, historically, the price of the primary digital asset has been surging in the year after the event, it seems logical to assume that this may be the main reason.

The situation now, though, might be a bit different. The COVID-19 outbreak caused jolts in the financial sector, leading to significant price slumps on all markets. At the start of March, it seemed as the world is heading towards another long-awaited recession. In times of uncertainty, people tend to rely on so-called safe havens, such as gold.

The virus, however, also disrupted the physical supply of the precious metal. The lack of actual gold and the high demand led to double and even triple premiums.

So if investors are unable to purchase gold because of the current circumstances, what are their options?

For starters, they can start accumulating the cryptocurrency that many have previously referred to as “digital gold.” And, if so, this could ultimately mean more new Bitcoin addresses.

The combination of the two is also a plausible reason. Or, maybe, it’s something entirely different.

It’s worth noting that new addresses don’t necessarily mean new Bitcoin users. A person can operate more than one. Generally, holders with more significant portions prefer splitting the amounts into different addresses for security reasons.

The post Interest in Bitcoin Rising: 430,000 New Wallets Created Over The Past 90 Days appeared first on CryptoPotato.

The post appeared first on CryptoPotato