We will increase the risk step on our XBTUSD Swap, ETHUSD Swap, and ADAU21, EOSU21, TRXU21 and XRPU21 Futures as detailed below, effective 31 August 2021 at 06:00 UTC.

We will increase the risk step on our XBTUSD Swap, ETHUSD Swap, and ADAU21, EOSU21, TRXU21 and XRPU21 Futures as detailed below, effective 31 August 2021 at 06:00 UTC.

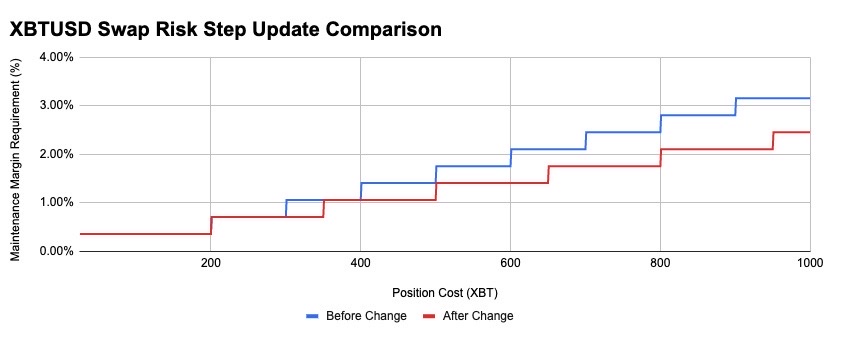

- The XBTUSD Swap Risk Step will increase from 100 to 150 XBT

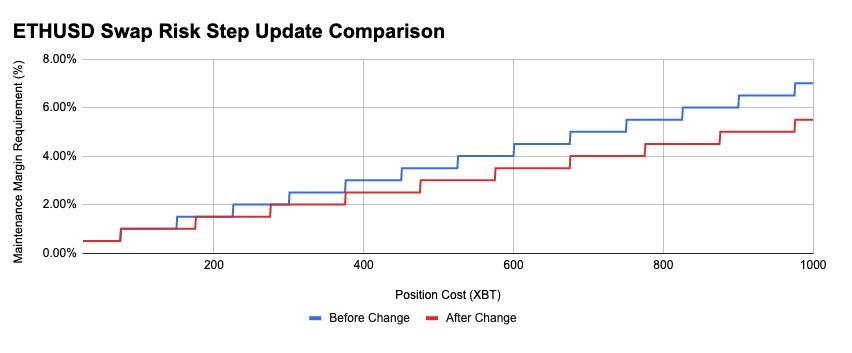

- The ETHUSD Swap Risk Step will increase from 75 to 100 XBT

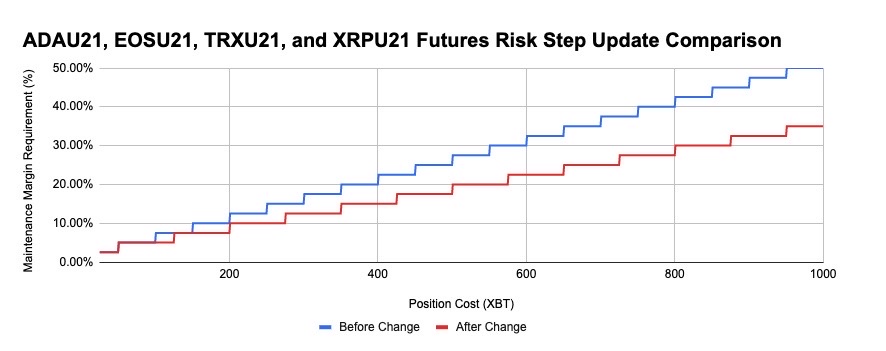

- The ADAU21, EOSU21, TRXU21 and XRPU21 Futures Risk Step will increase from 50 to 75 XBT

Here’s what it means for BitMEX users:

From 31 August at 06:00 UTC, those who have positions in the above-mentioned contracts with position size greater than the Base Risk Limit and First Risk Step will be immediately eligible for lower margin requirements.

There will be no changes to any of our Base Initial Margin or Base Maintenance Margin rates as this update relates to the size of position to which those rates apply. Users with positions at the Base Risk Limit and First Risk Step will continue to have the same market-leading margin requirements as before.

The Finer Details

Further details on the changes being implemented on 31 August can be found below:

- For all users:

-

- XBTUSD Swap Risk Step will increase from 100 to 150 XBT.

- ETHUSD Swap Risk Step will increase from 75 to 100 XBT.

- ADAU21, EOSU21, TRXU21, and XRPU21 Risk Step will increase from 50 to 75 XBT.

- Base Risk Limit on XBTUSD Swap, ETHUSD Swap, ADAU21, EOSU21, TRXU21, and XRPU21 Futures will be unaffected.

- Existing orders and trades will be unaffected.

- For users with positions greater than the Base Risk Limit and First Risk Step:

- Users with positions size greater than the Base Risk Limit and First Risk Step of the affected contracts will be eligible for lower margin requirements, as the change lowers the required Initial Margin and Maintenance Margin (but does not change any of our Initial Margin or Maintenance Margin rates).

- Example:

- Users with risk limits set at 400 XBT for the XBTUSD Swap will see their risk limit automatically increased to 500 XBT. If you fall into this category but have positions at or below 350 XBT, you will be able to manually lower your risk limits back to 350 XBT to enjoy smaller margin requirements.

- The ability to manually lower risk limits to enjoy smaller margin requirements will be available to users in higher risk limit tiers as well.

- The lower margin requirements described above only apply when the risk limit is lowered manually.

All of the risk limits on the BitMEX platform are determined by contract. For more details on the current risk limits on the affected contracts, please see here.

New Risk Limits (beginning 31 August at 06:00 UTC)

|

XBTUSD Swap |

||||

|

Risk Step |

Risk Limit (XBT) |

Min IM |

Max Leverage |

MM |

|

0 |

200 |

1.00% |

100 |

0.35% |

|

1 |

350 |

1.35% |

74.07 |

0.70% |

|

2 |

500 |

1.70% |

58.82 |

1.05% |

|

3 |

650 |

2.05% |

48.78 |

1.40% |

|

4 |

800 |

2.40% |

41.67 |

1.75% |

|

ETHUSD Swap |

||||

|

Risk Step |

Risk Limit (XBT) |

Min IM |

Max Leverage |

MM |

|

0 |

75 |

1.00% |

100 |

0.50% |

|

1 |

175 |

1.50% |

66.67 |

1.00% |

|

2 |

275 |

2.00% |

50 |

1.50% |

|

3 |

375 |

2.50% |

40 |

2.00% |

|

4 |

475 |

3.00% |

33.33 |

2.50% |

|

ADAU21, EOSU21, TRXU21, XRPU21 Futures |

||||

|

Risk Step |

Risk Limit (XBT) |

Min IM |

Max Leverage |

MM |

|

0 |

50 |

5.00% |

20 |

2.50% |

|

1 |

125 |

7.50% |

13.33 |

5.00% |

|

2 |

200 |

10.00% |

10 |

7.50% |

|

3 |

275 |

12.50% |

8 |

10.00% |

|

4 |

350 |

15.00% |

6.67 |

12.50% |

Graphs showcasing the differences below:

We know that the more we listen to our traders, the better informed we’ll be to make changes like these that are beneficial for all.

If you have any questions or feedback about this change, please reach out to Support.

Happy trading!

Related

The post appeared first on Blog BitMex