[Featured Content]

Decentralized Finance (DeFi) took the crypto field by a storm in 2020. The total value locked in various DeFi protocols is just under $10 billion, at the time of this writing.

If this doesn’t sound impressive, consider the fact that this number was just about $570 million in March. In other words, the market grew by an astounding 1607%.

Much of it was led by Uniswap, being the leading automated market maker and decentralized exchange. However, as the market matures, new solutions are coming to light and some of them aim to bring more than what Uniswap’s currently offering.

One protocol of the kind is OneSwap.

What is OneSwap and How is it Different?

OneSwap is a trading service platform based on the permissionless listing of decentralized exchanges (DEX). It also provides the good practices of automated market maker (AMM) projects, while also introducing an on-chain order book on the basis of the CFMM model to further improve the experience for AMM traders.

This particular combination provides users with the convenience of limit trading orders – something that Uniswap lacks and it also enhances the overall liquidity of digital assets.

The platform features an interactive and intuitive trading interface as well as a one-click currency issuance tool in the OneSwap Wallet which comes along with it.

Apart from the built-in wallet, the platform also comes with token repurchase and burn functionalities, on-chain governance, mining incentives, candlestick charts, and a depth map.

The public beta started on September 8th, featuring yield farming and transaction mining, while the official launch was on September 19th.

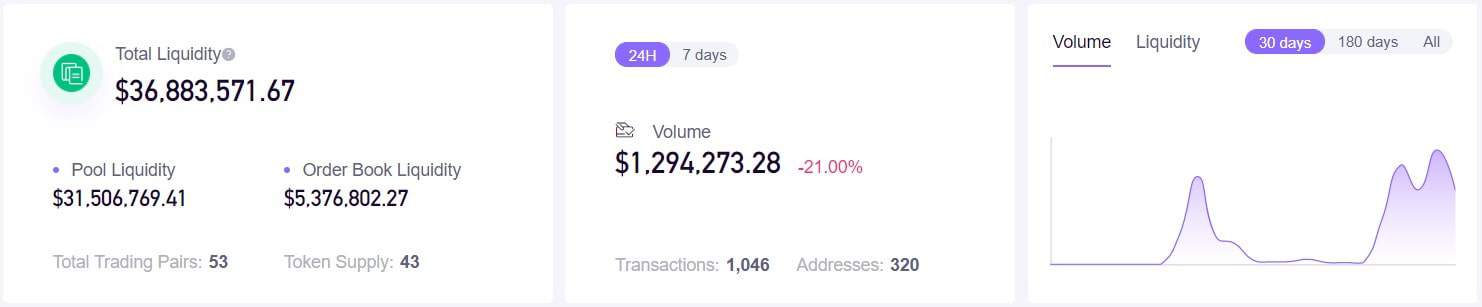

At the time of this writing, Oneswap boasts a total trading volume of more than $7.4 million since launch, where the total liquidity is around $36million.

OneSwap’s Architecture

Another important thing to discuss is the architecture of the protocol. OneSwap, deployed on each blockchain, comes with a series of capital pools. They are referred to with the transaction pair contract.

Each contract consists of three parts. Namely, these are the on-chain order book, the CPMM model which is the constant product market maker providing liquidity for that contract, and the equity tokens that record the privileges of the liquidity providers.

As soon as the liquidity provider injects digital assets in the capital pool of the given Pair contract, the latter will mint new equity tokens for the liquidity providers. The number of these tokens is based on the current size of the pool, as well as on the total amount of equity tokens that have been issued, as well as the current injections.

On the other hand, when the liquidity provider wants to retrieve their funds, the Pair contract is going to return the funds according to the corresponding proportion of the equity tokens and burn those equity tokens.

The ONES Token

OneSwap also has its ERC20-based governance token issued on Ethereum’s network and it’s called ONES.

It’s a deflationary token and according to the whitepaper, 40% of the transaction fees that are generated on the platform will be used to repurchase and burn ONES. This happens automatically and the burn goes through the BuyBack.

In addition, the on-chain governance of OneSwap happens through proposals and community voting where users who have enough ONES tokens (more than 1% of the total supply) can bring proposals up for discussion and votes. Any user who holds the token can vote against or for the proposal.

ONES now has been listed on CoinEx, Lbank, and MXC.

Conclusion

In general, OneSwap looks like an interesting project to consider in the current DeFi landscape. It does bring a few new exciting features, while also coming with the expected stack of technology that users are already accustomed to.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato