The last few weeks have only supported the argument that Bitcoin, the world’s largest cryptocurrency, remains highly correlated to the market’s altcoins. This, despite the fact that over the past few months, these alts have all recorded strong performances, some independent of BTC’s own movement. However, when BTC fell on 2-3rd September, so did the rest of the market. When BTC fell again by close to $500 a few days ago, so did the market’s altcoins, with Chainlink, IOTA, and Dash being among them.

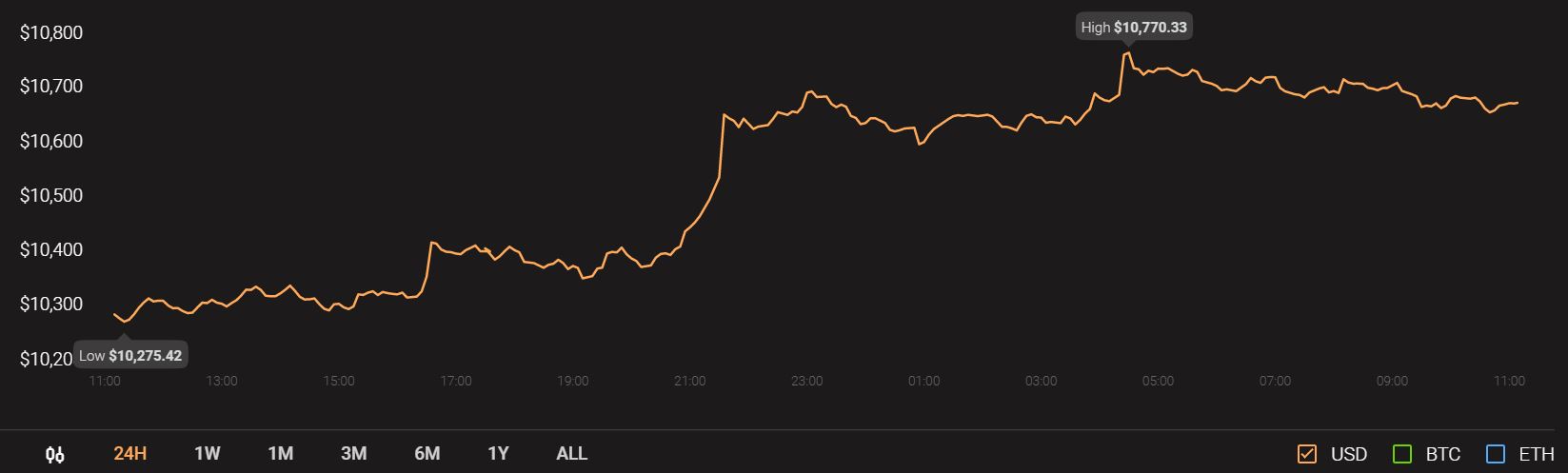

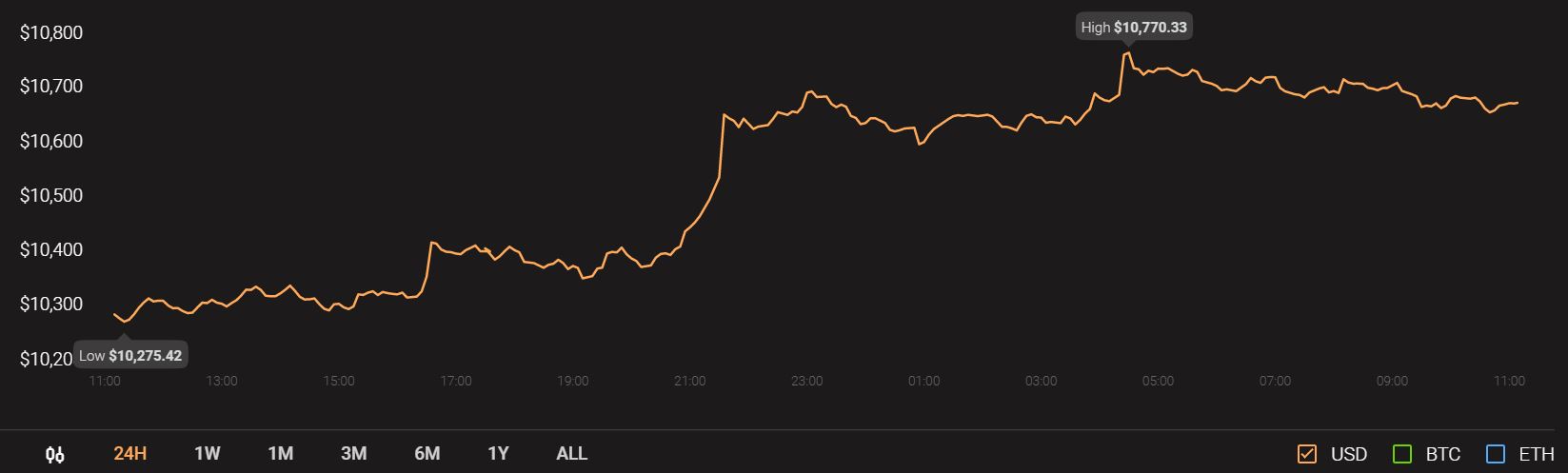

Source: CoinStats

At press time Bitcoin has retained its position above $10k and is being traded at $10,677.

Chainlink [LINK]

Source: LINK/USD on TradingView

Chainlink, the eighth-largest cryptocurrency by market cap, has had a good 2020, with LINK recording YTD gains of 445%, at the time of writing. However, these figures would have been much higher had LINK not fallen from its ATH from over a month ago. Over the past week, corresponding to Bitcoin’s own fall, LINK fell by over 30% on the charts. The same was accompanied by reports which suggested that the crypto’s developers were selling off their holdings.

It should be noted that at press time a recovery was in order since the last 48 hours had seen the crypto rise by almost 30%.

Despite the sheer scale of the aforementioned recovery, LINK’s technical indicators continued to lean towards the bearish side as while the Parabolic SAR’s dotted markers were well above the price candles, the MACD line was below the Signal line. Unless either of these indicators switches to give bullish signals, a trend reversal will be difficult to see.

LINK was in the news recently after Travala.com announced that it will be integrating LINK payments onto its platform.

IOTA

Source: IOTA/USD on TradingView

IOTA, once one of the market’s top cryptocurrencies, had fallen down to the 28th position on CoinMarketCap’s charts, at press time. Like Chainlink, IOTA’s movements over the past week also mirrored Bitcoin. However, that’s not all as, like LINK, IOTA too was climbing over the last 48 hours. In fact, the aforementioned uptick in IOTA’s value came on the back of a descent that saw the crypto fall by almost 18% on the charts.

While the mouth of the Bollinger Bands was slightly wide to make room for incoming price volatility, the Awesome Oscillator was noting a mixture of bullish and bearish momentum on the bearish side.

In a recent blogpost, the IOTA Foundation announced the successful deployment of Chrysalis Phase 1 components on the IOTA network.

DASH

Source: DASH/USD on TradingView

One of the crypto-market’s premier privacy coins, DASH has lost its previous position and a lot of is market share over the past few months. The 30th-ranked cryptocurrency, like the other two cryptos on this list, noted a dramatic fall when Bitcoin fell, before recovering somewhat over the last 48 hours. Despite the said recovery, however, DASH was still trading well below its highs from just a month ago, with the downtrend very evident on Dash’s charts.

While the Chaikin Money Flow was well over zero and suggested healthy capital inflows into the market, the Relative Strength Index was very close to the oversold zone, a finding that suggested that sellers may soon gain some momentum in the market.

The post appeared first on AMBCrypto