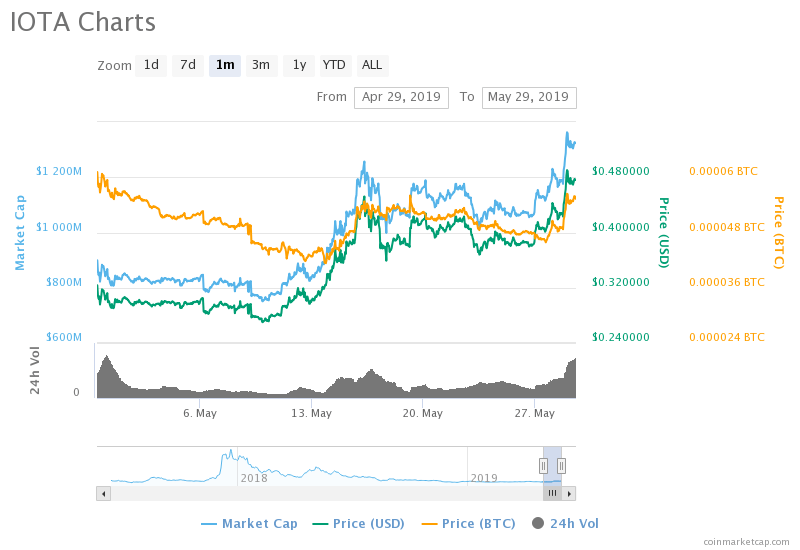

By CCN: IOTA price has appreciated more than 11-percent against the US dollar and circa 13-percent against bitcoin in the last 24 hours.

The internet-of-things cryptocurrency, which is also the world’s fifteenth largest by market capitalization, peaked towards $0.507 on May 28 at 1915 UTC, its highest since November 14, 2018, according to Binance exchange data. That took IOTA’s gains this year to above 37-percent, including a 58.14-percent rise this month.

IOTA daily volumes showed the coin changing maximum hands to/from Bitcoin’s BTC, Tether’ stablecoin USDT, and the US dollar, according to data provided by CoinMarketCap.com. On the whole, exchanges posted $90 million worth of IOTA-enabled trades, with Malta-based Binance taking the lead by hosting more than 40-percent of the total daily volume.

One Strong Fundamental

IOTA’s intraday gains closely followed the IOTA Foundation’s effort to make its blockchain more decentralized. The nonprofit announced Tuesday that it is brushing off Coordinator, a centralized protocol that was handling transactions and security on the IOTA blockchain to the date.

“We have been working towards the removal of the Coordinator since IOTA’s inception. Now with the maturity and growth of the protocol and the quality of our research team, we are bringing that promise to fruition,” said David Sønstebø, the co-founder of IOTA Foundation.

IOTA Announces Coordicide Solution: A Distributed Ledger Technology which Removes the Barriers to Real-World Adoption. https://t.co/g7qdimiDew

More details on https://t.co/Gx8P2tMgtH#IOTA #Coordicide— IOTA (@iotatoken) May 28, 2019

The foundation on Tuesday replaced Coordinator with a “modular” mechanism that promises to make the IOTA blockchain easily scalable, cheaper-to-use, and, nonetheless, totally decentralized. Mr. Sønstebø added:

“IOTA was designed to address the limitations of Blockchain with a feeless and scalable solution. That is now becoming a reality. With this major milestone, we are poised to accelerate into our next phase of growth and enterprise adoption in the real world.”

The announcement might have played a key role in determining IOTA’s bullish bias on the day when the majority of digital assets, including bitcoin, were seen plunging. The absence of adequate fiat capital injection suggested that traders might have hedged into IOTA by taking cues of the announcement as mentioned above.

Opportunities

IOTA price is awaiting a small breakout. | SOURCE: TRADINGVIEW.COM, BINANCE

The IOTA price uptrend appears to have a concrete footing in the rising trendline depicted in black in the chart above. A sharp pullback could, therefore, prompt day traders to set their short targets towards the said trendline. At the same time, a small correction to the downside would have them test $0.464 as interim support.

Conversely, the IOTA uptrend could continue higher in the medium-term, given the strong optimism in the overall cryptocurrency market. The asset’s next bull target is near $0.53, a level that served as both support and resistance between September 8 and November 6 trading session last year.

Among other cryptocurrencies, Bitcoin (BTC) on Wednesday adjusted its overbought signals and corrected lower by up to 3.28-percent to $8426.09 on Coinbase. Ethereum (ETH), the second largest digital asset, also dropped by as much as 4.05-percent. Only Ripple (XRP) and Bitcoin Cash (BCH) managed to post decent gains on a 24-hour adjusted timeframe. While BCH surged by 1.18-percent, XRP settled a little ahead with 1.84-percent profits.

Click here for a real-time IOTA price chart.

The post appeared first on CCN