Bitcoin is a decentralized p2p asset class that has gained worldwide popularity and has a market cap of $350 billion. But how decentralized is bitcoin?

Before we actually get into that, let’s break down the word “decentralized”.

Generally, decentralized is something that’s not concentrated and centralized. To bitcoin, the term ‘decentralized’ is mainly attributed due to the nature of the digital ledgers it holds. As a thought experiment, its meaning can be extended to apply to people who use bitcoin, or users that bitcoin has and how the price varies based on this.

So, how “decentralized” is bitcoin but in terms of its price movements?.

Bitcoin is an asset used by people across the world. However, most of the adoption, hence usage, seems to be happening in the countries with proper regulation.

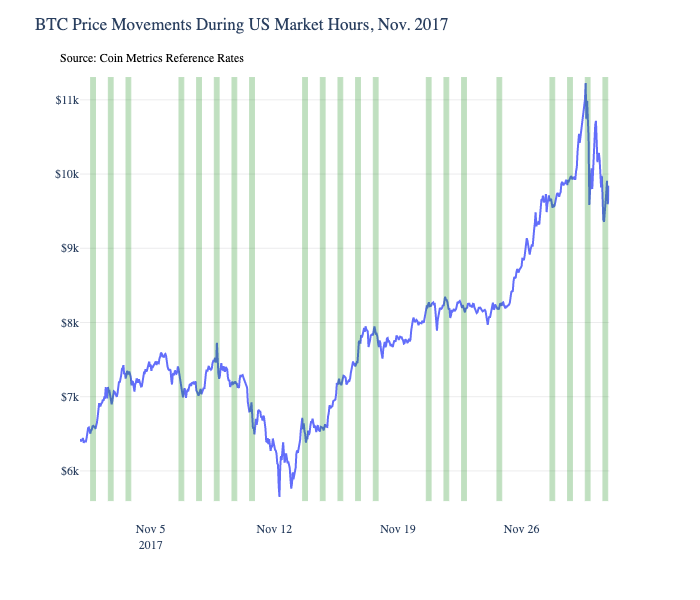

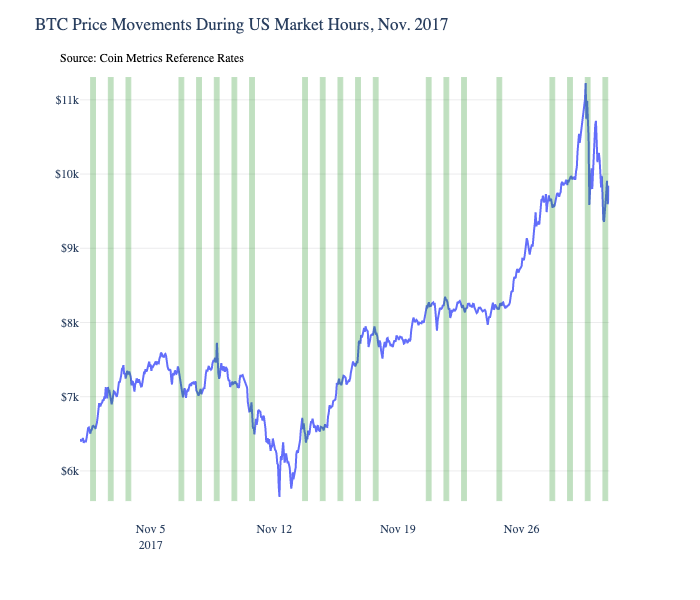

Even more importantly, it is happening in the US, not Europe, not India, but in the US. Take, the weekend price data of bitcoin, ie., when the US markets are closed, and compare it to when they are open.

We learn that there is an interesting connection, that the bitcoin market moves more than when the US markets are open. In fact, bitcoin’s hourly returns were about 0.1% during market open hours compared to about 0.04% when markets were closed.

Source: Coinmetrics

To this, Coinmetrics stated in their report, that the sample size, although small, and does not necessarily provide a definitive answer,

“We are starting to see some interesting evidence of growing institutional involvement, and will continue to investigate and dive deeper moving forward”

What does this mean?

Bitcoin is largely concentrated in the US, mostly due to its openness to new technology. The US was among the first to regulate cryptocurrencies and provide clear rules on its classification as a new asset class, taxing it, etc. The same was seen in Singapore, Europe, etc.

Hence, in these regions, there are investors exploring this asset class. However, in countries like India, where an outright ban was enforced by the central bank, not so much. In fact, a survey conducted by an Indian exchange CoinDCS showed that people are still finding it difficult to invest in bitcoin.

In countries with clear regulation, institutional investors have the opportunity to take advantage of bitcoin’s massive returns. Rightfully so, many companies and individual investors have done the same. Unlike retail, institutional investors are the big money and hence, move the price on a much larger time frame.

Despite being decentralized, bitcoin and the broader crypto market is localized to the US markets. While other countries are slow to regulate, some are catching up to bitcoin and hopefully, in the future, bitcoin becomes a truly decentralized global market.

The post appeared first on AMBCrypto