132 days post the third halving and Bitcoin is trading at $10450. The price has recovered nearly 25% from the post halving dip, it hit a high of 43.7% ROI last month. The ROI growth is in line with post halving prediction with YTD of 54%.

Source: Ecoinometrics

Though there is scope for real growth in price, above December 2017 level, the growth cannot be entirely attributed to the pandemic or Bitcoin’s correlation with Gold, Silver or the USD. There are several triggers along the way that led to the boost in price.

DeFi’s explosive growth did for Bitcoin what ICOs did back in 2017. Before the ICO bubble burst, when top ICO projects like Filecoin, Namecoin, and Tezos raised funds from investors, they were held in Bitcoin and this significantly increased the demand for Bitcoin on spot exchanges. The investment raised by these ICO projects was held in Bitcoin wallets on exchanges or offline and this added to the scarcity in supply, by driving demand across exchanges, globally.

With $9.77 billion locked in DeFi and projects like Yield Farming that have surpassed Bitcoin’s price, DeFi’s TVL is giving a boost for the demand of top cryptocurrencies like Bitcoin and Ethereum. The increased demand along with scarce supply may drive the price to 2017 levels by the end of 2020. Bitcoin Influencer A Pompliano is quoted commenting on the scarcity of supply in an interview with ET.com,

“Any time that you have got an asset that has scarce supply, people are going to be interested because as we know if the supply is capped and demand increases, of course, the price goes up”

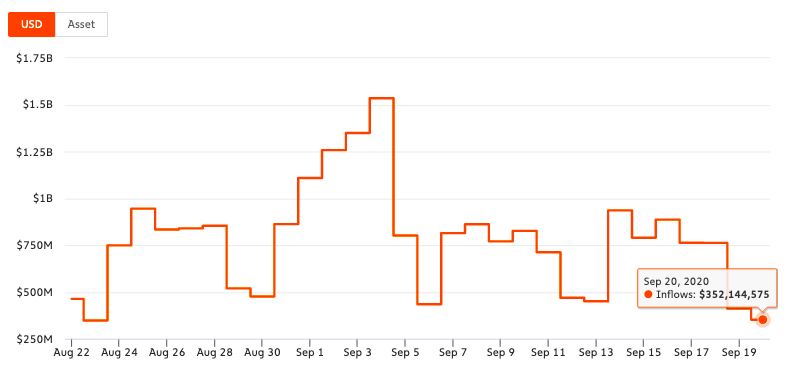

This scarcity is visible on exchanges, where Bitcoin inflow is the lowest in 180 days.

Source: Chainalysis

When the inflow goes up on exchanges, based on trigger events like increased open interest by institutional investors on CME or movement of BTC by HODLers/ Whales, the price may fluctuate based on our position in the market cycle.

Based on the Ecoinometrics chart above, there is scope for growth beyond the $19k price level and this depends on the next price rally. Institutional investors like MicroStrategy can drive the price higher by creating demand for the asset and its options/ futures. Growth attained post triggers will continue to be conservative, however, it is not as conservative as Gold or Stocks, hence the rewards are higher in the current phase of the market cycle. When the price hits the $19k level, then growth may get real.

The post appeared first on AMBCrypto