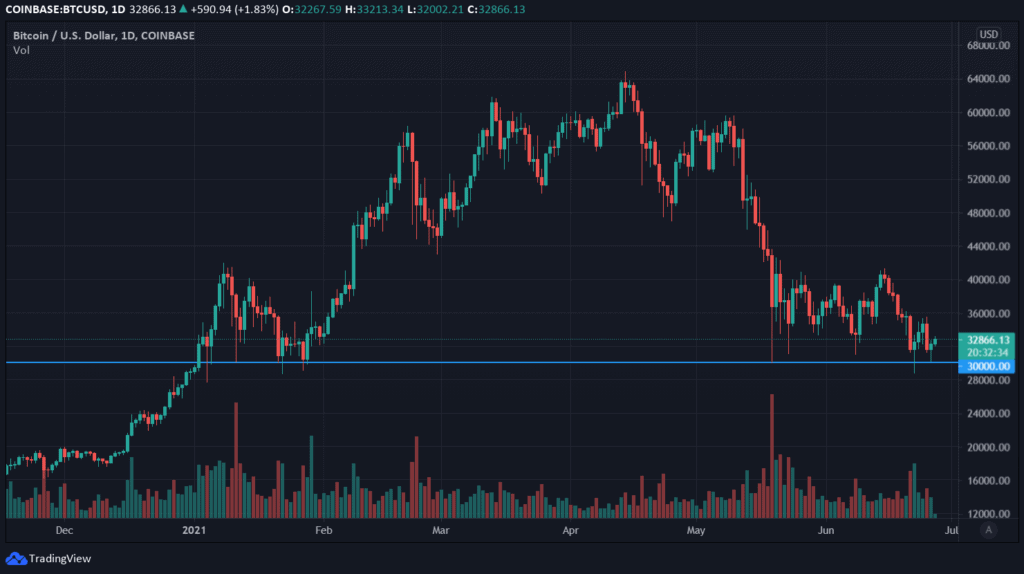

If Bitcoin’s fall grom $62,000 to the perilous $30,000 mark seems scary, then buckle up: Some analysts believe it could get even worse… And if conditions remain the same, that is very likely to be the case.

The sharp drop from $60,000, the arrival of the infamous death cross, the bad news coming out of China, and the lack of institutional appetite seem to be acting together to maintain a bearish mood in the markets and laying the groundwork for a brutal, cold crypto winter.

Brace yourselves… Crypto Winter is Coming

In a statement compiled by The Wall Street Journal, DailyFX analyst Peter Hanks said that it is easier to see red candles than green on price charts for the foreseeable future.

“I think bitcoin is certainly headed for more losses here … If it breaks [below $30,000], then crypto winter is certainly back on the docket.”

Bitcoin bulls have been able to hold the $30,000 price line, even though some bearish attempts have been fruitful and prices have briefly dipped below this zone. However, for the time being, $30,000 has cemented itself as strong price support.

Other experts such as J.P. Morgan analyst Nikolaos Panigirtzoglou have an explanation closer to market sentiment analysis rather than technical indicators per se. In a recent report, he explains that from his point of view, Bitcoin has not yet gained the trust of institutions, so not enough money has flowed into the markets.

ADVERTISEMENT

“More than a month after the May 19th crypto crash, bitcoin funds continue to bleed. Institutional investors, who tend to invest via regulated vehicles such as publicly listed bitcoin funds or CME Bitcoin futures, still exhibit little appetite to buy the bitcoin dip.

There is Room For a New Boom

However, not everyone is sure that this cold snap will turn into a freezings crypto winter.

For example, Sam Bankman-Fried, CEO of cryptocurrency exchange FTX said that institutions are eager to invest in cryptocurrencies; they are just waiting for the right time or don’t really have a full understanding of the market.

The first thing that we do is we just listen, right? We’re like, look, what’s what’s your goal here? What you actually want to do? And then we can say, all right, cool, here’s how the industry works right now. Ignoring what you said. Here’s this, here’s the lay of the land. […] We want to be a day away from pulling the trigger on a big deal.

Another who also thinks that – at least in the short term – the markets have bottomed out is John Bollinger himself, creator of the famous technical indicator that bears his name.

In a recent interview, he talked about a potential bottom around $30k, which earned him an avalanche of support on Twitter.

I don’t know what I could have been thinking, but I agreed to do @UpOnlyTV today. In any case I am ready, but I wonder if they are? Got a potential bottom in #Bitcoin to talk about, so at least there won’t be a lot of awkward silence…

— John Bollinger (@bbands) June 22, 2021

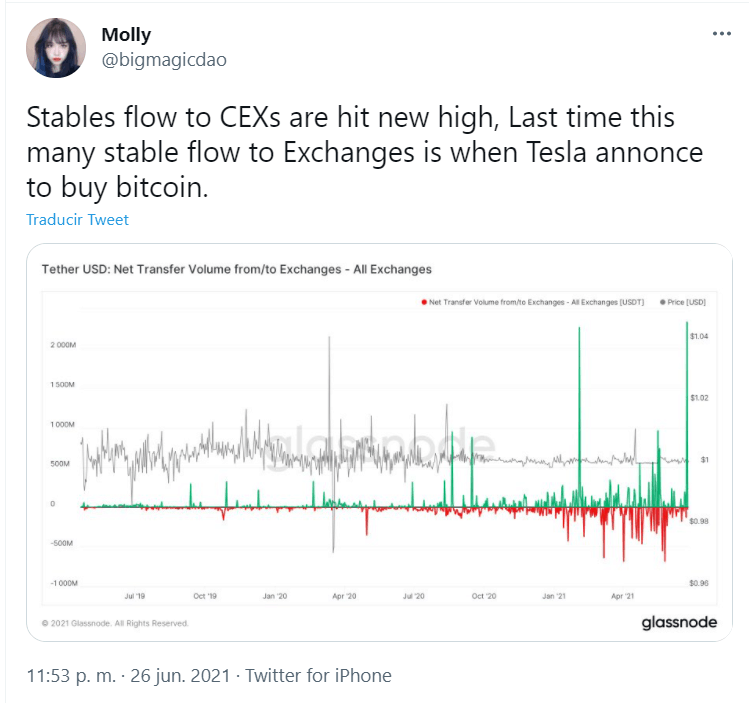

Molly, Head of Marketing at HashKey Hub, also shared a statistic that may provide a little light at the end of the tunnel. Never has so much stablecoins entered centralized exchanges since the days when Elon Musk announced that Tesla had bought Bitcoin.

If good things happen to repeat themselves, this money could go into buying Bitcoin, contributing to further upward pressure.

From there to skipping winter to a new spring is a long way off, but the wait sure be interesting.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to 1 BTC.

The post appeared first on CryptoPotato