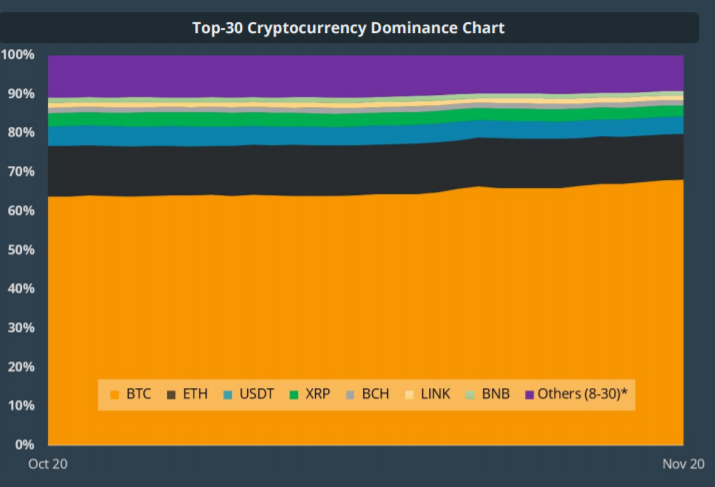

Every dollar increase in Bitcoin’s price is a testament to its worth in the cryptocurrency pie. Despite there being over 2000 coins in the market, Bitcoin’s undeniable importance is underlined by its share in the entire coin market.

According to the October report from cryptocurrency data analytics company CoinGecko, among the top cryptocurrencies by market capitalization, only one increased its share of the total crypto pie. Over the previous month, Bitcoin gained by 4.5 percent in terms of market capitalization, an increase that amounted to over $2 billion as the price rose by over 12 percent over the month.

To put this in perspective, no other major cryptocurrency gained in market share. In fact, most top altcoins fell. For instance, Ether held 11.5 percent of the market cap by 31 October, a fall of 1.3 percent on a month-on-month basis. Other altcoins giving up market share to Bitcoin were Tether, Binance Coin, and XRP, while the hard fork Bitcoin Cash and LINK didn’t see any changes.

In the aforementioned report, CoinGecko noted that alts losing ground to the world’s largest cryptocurrency could be a signal of the altseason being subsided by the Bitcoin bull run. It stated,

“This could be a signal that alt-cycle is slowing down as investors move back heavy into Bitcoin in their portfolio allocation.”

Ether’s slip against Bitcoin has been more of a recent theme. Back in Q1 of 2020, Ether gained by 0.8 percent in market share, increasing its share to 8.47 percent to Bitcoin’s 67.8 percent as Bitcoin began the year at $7,200 and dropped to $5,500. During Q1, Bitcoin lost 3.5 percent of the entire crypto-market as Tether was the biggest gainer with a 1.1 percent share, potentially benefiting from the need to store a stable currency, over a volatile one.

In Q2, between April and June, Bitcoin gained by 0.3 percent, even as Ether was the highest gainer at 1.6 percent. Even other major altcoins including XRP, Bitcoin Cash, Bitcoin SV, and Litecoin lost market share. The price increase didn’t benefit Bitcoin that much either because in Q3, between July and September, as Bitcoin started strong and withered away, it lost a whopping 6.6 percent of the entire market.

Ether holding firm at around $400 managed to gain by 2.3 percent. The Bitcoin market share was equally taken in by most altcoins as everything from exchange tokens (BNB) to stablecoins (USDT) gained market share.

Overall, Bitcoin has reached its June highs as far as market capitalization is concerned, and with the price climbing to yet another high as alts look muted, the pie is going to be increasingly eaten up by Bitcoin.

The post appeared first on AMBCrypto