Bitcoin has been in existence for 11 years since its inception in 2008. During this period, Bitcoin rose by nearly 131,000 from obscurity to the end of 2017, an increase of tens of millions of times. This has also created billions of myths in the currency circle one after another.

Although Bitcoin is still around $10,000, the constant drop in the middle of the cliff has also made the users of the currency circle suffer. The dream of entering the currency circle to realize the freedom of wealth was smashed again and again by the baptism of the market. How to stand in front of the wind and seize the right time to make accurate investment has become a big problem for users.

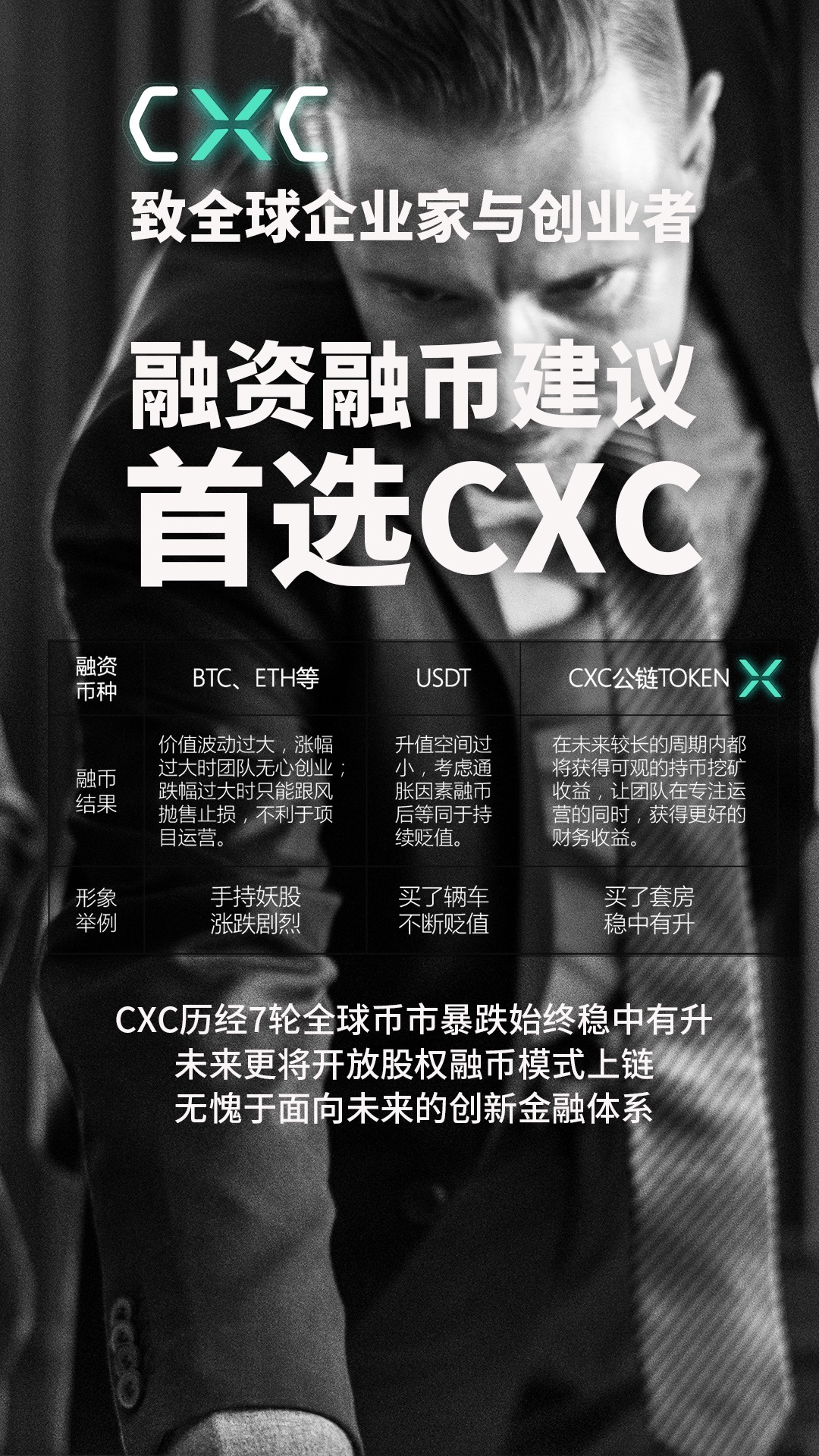

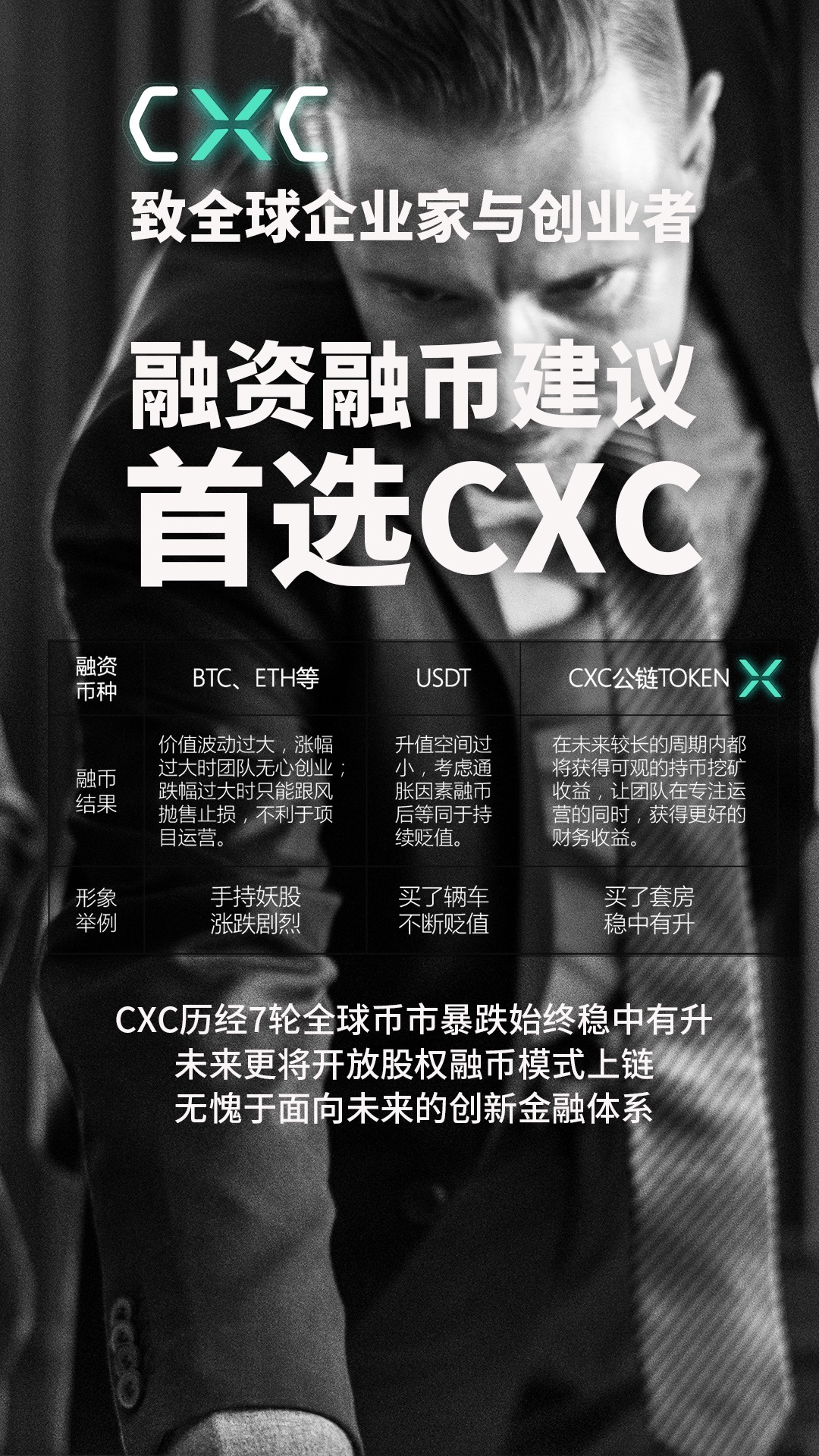

Today, the editor will focus on how to invest in a unicorn in advance. And the preferred currency for financing and currency exchange.

Users entering the currency circle can feel the changes in the overall market situation of the blockchain and the coming of the winter. In the first half of 2018, the entire market was in good shape, and many projects were financed on the basis of Bitcoin and Ethereum, and these projects are booming.

However, in the second half of 2018, Bitcoin fell to around 4,000 US dollars, Ethereum fell below 100 US dollars, a large number of blockchain companies continue to lay off workers for the winter, a large number of projects continue to break out, users are more painful. Although the market warmed up in 2019, Bitcoin rose to 10,000 US dollars, but the project is still in a bear market.

Many public chains and projects based on ERC20 issuing tokens have plummeted, even falling below 10,000 times, and directly below the issue price. Not to mention that this project gives users a reward mechanism.

In July, a long-term booming project, CXC, rose to 770%. Even after seven rounds of collapse in the global money market, CXC is able to maintain steady growth and moderate growth, in line with anti-inflation real estate.

CXC has the function of maintaining value and steadily increasing value. This also reflects that if a project can survive the severe winter market and stabilize its market value, it can not only reflect the strength of the project, but also discover the precise layout of the project to the market and the loyalty of users to the project.

In general, CXC has undoubtedly become the first choice for many project parties, investors in investment and financing, compared to the more volatile BTC and ETH, and the stable but persistent depreciation of the USDT.

The post appeared first on CoinSpeaker