Most people enter the cryptocurrency market with the sole purpose of making profits by investing, trading, or hodling. This is quite understandable, and for them, prices are the most crucial factor. Furthermore, they can get into real in-depth details to notice some positive or negative changes in the last day, week, month, or even a year.

One of the interesting things to consider is whether there is a correlation between the number of active addresses and the prices of different cryptocurrencies.

Prices And Addresses

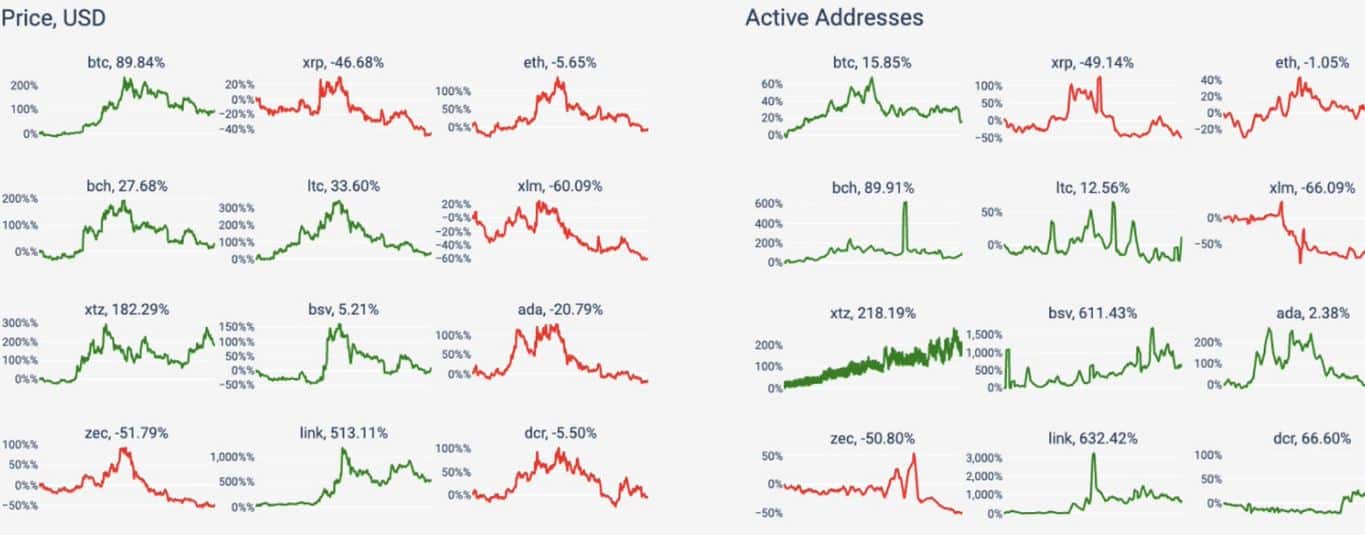

We know that the price of certain assets depends on numerous factors, such as fundamentals, trading volume, supply, demand, and so forth. The popular cryptocurrency monitoring resource, CoinMetrics, published another type of plausible price dependence – the number of active addresses. The report compiles data from January 1st, 2019 to December 31st, the same year.

By looking at the number of unique addresses in a particular network, one can more or less get a picture of how many users there are. It’s worth noting, though, that a single person can operate more than one address; therefore, these numbers represent the maximum possible users, but the actual number of daily users could be lower.

Cryptocurrency Data. Source: CoinMetrics

What Does It Tell Us?

So here’s the graphic showing red and green and so what? Let’s take, for example, Bitcoin. The largest cryptocurrency by market capitalization started last year at around $3,750 and finished at about $7,130, which represents an increase of about 90%, the report shows equal data. Interestingly enough, the number of active Bitcoin addresses has also surged by almost 16%.

Well, let’s continue examining the green data (first). Bitcoin Cash, currently placed 5th, has recorded an astonishing rise when it comes down to active addresses – almost 90%. At the same time, BCH’s price increased by 27.68%, according to the report.

Litecoin is also in the green in both categories – 12.56% climb in the number of addresses, and 33.60% in price. Tezos gathered notable steam during 2019, recording increases of 218% and 182%, respectively.

Bitcoin SV is the second-largest active addresses’ gainer with a 611% surge, while the price has been much more modest – only 5.21%.

And the 2019 winner is undoubtedly ChainLink (Link). It provides unmatched percentage increases, where its price skyrocketed with 513% and at one time was even at over 1,000%. Even larger is the number of active addresses – over 630% yearly increase but also at one point was over 3,000%.

Red On The Chart

As it usually happens, when there’s a positive movement, there must be a negative one as well. The second and third largest cryptocurrencies, Ethereum and Ripple, are both in the red. ETH’s price has dropped during 2019 with 5.65%, while the number of addresses is down with a little over 1%. XRP’s declines are more hurtful – 46.68% and 49.14%, respectively.

Stellar is also recording negative symptoms. XLM’s price plunges with 60%, and at the same time, active addresses are down with 66%. The same can be said for Zcash, showing around 51% declines in both categories.

The Exceptions

It’s well-known – every rule has its own exception, and this graph is no different. While the examples from the previous two paragraphs show cryptocurrencies recording losses or gains in both categories, there’re two cases provided with opposite data.

The first one is Cardano. ADA’s price didn’t have the best year, indicating a sizeable decline of over 20%. Yet, at the same time, the number of active addresses has risen slightly, with 2.38%.

Decred also shows a similar example, but its price has dropped only with 5.50%, while the addresses have surged with over 66%.

Conclusion

It’s still unclear if the number of active addresses has an actual impact on the price of a specific cryptocurrency. However, it’s interesting to see how, in most cases, both of these have experienced the same type of development in one year. It may be safe to assume that the more addresses are opened, the interest towards that asset increases, and vice-versa.

You might also like:

The post appeared first on CryptoPotato