The sudden breakout of the coronavirus in China and its continuous spread might already be taking its toll on the local and even global economy. In a recent statement, the Japanese Economy Minister said that he believes corporate profits and factory production are taking serious hits. And while major indexes are charting losses across the board, Bitcoin and gold continue their increase.

Coronavirus Impacts The Economy

The Japanese Economy Minister Yasutoshi Nishimura recently stated that the coronavirus outbreak is causing serious threats to the global economy. On a local level, he said that he’s concerned a lot, especially when it comes to tourism. Chinese tourists account for 30% of the people who visit Japan for that purpose. As such, transportation hurdles, as well as cancellations are among the minister’s prime concerns. If China’s affected cities remain closed, Nishimura fears that it will have more negative consequences on the Japanese economy:

“If the situation takes longer to subside, we’re concerned it could hurt Japanese exports, output, and corporate profits via the impact on Chinese consumption and production. “

According to Hideo Kumano, chief economist at Dai-ichi Life Research Institute, the decline in Chinese tourists could decrease Japan’s GDP growth by 0.2%. Moreover, he is also worried that this could negatively impact the upcoming 2020 Tokyo Olympic Games.

Some of the most notable names in the automotive industries have operations in Wuhan – the epicenter of the virus. The Japanese giants Nissan and Honda are among them, according to a recent report. Apparently, Nissan is planning to evacuate employees from the city, while Honda is already in the process of doing so.

Coronavirus Takes A Toll On Global Markets

The most common Japanese stock index – the Nikkei 225 is already feeling an adverse effect, with a 2.9% decrease in a full day. Other Asian indexes are performing similarly bad. Thailand’s SET index is down with the same percentage, while South Korea KOSPI is down 3.2%. As Cryptopotato reported, major international indexes such as the FTSE100 are also charting slight losses.

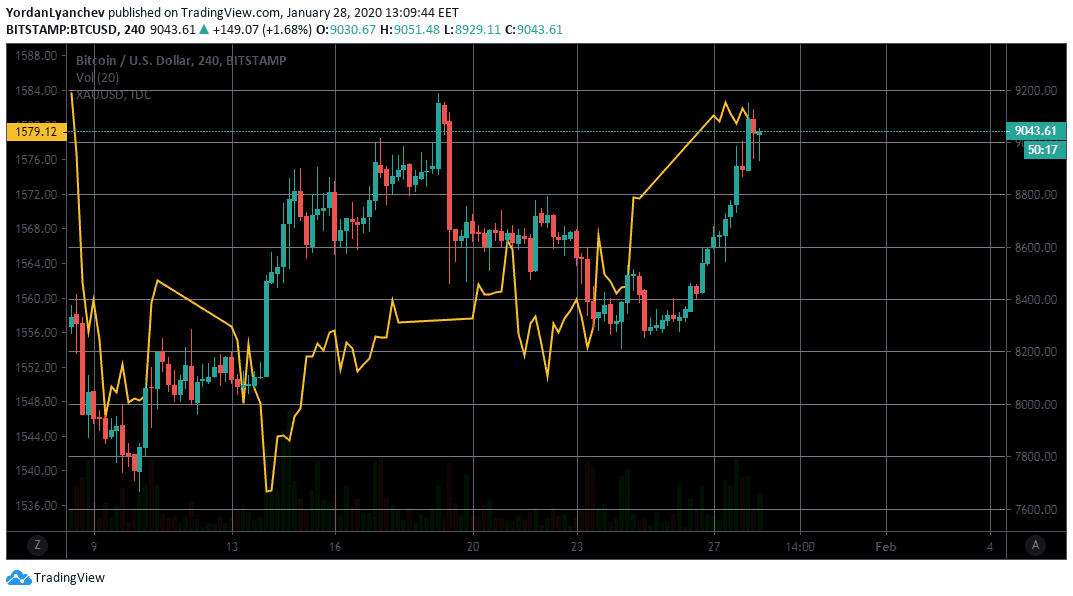

Contrary, Gold and Bitcoin are noticing price increases. The precious metal’s climb comes with 1.28% in the last few trading days. The largest cryptocurrency records an even higher ascend of over 8% since yesterday.

BTC/USD Compared With XAU/USD. Source: TradingView

As popular economic theories hold, Gold is generally the go-to financial asset whenever the global markets take a hit. However, the precious metal might have some competition in this manner. Bitcoin has so far demonstrated a negative correlation with traditional markets and it might be the case that investors are looking at it as a hedge in times of economic uncertainty.

The post appeared first on CryptoPotato