Top-Tier Exchange Volumes Surge, Gaining Market Share

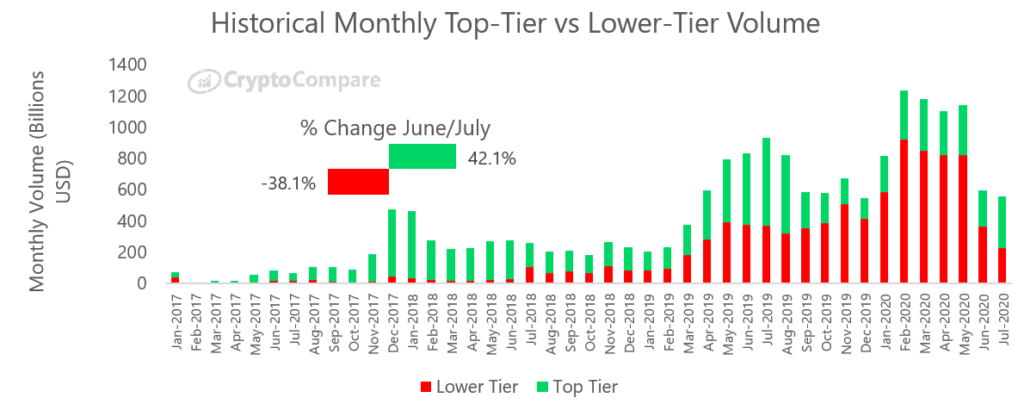

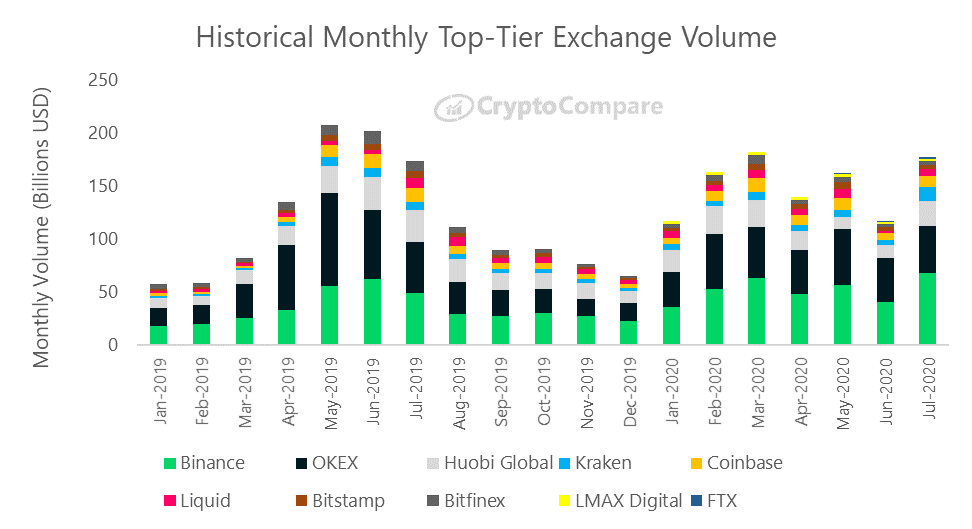

In July, Top-Tier volumes increased 42.1% to $334bn while Lower-Tier volumes decreased 38.1% to $224bn. Top-Tier exchanges now represent 60% of total spot volume.

Deribit Options Volumes Set New Record, Tripling Previous High

Deribit’s options volumes have set a new all-time daily high in July, dwarfing the previous record by almost a factor of 3 to reach $585mn in a single day. The previous daily record was $196mn traded this year on the 10th May.

Deribit has also set an all-time monthly options volume high of $4.07bn (up 61.9% since June), surpassing the previous record of $3.06bn set in May 2020.

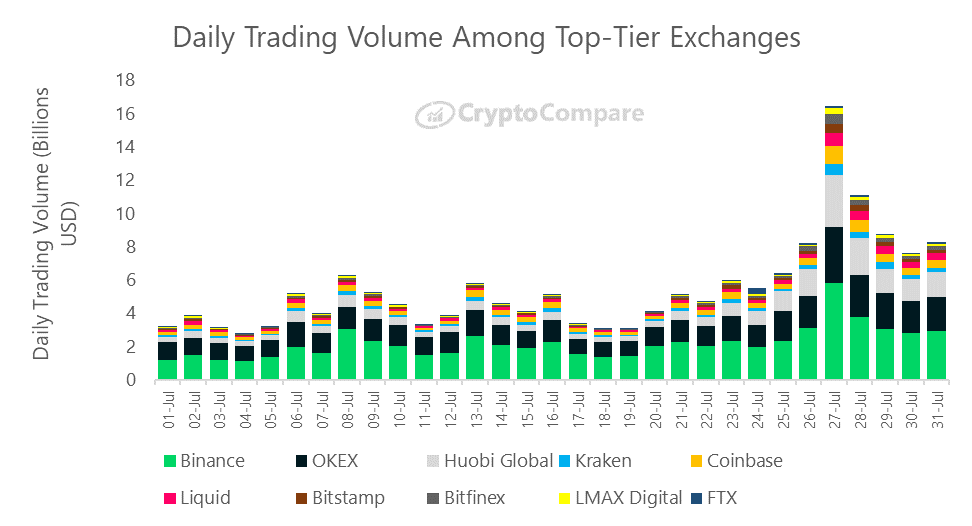

Derivatives Volumes Soar on July 27th

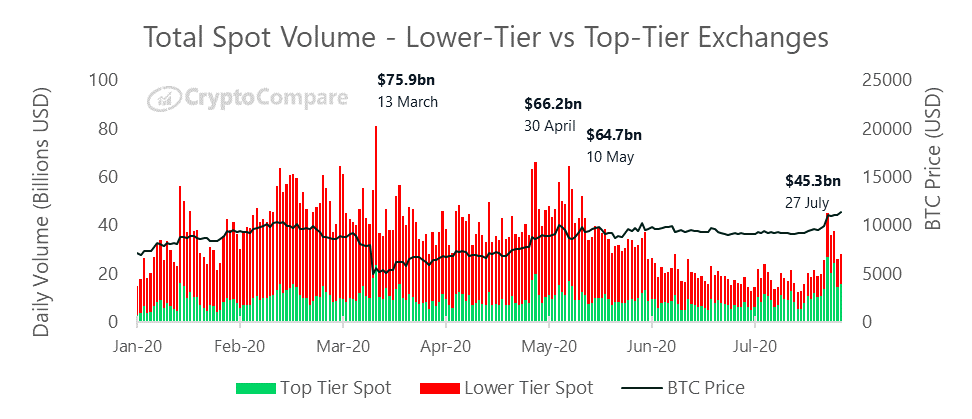

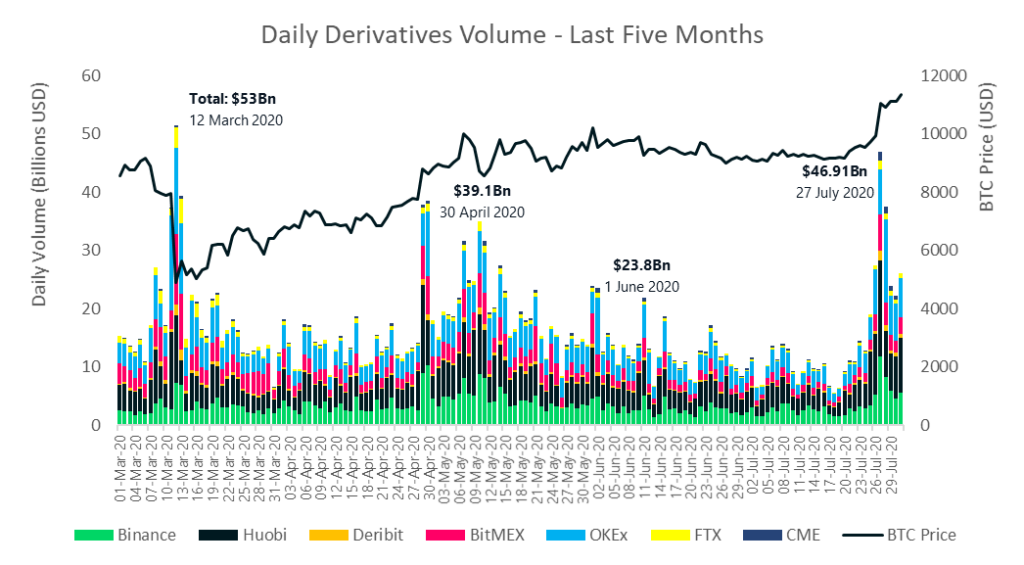

Derivatives trading on the 27th of July saw the highest volumes ($46.91bn) in a day since the Bitcoin price crash on the 12th of March. The top 4 exchanges Huobi, OKEx, Binance and BitMEX represented 90% of the volume traded on this day.

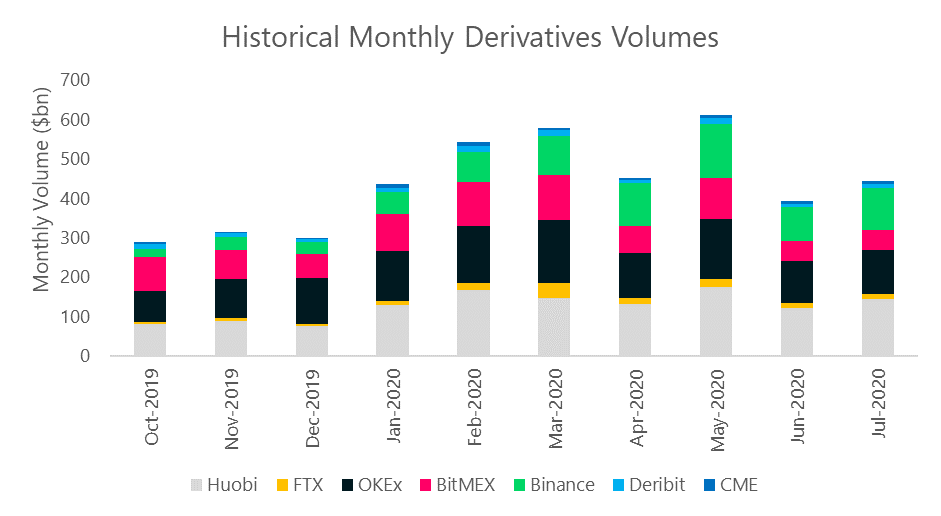

Derivatives Continue to Gain Market Share Against Spot Volumes

Derivatives volumes increased 13.2% in July to $445bn. Meanwhile, total spot volumes have decreased by 0.5% to $639.1bn. As a result, derivatives have continued to gain market share and represented 41% of the market in July (vs 38% in June).

In July, Top-Tier volumes increased 42.1% to $334bn while Lower-Tier volumes decreased 38.1% to $224bn. Top-Tier exchanges now represent 60% of total volume.

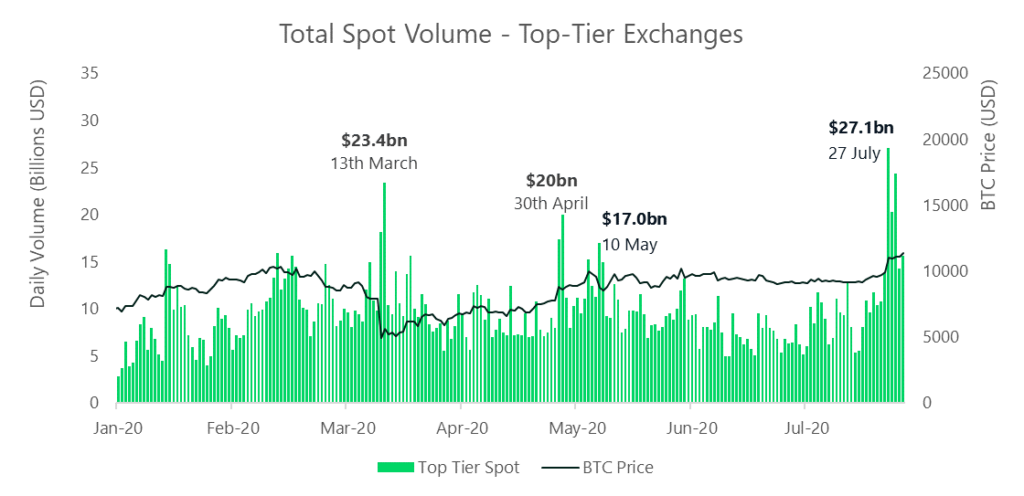

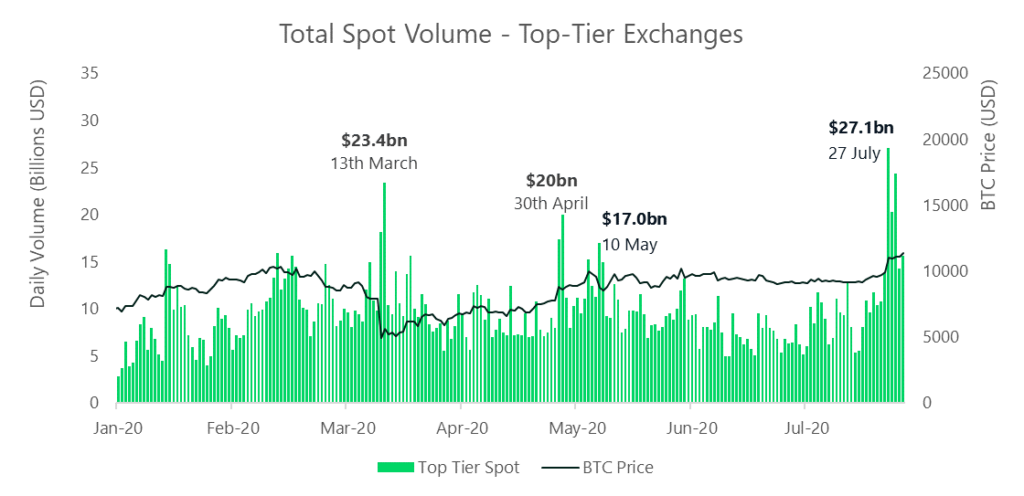

Spot volumes have picked up again towards the end of July amid the current market bull run. Following the July update to CryptoCompare’s Exchange Benchmark Ranking, the data shows that higher risk exchanges have generally dwindled in volumes, as users begin shifting to lower risk (Top-Tier) exchanges.

Top-Tier exchange volume, selected based on our rigorous Exchange Benchmark methodology, has increased 42% overall in July from June.

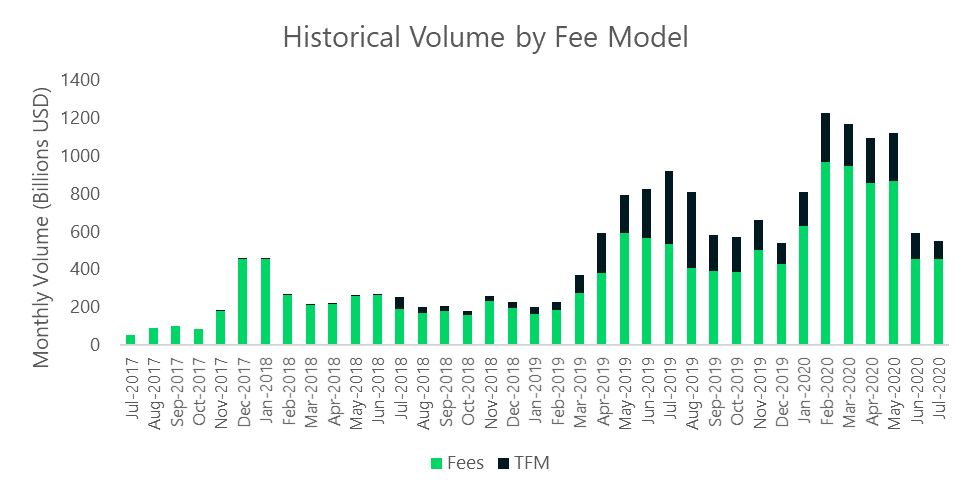

Exchanges that charge traditional taker fees represented 82% of total exchange volume in July, while those that implement Trans-Fee Mining (TFM) represented less than 18%. In June, fee charging exchanges represented 76% of total spot volume.

Fee-charging exchanges traded a total of $456bn in July (up 0.5% since June), while those that implement TFM models traded $95bn (down 32% since June).

In July, volume from the 15 largest Top-Tier exchanges increased 69% on average (vs June).

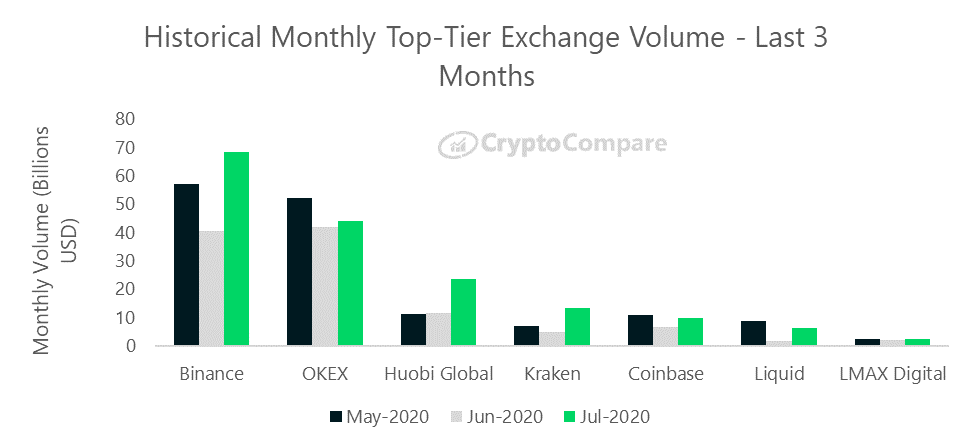

Binance (Grade A) was the largest Top-Tier exchange by volume in July, trading $68.4bn (up 68.3%). This was followed by OKEx (Grade BB) trading $44.1bn (up 5.4%), and Huobi Global (Grade BB) trading $23.5bn (up 99.2%). AA Exchanges Kraken and Coinbase followed with $13.3bn (up 177%) and $10.1bn (up 47.3%)

Binance (A), OKEx (BB) and Huobi Global (BB) remained the top players in terms of volume in July relative to other Top-Tier exchanges. Among the top 15 Top-Tier exchanges, they currently represent 63% of the volume.

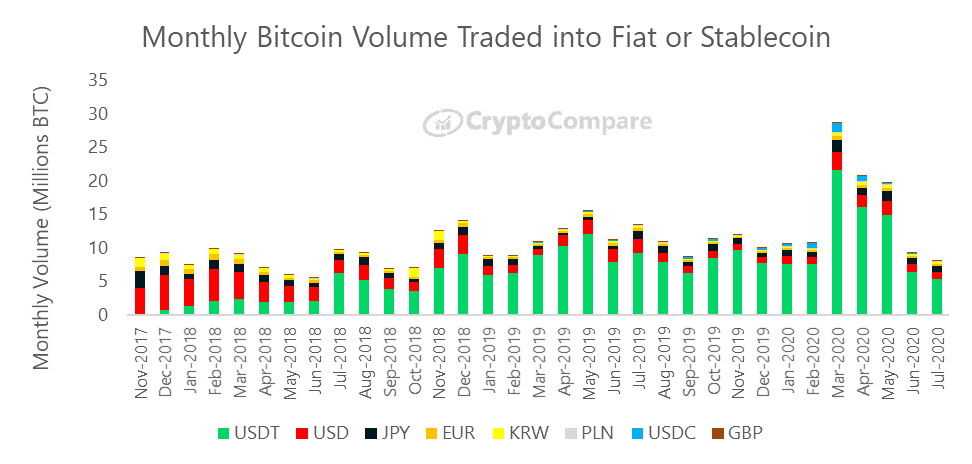

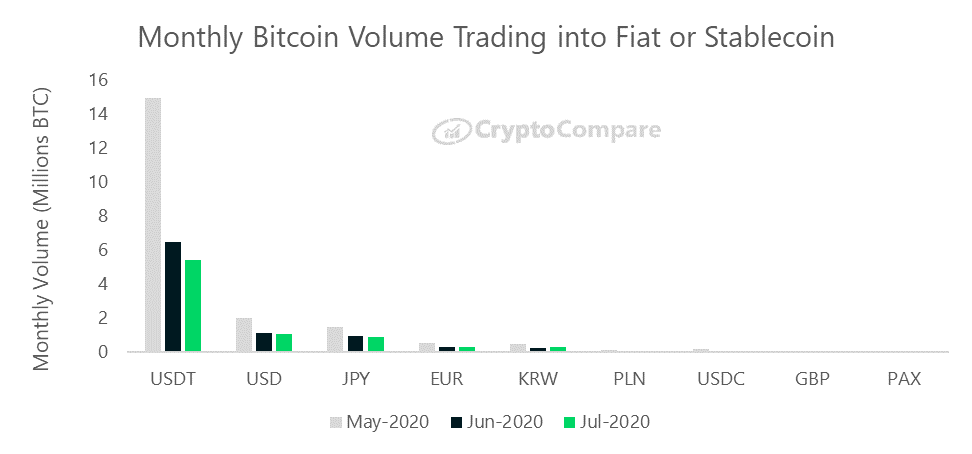

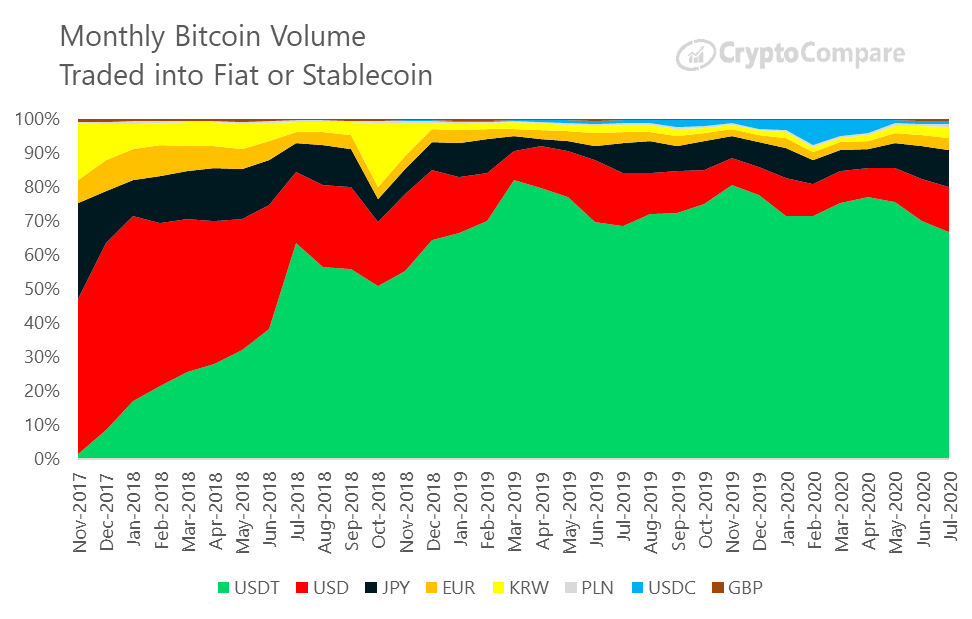

Bitcoin to Fiat Volumes

BTC trading into USDT decreased 16.25% in July to 5.41mn BTC vs 6.47mn BTC in June. Trading into USD and JPY also decreased to 1.06mn BTC (down 6%) and 0.88mn BTC (down 4%) respectively. EUR markets remained relatively constant, while BTC trading into KRW increased 16%.

Stablecoin markets BTC/USDC and BTC/PAX traded 66.8k BTC (down 13.3%) and 18.7k BTC (up 38.3%) respectively in July.

The BTC/USDT pair still represents the majority of BTC traded into fiat or stablecoin in July at 66%. Its proportion of total volume in June was 69%.

Derivatives volumes increased 13.2% in July to $445bn. Meanwhile, total spot volumes have decreased by 0.5% to $639.1bn. As a result, derivatives have continued to gain market share and represented 41% of the market in July (vs 38% in June).

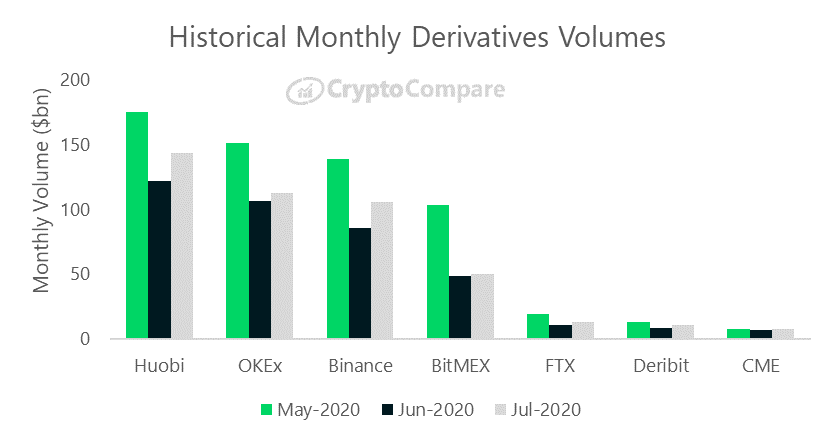

Derivatives exchanges saw large increases in trading volume in July. Huobi (up 23.5%), OKEx (up 17.7%) and Binance (up 19.2%) led with $144.1bn, $112.9bn and $106.1bn traded respectively. BitMEX volumes saw slower growth with $50.5bn (up 3.1%) traded In July.

Derivatives trading on the 27th of July saw the highest volumes ($46.91bn) in a day since the Bitcoin price crash on the 12th of March. The top 4 exchanges Huobi, OKEx, Binance and BitMEX represented 90% of the volume traded on this day.

Deribit’s options volumes have set a new all-time daily high in July, dwarfing the previous record by almost a factor of 3 to reach $585mn in a single day. The previous daily record was $196mn traded this year on the 10th May.

Deribit has also set an all-time monthly options volume high of $4.07bn (up 61.9% since June), surpassing the previous record of $3.06bn set in May 2020.

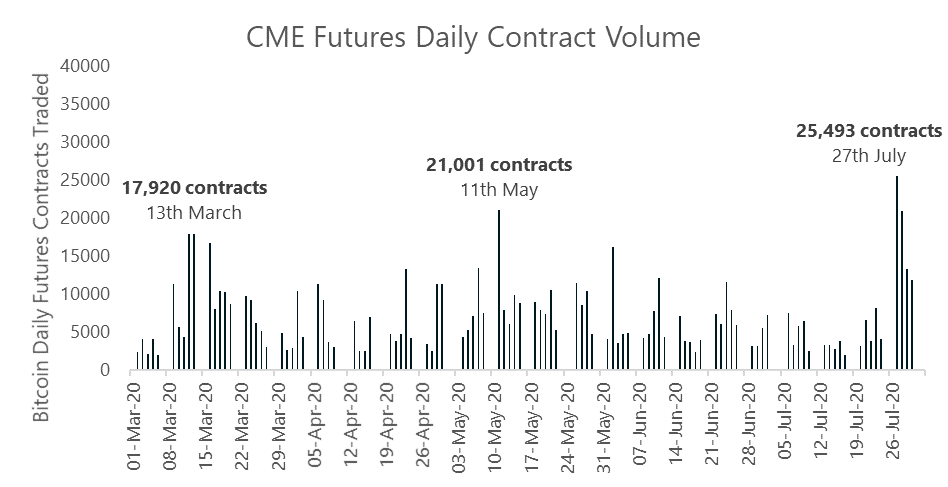

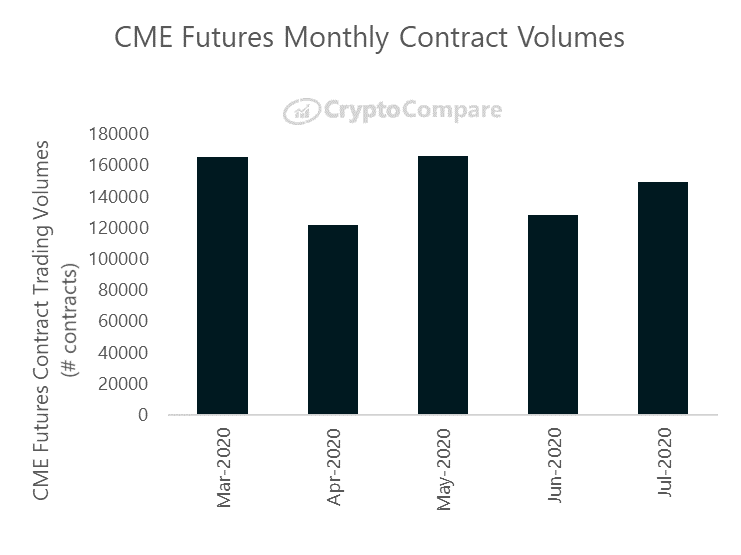

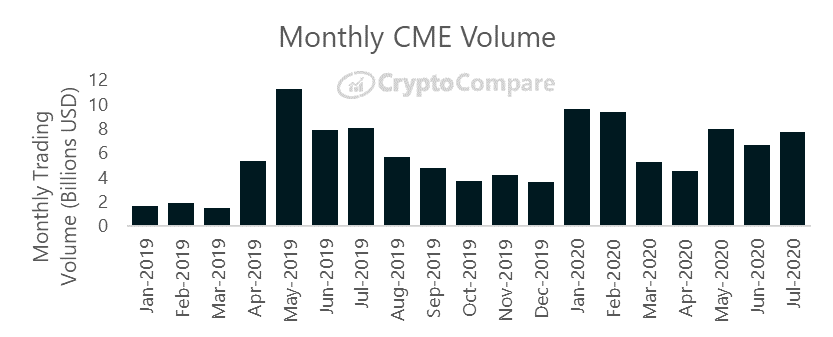

Monthly CME futures contract volumes have increased 16.7% since June to reach 149,626 contracts traded in July. Daily futures contract volume reached a daily high of 25,493 contracts traded. This represents an 21% increase on the previous daily high of 21,001 contracts traded on 11th May.

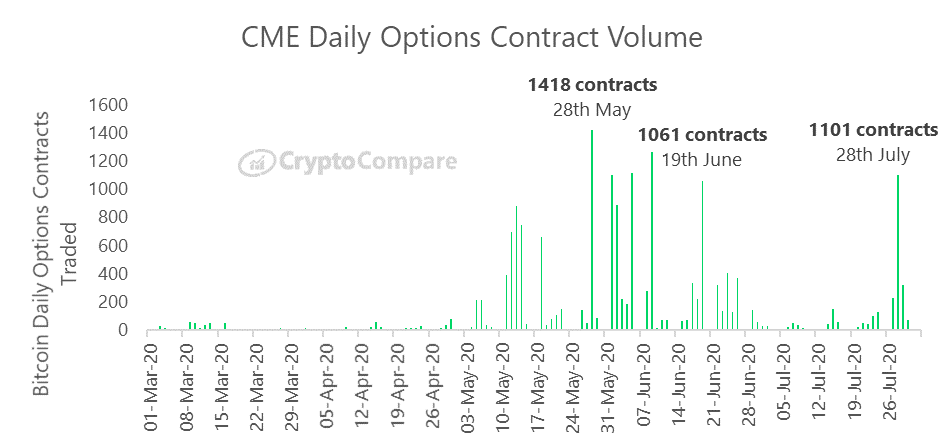

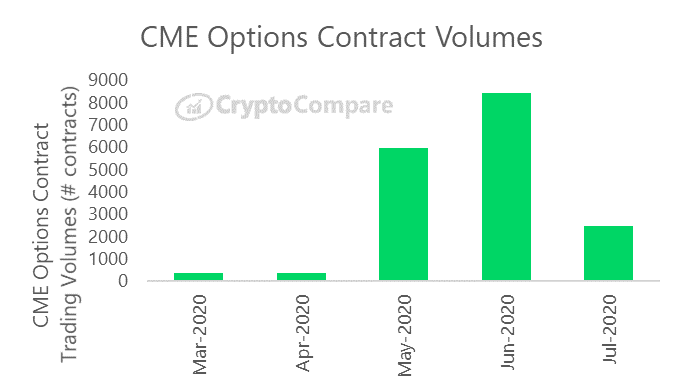

CME options contract volumes dropped 70.3% in July to 2,504 contracts traded. In June, this figure was 8,444 contracts. A monthly high of 1,101 contracts were traded on the 28th of July.

In terms of total trading volume in July, CME’s volumes have increased 16.0% to reach $7.72bn.

Related

The post appeared first on Blog BitMex