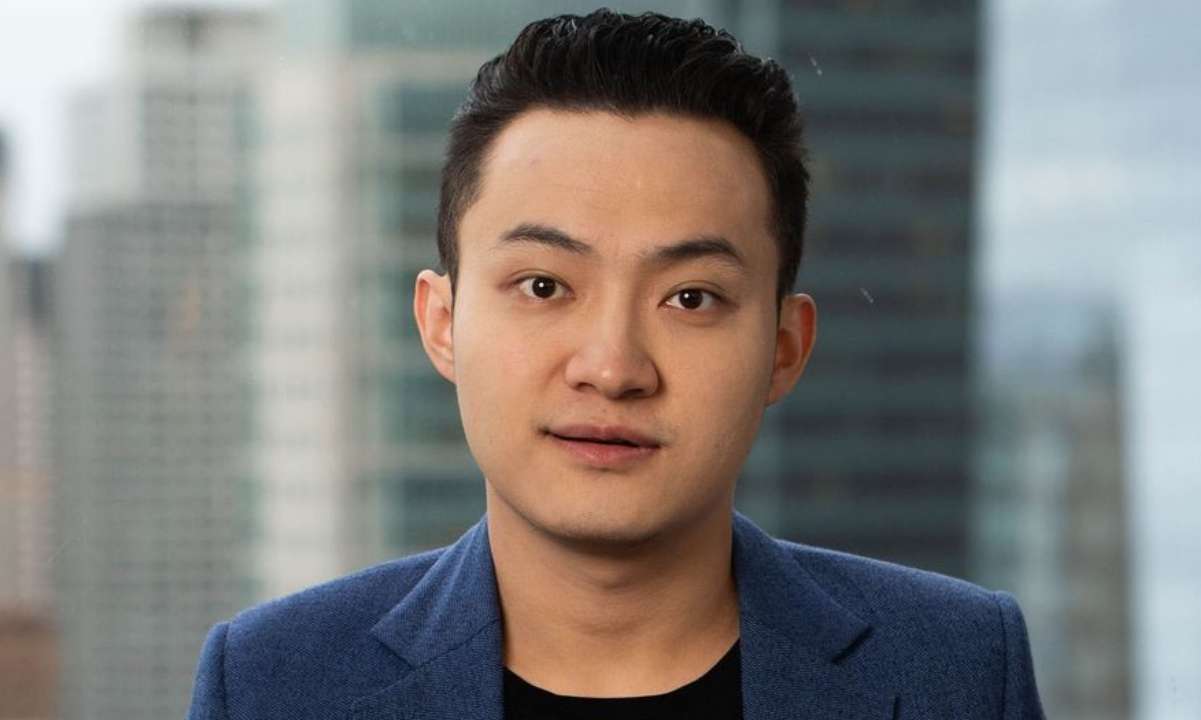

Tron founder Justin Sun has urged China to reconsider its stance on cryptocurrency and embrace friendly policies.

Sun’s call to action comes in the wake of former President Donald Trump’s speech at the Bitcoin 2024 event, where the former President pledged to prevent China from dominating the global digital asset industry.

Sun Sees US-China Crypto Rivalry as a Positive Force

In a July 28 post on X, Sun urged China to advance its crypto regulations in response to former President Donald Trump’s recent support for Bitcoin. Sun stated that U.S. policies have warmed since President Trump pushed for Bitcoin.

China also needs to step up. Since President Trump pushed for Bitcoin, U.S. policies have warmed. China should make further progress in this area. Competition between China and the U.S. in Bitcoin policy will benefit the entire industry.

— H.E. Justin Sun 孙宇晨 (@justinsuntron) July 28, 2024

Trump made his remarks on July 27 at the Bitcoin 2024 event in Nashville, Tennessee. He stressed the necessity for the U.S. to adopt crypto technologies, saying China is already progressing too much.

On the other hand, Sun views the potential rivalry between the two superpowers positively, believing it would benefit the broader crypto industry. He has consistently expressed hope that China will favor crypto assets more. Earlier this month, Sun argued that the perception of China’s anti-crypto policies is exaggerated.

Market analysts highlight that Bitcoin’s unique properties as “digital gold” could be crucial in global geopolitics. They speculate that Trump’s endorsement of Bitcoin might push China to reconsider its approach to the digital asset.

According to Bitcoin Treasuries data, both the US and China hold significant Bitcoin reserves, with a combined total of around 400,000 BTC. However, their regulatory paths seem to be diverging.

China’s Strict Crypto Regulations Persist

The Chinese government has maintained a strict stance against activities that promote speculation in virtual currencies or deviate from the real economy’s needs since 2017. In September 2021, China intensified its crackdown on crypto mining, causing many mining operations to relocate from the country.

Major crypto exchanges such as Binance and OKX, which originated in China, have since moved their operations elsewhere due to the unfriendly regulatory environment.

Beijing has implemented restrictions on various crypto-related activities. Financial firms are prohibited from facilitating crypto payments, and startups are also restricted from using blockchains to raise money.

Despite these measures, cryptocurrency trading remains popular, with many citizens finding ways to bypass these limitations. Beijing is also making significant investments in blockchain and Web3 technologies.

Meanwhile, earlier this month, Sun said that China might reconsider its stringent stance on cryptos following his legal victory against Chongqing Business Media Group. The court ruled that the media group’s allegations that Sun was suspected of insider trading and under FBI investigation were “entirely unsubstantiated.” Sun termed the legal victory as “very important” for the industry.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

The post appeared first on CryptoPotato