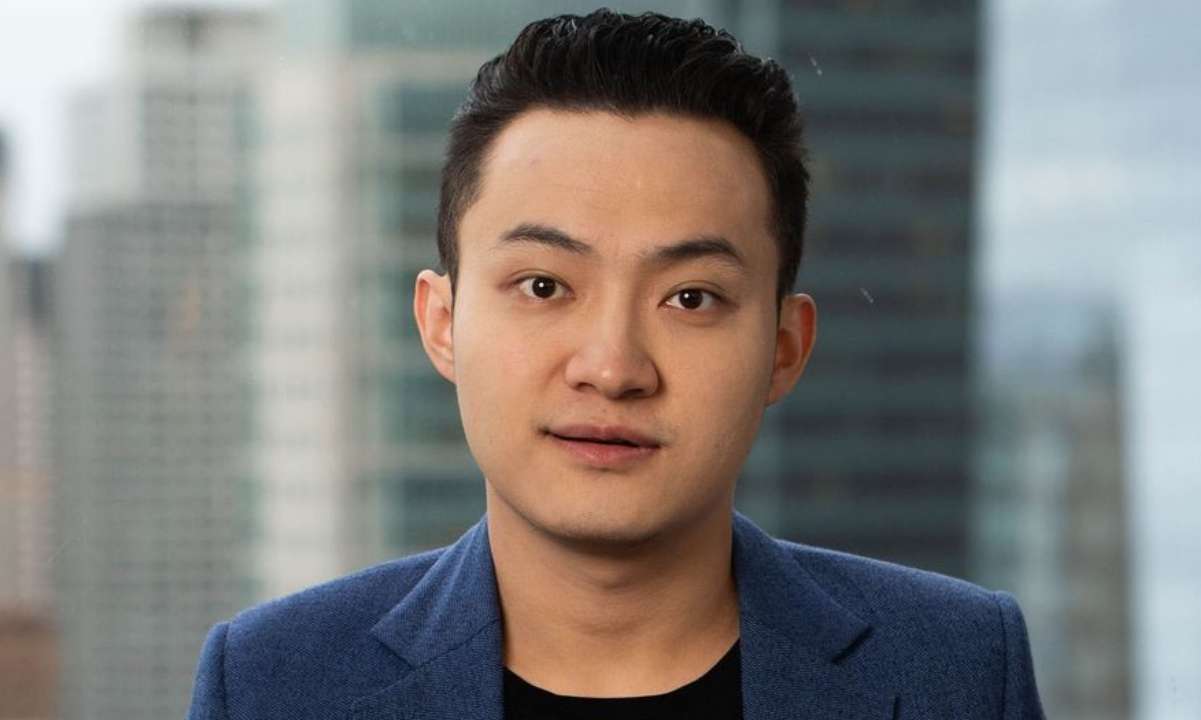

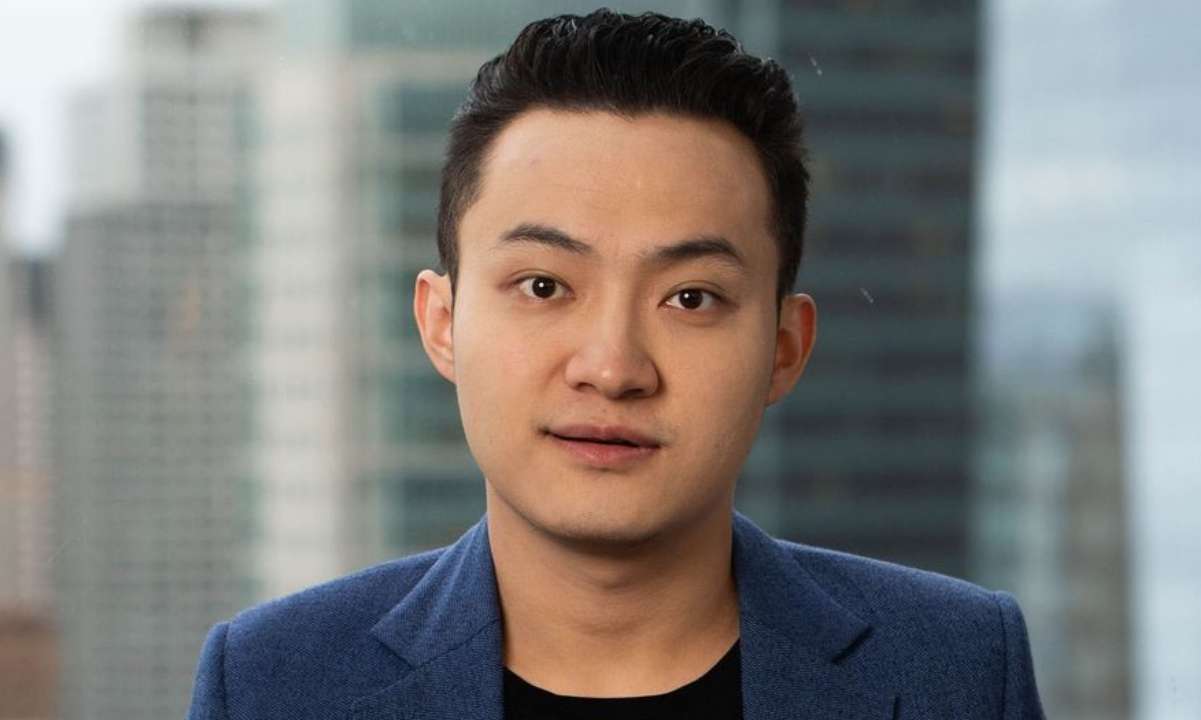

In a post on X on Sept. 12, Justin Sun let rip at Coinbase, stating that its wrapped Bitcoin launch was a “dark day for BTC.”

Sun said that cbBTC lacks proof-of-reserve, has no audits, and the company can freeze anyone’s balance anytime. He said it essentially is “just trust me,” as any U.S. government subpoena could seize all of your BTC.

“There’s no better representation of central bank Bitcoin than this.”

The American crypto exchange launched cbBTC on Ethereum and its layer-2 network Base on Sept. 12, as reported by CryptoPotato.

Sun said he was “friends with many DeFi protocol founders” and cautioned that integrating cbBTC “will pose major security risks to decentralized finance.”

“There is no more ridiculous combination in the world than putting central banks and Bitcoin together. I imagine this is a day Satoshi Nakamoto could never have envisioned when creating Bitcoin,” Sun continued.

cbbtc=central bank btc. There is no more ridiculous combination in the world than putting central banks and Bitcoin together. I imagine this is a day Satoshi Nakamoto could never have envisioned when creating Bitcoin. https://t.co/bi7EkKznpn

— H.E. Justin Sun(hiring) (@justinsuntron) September 12, 2024

But There’s More …

The Tron founder is in the middle of a controversy surrounding the rival product, current industry standard, and the largest of the wrapped Bitcoin variants, WBTC. In August, WBTC custodian BitGo announced a partnership with Hong Kong-based BitGlobal to diversify custody operations and cold storage.

BitGlobal is the exchange formerly known as Bithumb Global, which has connections to Justin Sun, as evidenced by shared directors and corporate structures. Despite claims of a decentralized governance structure for WBTC, it appears that the large DAO was not consulted about the change in custody, reported Protos at the time.

The new custody setup involves BitGlobal and BitGo sharing control of keys, with recent modifications to include BitGo Singapore Ltd.

Sun is also associated with a competing wrapped Bitcoin product on the Tron network, which allegedly lacks transparency about its BTC storage and security. These issues have been cause for concern within the crypto and DeFi communities that rely on WBTC.

There are around 152,958 wrapped Bitcoin on Ethereum, according to the official order book. It has a market cap of around $8.8 billion, which is down 44% from its peak in November 2021.

Sky Drops WBTC

DeFi pioneer Sky, formerly known as Maker, has proposed ditching all WBTC collateral from its SparkLend liquidity protocol. In a forum post on Sept. 12, the team stated:

“Based on available evidence, it is highly likely that Justin Sun or affiliates control BitGlobal, with ownership concealed through shell companies and nominee directors.”

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

The post appeared first on CryptoPotato