(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

I recently went kitesurfing in Fuerteventura, one of the Canary Islands that is technically part of Spain. If you had seen me, you would have snickered to yourself and said, “man, Arthur really needs to stick to crypto!”

My overwhelming shittiness has inspired me to dedicate a decent amount of time to getting better. What makes the sport difficult for me is the combination of having to concentrate on a kite that is attached to your waist and can easily overpower you, while also needing to get up on your board and navigate constantly shifting water conditions. There is no downtime while kitesurfing, at least for me, as I’m intensely concentrating on all these variables at all times – and yet I still look like Gumby flailing in the water.

A few years ago in Mauritius, I spent a week kitesurfing, and I thought I was making good progress. I could tack upwind and was almost able to transition between going left and right without stopping. But before I hit Fuerteventura a few weeks ago, it had been many years since my last lesson. Even so, I went into the experience feeling pretty confident I would be able to pick up right where I left off. Wrong.com.

The wind in Fuerteventura is strong and consistent in the summer months. However, the kite schools there don’t take students to the beaches because while the water is shallow, there are quite a few exposed rocks. Given students’ propensity for getting dragged around by their kites, it doesn’t make sense to tee them up for regular matches of man vs. rock – even if they’re sporting the appropriate protective gear. So instead, the schools sail out into the open ocean for lessons.

The island of Fuerteventura sits just off the coast of north west Africa, surrounded by the fresh, turbulent waters of the Atlantic. The swells in the open ocean add a significant level of difficulty for beginners. As I was riding the dinghy out into ocean on my first day, I thought to myself, “holy fuck – I hope I don’t come back in a body bag”. My gear consisted of a wetsuit, lifejacket, harness, and helmet, and yet I still felt wholly exposed to the elements. Once you jump into the water, you bob up and down like a human buoy in half-to-one-metre swells. Then an instructor rides over, attaches the kite, throws you a board, and it’s time to “learn”.

I was able to get up and ride a bit, but I found it quite difficult to judge how much power to give the kite so I could maintain control and ride the waves. As always happens, I would frequently give the kite too much power and launch myself out of my board into the water, sometimes smacking the water face first. Let me tell you – it fucking hurts. It is quite unnerving to be attached to a kite 25 metres above you while getting pounded by the choppy Atlantic, with almost no other humans in sight. It took a lot of concentration to keep my heart rate down and just chill.

The conditions in Mauritius couldn’t have been more different. The kite school was located in a protected lagoon with water that was waist deep for a few kilometres out. There were zero waves. When you fell, you could just put your kite at 12:00, walk over to your board, and you were up and riding again.

I know most of you don’t give a fuck about my struggle to improve my kitesurfing abilities – but I promise that there’s a point to my ramblings. More on that in a bit; for now, all you need to know is that everyone who is managing money today is deeply invested in analogies comparing how the US Federal Reserve dealt with inflation in the early 1980’s and today. Fed chairperson Jerome Powell believes he is this moment’s Paul Volker (the Fed chairperson credited with slaying 1970’s inflation), and as such we can expect him to try to apply the same medicine and rid America of inflation. He has all but said this in many interviews since late 2021, when he first telegraphed that the Fed would begin tightening monetary policy by raising interest rates and reducing its balance sheet.

The problem is that the economic and monetary conditions in the US today are markedly different from what they were in 1980. Anyone who thinks the Fed can run the same playbook and achieve the same result is going to experience something akin to my recent kitesurfing episode. In short, what worked in past idyllic conditions will not succeed in the rough, tumble, and competitive times of today.Using this essay, I want to show readers how the Fed is doomed to fail, and how the more they try to right the ship using Volkernomics, the further they will push the US in a direction that is directly opposite their desired destination. The Fed wants to cool US domestic inflation, but the more they simultaneously raise rates and reduce their balance sheet, the more stimulus will be handed to rich asset holders. The Fed will get a tap on the shoulder by the US Federal Government to change tactics, and I will reference a paper written by an establishment Columbia economics professor Dr. Charles Calomis that was published by none other than the St. Louis Fed. The Fed is telling the market quietly that it fucked up and laying out its path to redemption. And as we know, the path to redemption always requires more financial repression and money printing. Long Live Lord Satoshi!

Back in the Water

When you’re taking kitesurfing lessons, there is a radio attached to your helmet so that the instructor can give you feedback. One of my most frequent mistakes was that when I finally found my board again, I would focus more on the board than the kite. “Control your kite first, then get your board,” blared in my ear over and over again. I had to focus on the most important thing first – the kite – before getting to the fun part of putting my feet into the straps and attempting to water start.

The Fed is currently trying to accomplish something similar. They want to control both the quantity and price of money. I believe the quantity of money is more important than its price, in a similar vein to how control of the kite that is physically attached to you is more important than your board, which can move freely.

The Fed controls the quantity of money by changing the size of its balance sheet. The Fed buys and sells US Treasuries (UST) and US Mortgage Backed Securities (MBS), which causes its balance sheet to rise and fall. When the balance sheet is rising, they call it quantitative easing (QE); and when it is falling, they call it quantitative tightening (QT). The New York Fed’s trading desk manages these open market operations. Due to the trillions of dollars worth of UST and MBS the Fed holds and trades, I argue the US fixed income markets are no longer free because you have an entity that can print money at will and unilaterally change the banking and financial rules, that is always trading in the market, and that pins rates to whatever position is politically expedient. Don’t fight the Fed unless you want to get rugged.

When Volker came to power at the Fed, he advocated for what was considered a crazy policy at the time: targeting the quantity of money and letting its price (Fed Funds Rate “FFR” or short-term rates) go wherever the market desired. Volker didn’t care if short-term rates spiked higher, as long as money/credit was removed from the financial system. It is extremely important to understand this; while the Fed in the 1980’s might raise or cut its policy rate, it did not try to force the market to trade at that level. The only variable that changed from the Fed’s perspective was the size of its balance sheet.

Starting more recently, the Fed has wanted to ensure that short-term market rates match its policy rate. The way the Fed accomplishes this is by setting rates on both its Reverse Repo Program (RRP, and the Interest on Reserve Balances (IORB) between the lower and upper bound of its policy rate.

I know I have explained this stuff before, but if you don’t understand the mechanics of how this works, then you will be clueless as to how the Fed and other central banks exert influence on global money markets. Clueless traders are broke traders. Broke traders don’t pay fees, so I have an interest in y’all surviving.

Approved participants like banks and money market funds (MMF) are allowed to deposit dollars with the Fed on an overnight basis and earn the RRP rate set by the Fed. This means that retail and institutional savers will not purchase a USD-denominated bond at a yield lower than this. Why would you take more credit risk and earn less interest than you could by depositing money with the Fed on a risk-free basis? I shouldn’t be so presumptuous – I bet Su and Kyle of the now defunct Three Arrows Capital could concoct a way to convince folks that is prudent investing.

In order to keep a certain amount of bank reserves deposited with the Fed, the Fed bribes the banks by paying them interest on these balances. The IORB rate is another limiting factor in that a bank will not lend to an individual, corporation, or the US government at less than it receives from the Fed risk free.

There is also a line of thinking that argues the Fed must pay RRP and IORB depositors in order to reduce the amount of money sloshing around. In total, these facilities have almost $5 trillion deposited in them; imagine the level of inflation if this money was actually used to create loans within the real economy. The Fed created so much money via its post-2008 GFC QE programs that it pays billions per month in interest to keep this capital sequestered and prevent it from all being injected into the monetary system. Whatever the reason, they have created a shitty situation for themselves in order to “save” the fiat banking system from destruction over and over again.

In practice:

Federal Funds Rate Lower Bound 5.25% < RRP Rate 5.30% < IORB Rate 5.40% < Federal Funds Rate Upper Bound 5.50%

Currently, the Fed sets short-term rates and manages the size of its balance sheet. Powell has already diverged from his god Volker in a very important way. In order to effectively manipulate short-term rates the Fed must print money, and then hand it to RRP and IORB depositors. The problem with this is that if the Fed believes that to kill inflation it must both raise interest rates and reduce the size of its balance sheet, then it is cutting its nose to spite its face.

Let’s first look at the banking system in isolation to understand why the Fed’s current policy is counterproductive. When the Fed conducts QE, it buys bonds from banks and credits them with reserves at the Fed (i.e., IORB increases). The reverse happens when QT is conducted. If the Fed were just doing QT, then IORB would steadily decline. This means banks must reduce loans to the real economy and require a higher rate of interest on any loans or securities investments, because they have billions more in higher-yielding bonds that they bought from the Fed. That’s one side.

The other side is that at ~$3.2 trillion, the banks still have a lot of IORB they don’t need, and this money is parked at the Fed earning interest. Every time the Fed raises rates, the Fed hands billions more every month to the same banks.

The Fed is continuously adding (QE) and taking away (QT) reserves from banks as they try to control the quantity and price of money. I will mathematically show how futile this is later, but I wanted to provide some context first before I present some tables.

QT doesn’t impact regular individual and corporate savers directly; however, by handing out billions per month to RRP depositors, the Fed is touching these groups as well. The reason the Fed is handing out cash to these folks is because they want to control the price of money. This also directly counteracts the tightening effects of QT, because the Fed hands out free money to rich rentiers who are individuals, companies, and banks. If you have a pile of cash, and you want to engage in zero financial analysis and take zero risk, you can earn almost 6% depositing with the Fed. Every time the Fed raises rates I cheer, because I know I’m getting more free money deposited in my MMF account.

To summarise how the Fed is trying to ride two horses with one ass, here are some handy tables.

|

Size of Facility |

Rate PA |

Monthly Amount (USD Bn) |

|

|

IORB |

3228.582 |

5.40% |

$14.53 |

|

RRP |

1759.897 |

5.30% |

$7.77 |

|

QT |

NA |

NA |

-$80.00 |

|

Total |

-$57.70 |

Technically, the Fed is supposed to be reducing its balance sheet by $95 billion per month, but in recent months they have averaged only $80 billion.

Looking at these two tables, you would conclude that the Fed is still being restrictive, because the total is $57.47 billion per month of liquidity drained. However, I have omitted an important source of free money: interest payments on US treasury debt. I will explain how the Fed’s actions are impacting the ability of the USG to finance itself through the sale of bonds in the next section. When this piece is added, Sir Powell’s quest looks a lot more quixotic.

Paradise Lost

After Europe blew itself up in WW2, the US was able to build and grow a manufacturing economy which was so profitable and unchallenged that by the 1980’s, America was very rich and on a strong growth trajectory. There was a large educated young workforce (the Baby Boomers) who had ample cheap energy (even after the 1970’s Organization of the Petroleum Exporting Countries engineered squeeze, oil was in the $10 range), and most importantly to this analysis, the government had little debt.

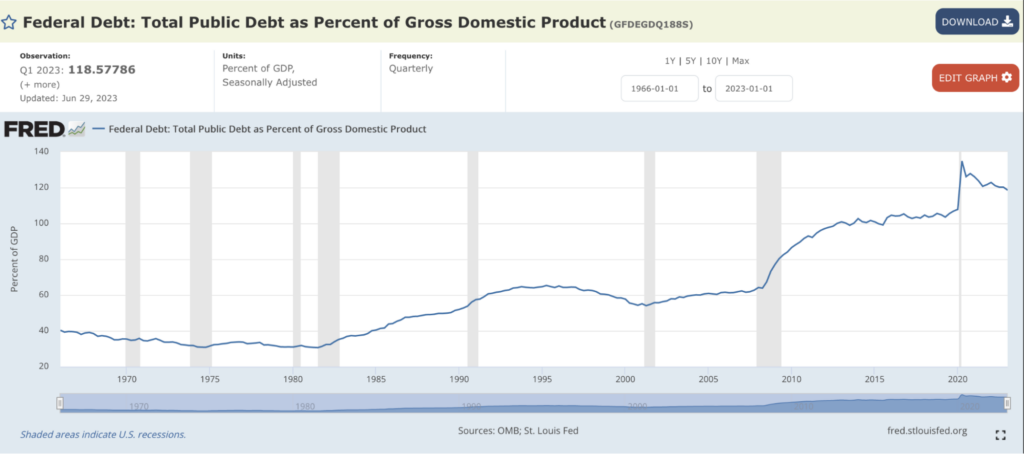

The key statistic here is that in 1980, US debt-to-GDP was 30%. Today, it is 118%. This means that when Volker began tightening money supply and rates spiked, the USG’s finances were not impacted that significantly because the government didn’t have much outstanding debt. That is the complete opposite of 2023, as the debt profile today is 4x bigger.

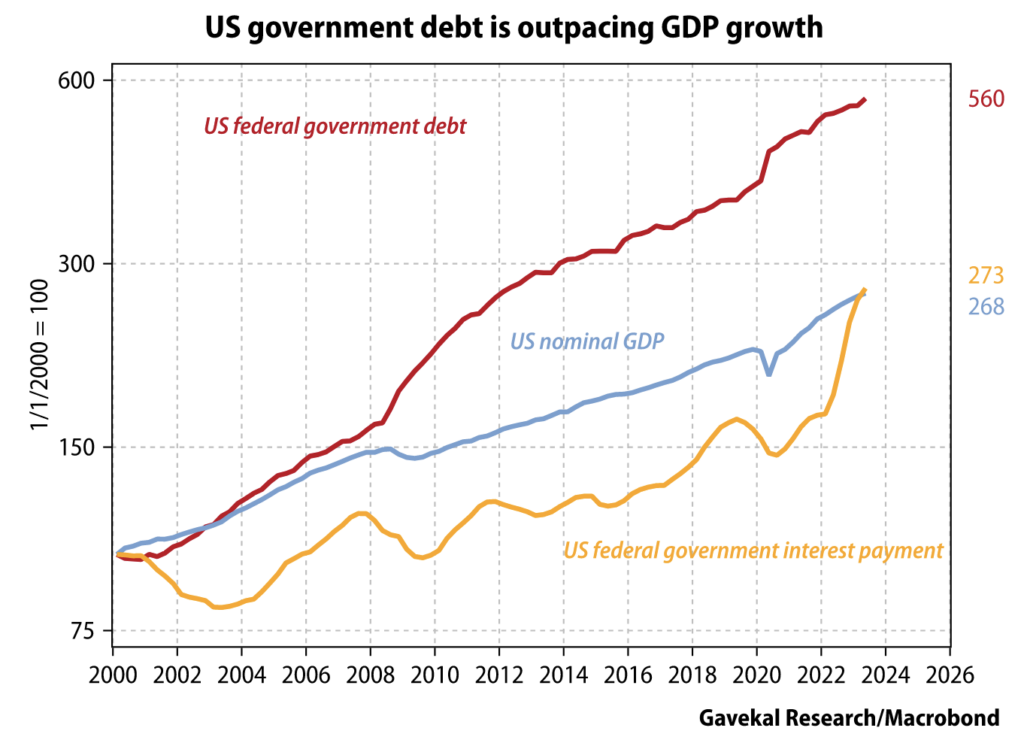

This is an excellent chart published by Gavekal Research on the runaway growth of USG debt. If debt grows at the same pace as nominal GDP, then it is sustainable; when it is growing at close to double nominal GDP growth, it is “rut roh” time. Faces of Rekt, Benjamin Franklin edition.

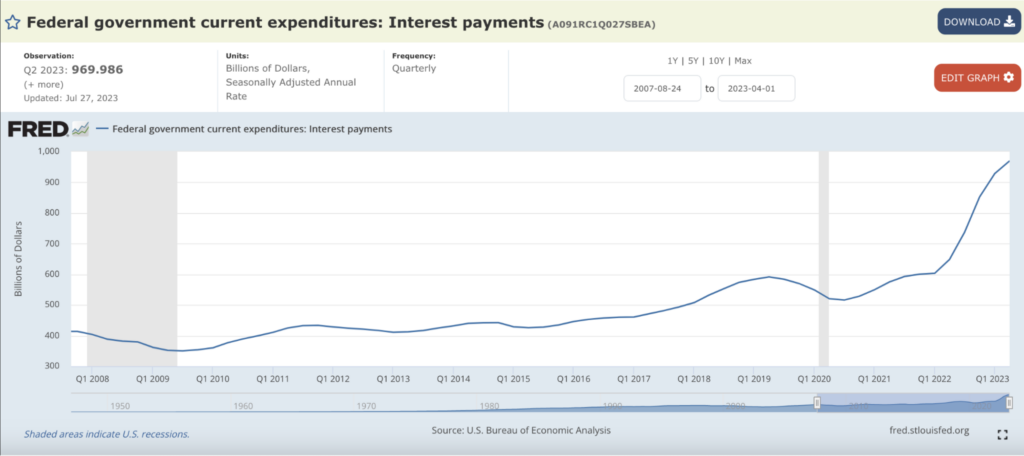

The USG debt balance has a big impact on the efficacy of raising rates. Because the US Treasury will not find any buyers of debt below the Fed Funds Rate, every time Powell raises rates, he makes it more expensive for the Treasury to fund the government. Due to the short average maturity profile of US debt (2 to 3 years) and high and rising budget deficits, the US Treasury must issue more and more debt to pay back the old debt, fund interest payments on the current debt, and pay for government spending. As a result, the interest payments that the US Treasury must pay to debt holders are pumping harder than Sam-Bankman Fried’s heart on Emsam.

As of 2Q 2023, the US Treasury hands out close to $1 trillion in interest payments to debt holders on an annualised basis. At a macro level, it is clear that as the Fed raises rates, it causes the US Treasury to hand out rich people stimmies in the form of interest payments. When combined with the money given via the RRP and IORB facilities, net-net the Fed’s quest to control the price and quantity of money in order to tighten monetary conditions and slay inflation is achieving the opposite effect. Monetary conditions for asset holders are improving on a monthly basis.

|

Size of Facility |

Rate PA |

Monthly Amount (USD Bn) |

|

|

Interest Expense |

NA |

NA |

$80.83 |

|

IORB |

3228.582 |

5.30% |

$14.26 |

|

RRP |

1759.897 |

5.40% |

$7.92 |

|

QT |

NA |

NA |

-$80.00 |

|

Total |

$23.01 |

I estimate that ~$23 billion in liquidity is net injected every month.

This would not happen in the 1980s because the USG’s debt profile didn’t necessitate large interest payment outlays in order to fund past, present, and future debt. And more importantly, the Fed wasn’t paying interest in order to fix the price of money and/or attempt to counteract the potential inflationary consequences of past folly.

Consumption Baskets

Why is US growth going gangbusters while regional banks are the walking dead, and various indicators show that the small businesses that power the American economy are struggling? It’s because rich people are spending on services.

America, Fuck Yeah!!!! The Atlanta Fed guesstimates GDP in real time, and the American economy is booming. There is a large error rate this early in the quarter, but even subtracting 2% still leaves a forecast of a 3% annualised GDP real-growth rate, which is amazeballs.

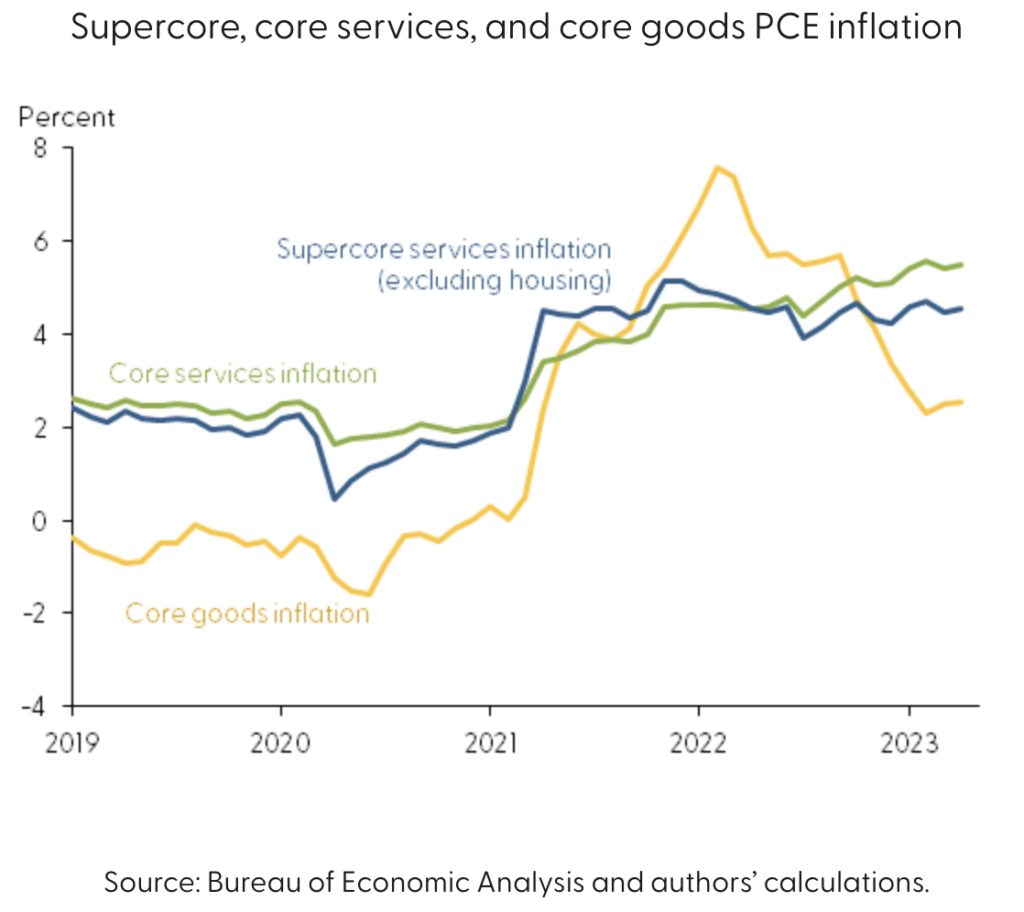

When the majority of American plebes received their COVID stimmies, they went out and bought stuff they needed (or at least, what social media told them they needed). People bought new cars, vacation homes, washing machines, etc. That is why goods inflation spiked and things were out of stock globally: because the American middle class – which is quite wealthy relative to the average global citizen – bought stuff. But, rich people have all of these things already. In fact I would argue there is a limit to the amount of bottles of Dom P one can spray at the clerb, although I know Jho Low might disagree with me. When you hand money to rich people, they spend more on services and they buy more financial assets. You go from getting the cheap mani-pedi around the corner to one at a Bastien salon.

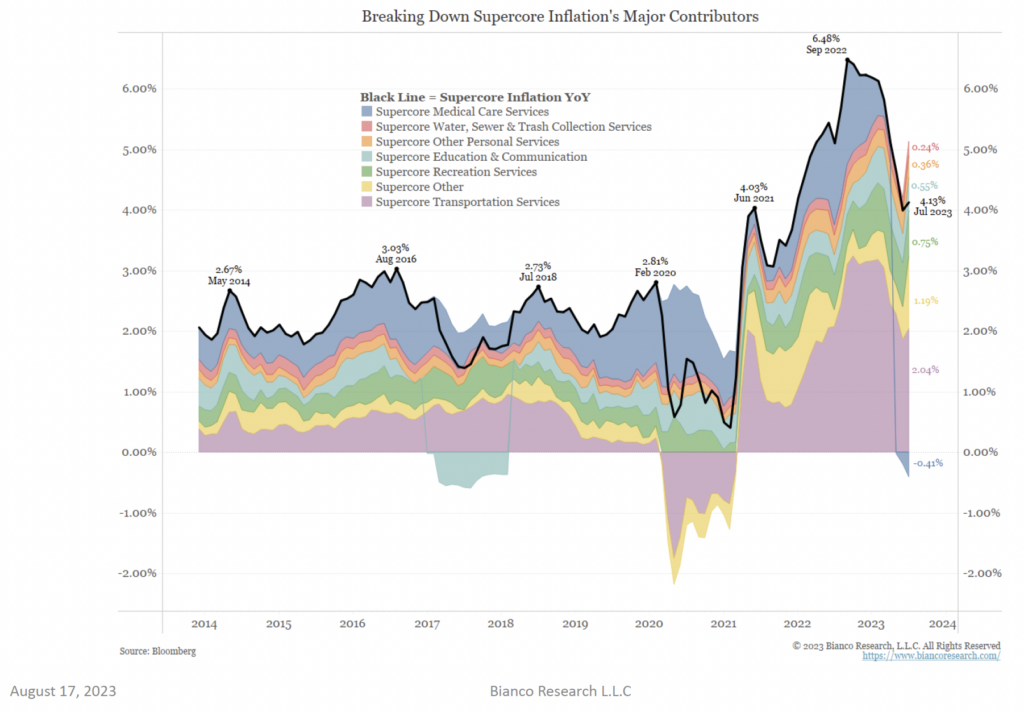

Services make up a large portion of the Consumer Price Index (CPI) basket. The Fed put forward a measure of “super core” inflation, which is basically just services.

Source: Bianco Research

“Wasn’t that European summer vacation fun, honey? How about next we rent a baller chalet in Aspen for the ski season and take the PJ instead. Don’t worry baby, we can afford it – all thanks to Powell Power.”

Powell and his staff are laser focused on getting this measure of inflation to decline markedly. But how can it decline if every time they apply the medicine (a rise in interest rates), it actually makes the biggest services spenders wealthier?

Services inflation is the highest of all the manipulated government inflation indices.

Dispersion

Before I move onto the future, let’s examine the recent past.

Just because the Fed is injecting liquidity into the markets doesn’t mean all assets will go up.

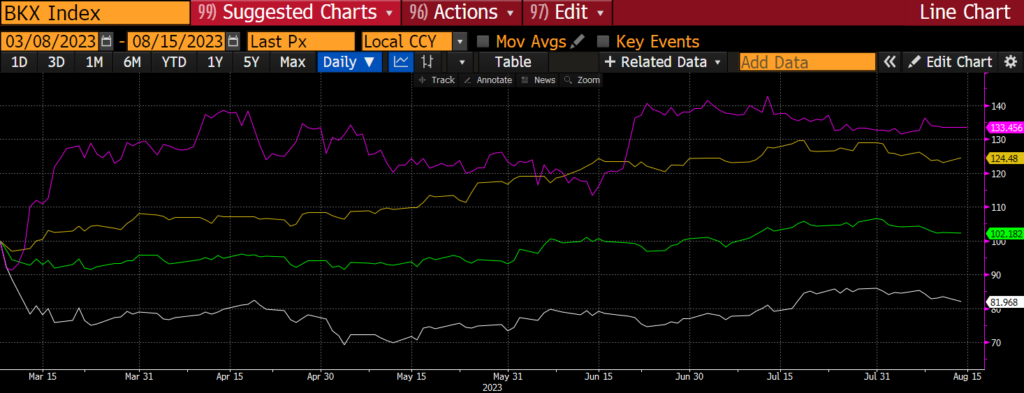

Using a starting index of 100 as of 8 March 2023 (the day Silvergate filed for bankruptcy), I looked at the performance of the US Regional Bank Index (white), The Russell 2000 Index (green), The Nasdaq 100 Index (yellow), and Bitcoin (magenta).

If you are not a US Too Big to Fail Bank (TBTF), of which there are 8, then you are fucked. That is what the Regional Bank Index, which is down 24%, is telling us. These banks cannot make money when retail depositors can earn almost 6% from the Fed, but the banks’ loan book yields 2% to 3% (this was explained in detail in my essay “Kaiseki”). This problem is only getting worse as the Fed continues to raise interest rates. Moody’s recently downgraded a fuck-ton of small banks due to this phenomenon.

As Lacy Hunt routinely says, you cannot have a healthy economy if your banks are sick. The businesses that employ folks and power the US economy rely on the regional banks for credit. These banks cannot provide it while their balance sheets are so compromised; therefore these businesses will continue to be unable to expand and in many cases will go bankrupt. That is what the Russell 2000 Index, which comprises mostly smaller companies, is telling us. It has barely risen over the last quarter.

Big tech and AI companies do not need banks. Either their businesses are super profitable and any CAPEX can be funded directly by retained earnings, as is the case for Google, Facebook, Microsoft, Apple, etc., or they are benefiting from the AI boom like NVIDIA. I receive so many pitch decks about this or that new “AI” VC fund. If I wanted to burn my money, I would rather do it at a nightclub, so I’m passing on these new funds. Clearly this is where those with spare cash are allocating, and I have no doubt that tech AI startups will have all the cash they need. If the US banking system is sick, tech gives no fucks. Those with spare capital are happy to sign up and buy the tech top over and over again. That is why the Nasdaq 100 is up 24% since the onset of the banking crisis.

One of Bitcoin’s value propositions is that it is the antidote for a broken, corrupt and parasitic fiat banking system. Therefore, as the banking system falters, Bitcoin’s value proposition grows stronger. Also, Bitcoin benefits from increased fiat liquidity. Rich people don’t need real stuff; they need financial assets so they can effortlessly consume to their hearts desire. Bitcoin has a finite supply, and therefore as the denominator of fiat toilet paper grows, so will Bitcoin’s value in fiat currency terms. This is why Bitcoin is up 18% since March.

As long as the Fed is committed to its current path, tech stocks and crypto will continue rising. Apart from big tech and crypto, nothing else returns more than just parking your money with the Fed earning close to 6%. If you are a non-USD investor, the return on cash deposited in short-term government bonds or a bank account most likely exceeds the benchmark equity index of your country. For example, in Brazil, the central bank policy rate is 13.15%, and the Ibovespa Index only returned ~5% year to date. Globally, cash is king.

Trapped

The Trump Era

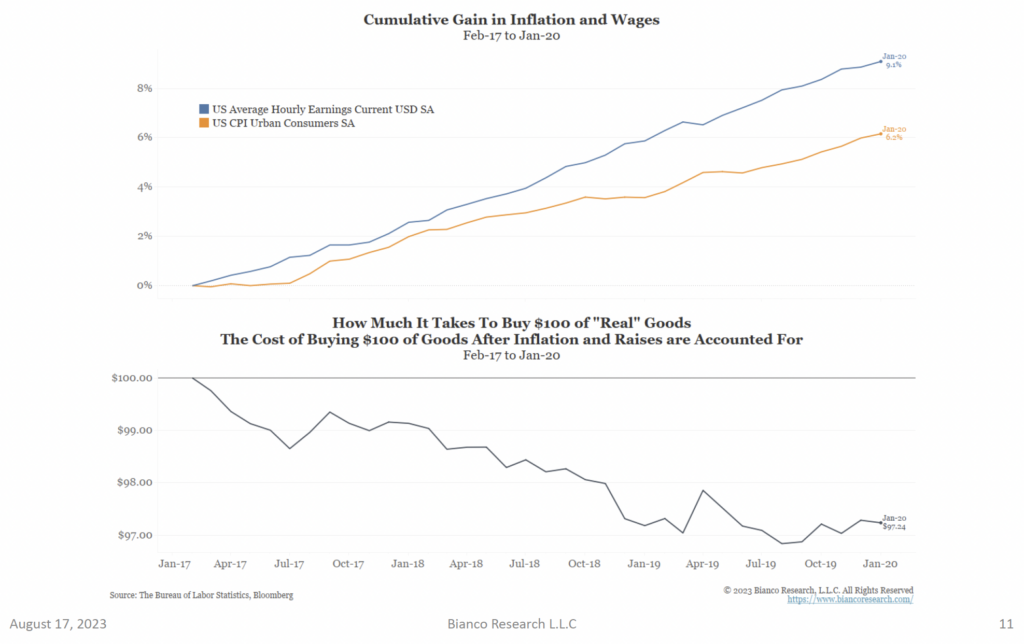

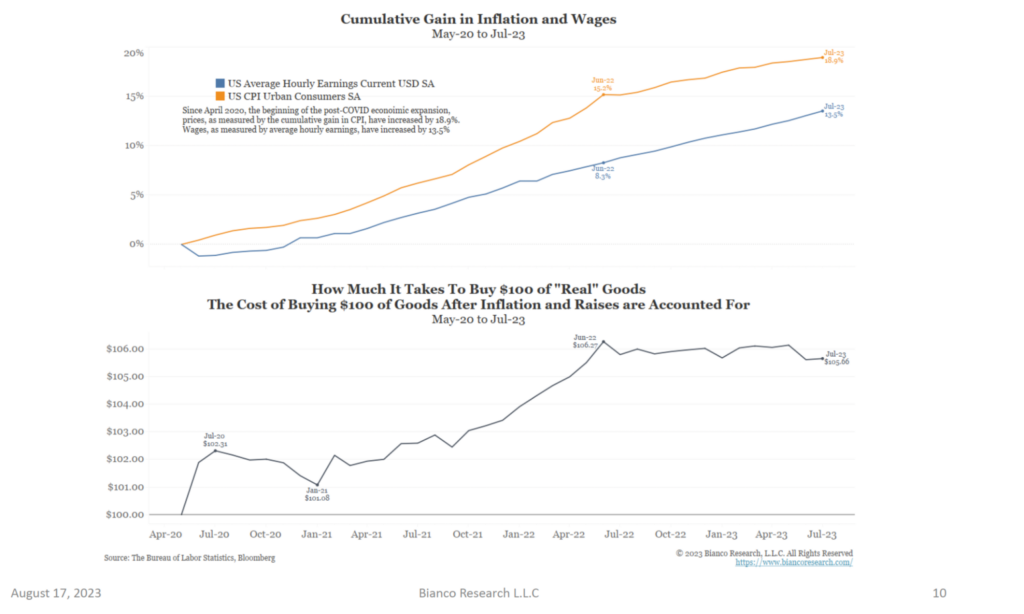

Source: Bianco Research

What this chart from Bianco Research shows is that from 2017 to 2020, when Trump was the US President, wages outpaced inflation. This is shown by the falling line in the bottom panel.

The Biden Era

Source: Bianco Research

However, during US President Biden’s administration, wages have not kept up with inflation. This is shown by the rising black line in the bottom panel.

The media tells you that former President Trump is a misogynist, a racist, and a threat to democracy. Conversely, the media says President Joe Biden is a tolerant, inclusive, and friend of the average American working man and woman. Given the mainstream media bias, you would assume Biden would be the clear favourite in a 2024 rematch with Trump – but they are polling in a dead heat.

Inflation is always the number one issue for any population. If the people can work hard and buy more stuff for less money, they don’t really care about the personal traits of who is in charge. But god help the politician who must run for re-election when the price of gas and or ground beef is high and rising. Good politicians know that if there is inflation, they have to get it under control, or they will be forced to work for a living, like the rest of us. And where’s the fun in that?!

This is a photo of a meeting between US President Biden, US Treasury Secretary Yellen, and Fed chair Powell. Look at the body language. Doesn’t this remind you of two parents (Biden and Yellen), scolding their prodigal son (Powell)? Look at Powell’s beta body language; he ain’t no Chad like daddy. What are they talking about? Inflation. Biden told Powell he has to get inflation under control, because when all is said and done, it doesn’t matter what Biden has done as President if the price of gas is too expensive on election day. Let’s see if this talking to works – maybe Biden should call Hunter in for one as well, although I imagine it might be tough for his son to sit still long enough to listen to the message.

The Fed is going to continue this bass-ackwards strategy of attempting to control the quantity and price of money because the politics demand it. Powell can’t stop until the politicians give him the all-clear signal. With the 2024 US election right ahead of us, the Fed is more paralysed than ever. Powell doesn’t want to alter Fed policy between now and next November for fear of being accused of favouring either political party.

But the maths doesn’t work. Something must change. Look at the chart below – savers continue to pull money from banks who have low deposit rates and send them to MMF, which essentially parks the money with the Fed. The non-TBTF banks will continue to go bankrupt one by one if this continues, and it will, because this is a direct effect of Fed policy.

Source: Bloomberg

More importantly, the US Treasury is upsizing the amount of debt it must issue, because tax receipts are down and fiscal deficits are high and rising. The interest expense will only get larger as the price of money increases (courtesy of the Fed), and the amount of debt issuance rises along with it. There has to be a way to cut this gordian knot …

The best thing about the current crop of charlatans running things is that, while they might be intellectually dishonest, they don’t outright lie to you. Thankfully, they also tell you exactly what they are going to do in the future. You just have to listen.

Fiscal Dominance

For those who want to understand how the Fed and US Treasury will both do right by maths and politics, the most important paper was published earlier this year by the St. Louis Fed. They have a research outfit that allows establishment economists to publish papers. These papers inform Fed policy. If you are serious about investing, you must read this paper in its entirety. I’m only going to excerpt a few sections.

While this paper is US-focused, the premise of fiscal dominance is a global one. Currently, Japan is serving as a real-time example of what happens at the onset of fiscal dominance. The Bank of Japan (BOJ) is a lot less communicative and transparent than the Fed. The BOJ would never admit that they were dominated, and certainly would not publish a paper by a University of Tokyo economics professor lambasting their monetary policy. I will talk a bit more about what’s going on in Japan in the next section, but as usual, Japan is the globe’s future playing out in the present. In the modern USD fiat reserve currency era, the BOJ was the first central bank to try QE. Then, it moved to Yield Curve Control (YCC). And now, the central bank has in practice lost its independence to quell domestic inflation.

Before I quote Dr. Calomiris, who will explain in detail what fiscal dominance is and its practical implications, I want to give readers a quick summary.

- Fiscal dominance occurs when the central bank must set policies not to maintain stable prices, but to ensure the federal government can afford to fund itself in the debt markets.

- Because the government needs the yield on debt to be less than nominal GDP growth and/or inflation, investors have no appetite to purchase this debt. This is the definition of negative real yield.

- In order to find a sucker to buy the debt, the central bank requires commercial banks to place substantial reserves with it. These reserves pay no interest and can only buy government bonds.

- Commercial banks’ profitability declines as they are unable to attract deposits to lend out because the deposit rate they are allowed to offer is much less than nominal GDP growth and/or inflation.

- Because depositors cannot earn a real yield at the bank or in government bonds, they flee to financial instruments outside of the banking system. In many cases, the commercial banks themselves are active participants in funnelling money into different jurisdictions and/or asset classes in order to earn fees from their clients. This is called financial disintermediation.

- The open question is whether the commercial banks have enough political power to protect their clients and enable this financial disintermediation to occur.

Back to the land of the “free”. Why go through all of this effort, when it would be simpler to tell the Fed to just cut rates? Because, in Dr. Calomiris’ words, this is a “stealth” tax that most Americans will not notice or understand. It is politically more expedient to keep rates high than to publicly instruct the Fed to start cutting rates and juice the markets again – or heaven forbid, cut government spending –when inflation is still ravaging the American middle class.

Now I will share some of the most salient quotes from the article. But, and I can’t stress enough, you need to read this yourself. I want the fucking St. Louis Fed website to crash because so many people decided to swipe away from TikTok and Instagram thirst traps and educate themselves instead.

Who the fuck is Dr. Charles W. Calormiris?

“Charles W. Calomiris is Henry Kaufman Professor of Financial Institutions Emeritus at Columbia Business School, and Dean of the Center for Economics, Politics and History at UATX.”

Charles is a card-carrying member of the Western economic illuminati. He isn’t some Bitcoin-maxi, crypto-twitter keyboard warrior like myself. You can be sure that his paper will be discussed at the upcoming central banker jamboree in Jackson Hole, Wyoming USA.

Charles, what is Fiscal Dominance in your own words?

“This article considers fiscal dominance, which is the possibility that accumulating government debt and deficits can produce increases in inflation that “dominate” central bank intentions to keep inflation low.”

What causes Fiscal Dominance? Is the USG spending too much fucking money?

“The above quotation from the Treasury’s Financial Report admits that the current combination of government debt and projected deficits is not feasible as a matter of arithmetic because it would result in an outrageously high government debt-to-GDP ratio.”

When will Fiscal Dominance be upon us?

“… if global real interest rates returned tomorrow to their historical average of roughly 2 percent, given the existing level of US government debt and large continuing projected deficits, the US would likely experience an immediate fiscal dominance problem.”

Real Interest Rate = 2% (from Dr. Calomiris) + 4.7% July 2023 Core CPI Inflation = 6.7%

This is a moving target, but imagine what would happen if the entire US debt yield curve was at least at 6.7%. Game over!!!

Why is this a bad thing for the people?

“Fiscal dominance leads governments to rely on inflation taxation by “printing money” (increasing the supply of non-interest-bearing government debt). To be specific, here is how I imagine this occurring: When the bond market begins to believe that government interest-bearing debt is beyond the ceiling of feasibility, the government’s next bond auction “fails” in the sense that the interest rate required by the market on the new bond offering is so high that the government withdraws the offering and turns to money printing as its alternative.”

A Fed sanctioned economist publishing a paper on the Fed’s website just told you the future, are you fucking listening????!!!!

Let’s get into some specifics about how commercial banks would be affected under these circumstances.

What happens to bank deposits?

“Furthermore, some changes in policy with respect to reserve requirements are likely if fiscal dominance becomes a reality. The existing amount of the zero-interest debt (the inflation tax base) is currently limited to only currency, given that bank reserves bear interest today. Given the small size of the currency outstanding, if the government wishes to fund large real deficits, that will be easier to do if the government eliminates the payment of interest on reserves. This potential policy change implies a major shock to the profits of the banking system.”

Banks ‘bout to get rugged.

There are some other effects of this policy:

In addition to ending interest paid on bank reserves, the Fed must also end payments on RRP balances as well. There can be no arm of the government offering yields above that of long-term treasuries. And given the whole point of this exercise is to pin long-term treasury yields well below inflation and nominal GDP growth, it will be unattractive to deposit in MMFs and/or buy US Treasuries. As such, the current phat yield earned on cash will disappear.

Essentially, the Fed will end its attempt to control the price of money and just focus on the quantity. The quantity of money can be changed by altering banks’ reserve requirements and/or the size of the Fed’s balance sheet. Short-term rates will be cut aggressively, and most likely to zero. This helps bring the regional banks back into profitability, as they can now attract deposits and earn a profitable spread. It also makes financial assets outside of big tech appealing again. As the stock market in general rises, capital gains taxes rise, which helps fill the coffers of the government.

Charles, why is rugging the banks the best policy option?

Charles pulls no punches, and I couldn’t say it better myself.

“First, instead of new taxes enacted by legislation (which may be blocked in the legislature), reserve requirements are a regulatory decision that is generally determined by financial regulators. It can be implemented quickly, assuming that the regulator with the power to change the policy is subject to pressure from fiscal policy. In the case of the US, it is the decision of the Federal Reserve Board whether to require reserves to be held against deposits and whether to pay interest on them.”

The Fed is not accountable to the public like an elected representative. It can do whatever it wants, without voters’ approval. Democracy is great, but sometimes a dictatorship is better faster stronger.

“Second, because many people are unfamiliar with the concept of the inflation tax (especially in a society that has not lived under high inflation), they are not aware that they are actually paying it, which makes it very popular among politicians.”

Charles, can we be friends? Charles just said that you are too dumb and distracted to notice how the government is continuously caressing you softly with inflation.

Finally, Charles lays out exactly why this will be the policy of choice for the Fed or any other central bank.

“If, as I argue below, a policy that would eliminate interest on reserves and require a substantial proportion of deposits to be held as reserves would substantially reduce inflation, then I believe it would be hard for the Federal Reserve Board to resist going along with that policy.”

To understand the maths behind why this policy reduces inflation, please read the paper. There is a detailed section showing why this policy actually reduces the inflation needed for the government to reduce its debt-to-GDP ratio.

How can the banks fight back?

Do you think Jamie Dimon (CEO fo JP Morgan) is going to get fucked and not put on some protection?

“Such a policy change would not only reduce bank profitability but also reduce the real return earned on bank deposits to substantially below other rates of return on liquid assets, which potentially could spur a new era of “financial disintermediation,” as consumers and firms seek alternatives to low-interest paying bank deposits.”

This would be a return to the period of 2008 to 2021, when cash was trash because it yields next to nothing, and stocks, property, crypto, NFTs, art, etc. all offer better returns. As a result, capital would flow out of the banking system and into these financial assets.

Charles continues …

“The need to preserve a high inflation tax base could lead to a political choice to preserve a technologically backward banking system. (This would be a continuation and acceleration of recent political trends to limit Fintech bank chartering, as discussed in Calomiris, 2021.)”

Easy-to-use digital banking systems make it easier for money to leave the banking system. One large reason why three US banks failed in the span of two weeks is that depositors can now move all their money to another bank in less than five minutes. The bank runs happened so fast that management was powerless to stop it. If fiscal dominance is in play, there is no reason for the banking regulators to encourage more innovation.

“Of course, banks and their political allies might try to oppose financial innovations to allow firms and consumers to exit from banks, which would lead to a potentially interesting regulatory battle over the future of financial intermediation.”

Financial Disintermediation

Financial disintermediation is when cash flees the banking system to alternatives because of paltry yields. Bankers come up with all sorts of new and creative ways to give their clients higher yielding products as long as the fees are phat. Sometimes, the regulators aren’t so pleased with this “ingenuity” or “innovation”.

Fiscal dominance happened throughout the Vietnam War period in the US. In order to keep a lid on interest rates in the face of high inflation, US regulators imposed deposit rate ceilings on banks. In response, US banks opened up offshore branches – mostly in London, outside of the US banking regulators’ control – that were free to offer a market-based rate of interest to depositors. Thus was born the Eurodollar market, and it and its associated fixed income derivatives became the largest financial markets by trading volume in the world.

It’s quite funny how the efforts to control a thing usually leads to the creation of a bigger, more uncontrollable beast. To this day, the Fed and US Treasury barely understand all the nooks and crannies of the Eurodollar market that the US banks were forced to create to protect their profitability. Something similar will happen with crypto. This is one example of financial disintermediation Charles spoke about.

The heads of the large TradFi intermediaries like banks, brokerage houses, and asset managers are some of the most intelligent humans on earth. Their whole job is to predict political and economic trends well in advance and align their business models to survive and thrive. Jamie Dimon, for example, has highlighted for many years the unsustainable nature of the US government debt load and fiscal spending habits. He and his ilk know a reckoning is coming, and the result will be that the profitability of their financial institutions will be sacrificed in order to fund the government. Therefore, they must create something new in today’s monetary environment akin to the Eurodollar market back in the 1960’s and 1970’s. I believe that crypto is part of the answer.

The ongoing crypto crackdown in the US and West in general is focused on making it hard to do business for operators who don’t power lunch at The Racquet & Tennis Club on Park Ave in New York. Ponder this: how is it that the Winklevii – two tall, handsome,Harvard-educated, cis-gendered, tech billionaire men – couldn’t get their Bitcoin ETF approved in America, but it appears it’s going to be smooth sailing for crusty old Larry Fink over at BlackRock? Maybe it’s because BlackRock’s ESG policies are more evolved, LOLZ… The 50 Shades of Beige, Midtown Manhattan Edition. What I’m trying to say is that crypto itself was never the problem – this issue is who owns it.

Does it make sense now why banks and asset managers all of the sudden warmed up to crypto as soon as their competition was deaded? They know the government is coming for their deposit base, and they need to make sure that the only available antidote to inflation, crypto, is under their control. TradFi banks and asset managers will offer crypto exchange traded funds (ETF) or similar type managed products that give the client a crypto derivative in exchange for fiat cash. The fund managers get to charge egregious fees because they are the only game in town that allows investors to easily sell fiat for a crypto financial return. If crypto in the coming decades can have a larger monetary systemic impact than the Eurodollar market, then TradFi can more than recoup their losses due to unfavourable banking regulations. They do this by becoming the crypto gatekeepers for their multi-trillion-dollar deposit bases.

The only hiccup is that TradFi did such a good job creating a negative impression of crypto, the politicians actually believe it. Now TradFi needs to change the narrative to ensure the financial regulators give them the space to control where capital flows as the federal government enacts this stealth inflation tax on bank depositors.

The banks and the financial regulators could easily find common ground by restricting in-kind redemptions of any crypto financial products offered. That means that holders of any of these products will never be able to redeem and receive physical crypto. They can only redeem and receive dollars which will be put right back into the banking system that is fucking them front, back and sideways.

The more philosophical question is whether we can retain the ethos of Lord Satoshi when the industry is flooded with possibly trillions of dollars parked in financial products firmly within the fiat TradFi system. Larry Fink doesn’t give two fucks about decentralisation. His business is based on centralising assets at BlackRock. What impact would an asset manager like BlackRock have on Bitcoin Improvement Proposals that, for example, increased privacy or censorship-resistance? BlackRock, Vanguard, Fidelity, etc. will rush to offer ETFs that track an index of publicly listed crypto mining firms. Very quickly, miners will discover that these mega asset managers will control large voting blocks of their stock and will affect management decisions. I have hope that we can remain true to our Lord, but the devil awaits and offers a siren song many cannot resist.

Before I lay out some final thoughts on trading, let me ask Charles if there is any other way to solve the US financial system’s problems.

“An alternative policy path, of course, with less inflation taxation, would be for the government to decide to reduce fiscal deficits and thereby avoid the need for rising inflation and its adverse consequences for the banking system.”

Wow, it’s just that easy! But hold on – Charles throws cold water on that silly idea.

“This may be a hard policy to enact, however, given that the main contributors to future deficits are large Medicare and Social Security entitlement payments. Also, defense spending seems likely to rise as the result of increasing geopolitical risks related to China.”

The USG’s three biggest spending habits are politically untouchable. That ends that debate – the USG must print the money instead.

“Ultimately, it seems likely that the US will either have to decide to rein in entitlements or risk a future of significantly higher inflation and financial backwardness.”

“… banks and their political allies will redouble their efforts to use regulation to protect the bank-ing system from innovation and competition, as they have already been doing (see Calomiris, 2021). Ultimately, the US may face a political choice between reforming entitlement programs and tolerating high inflation and financial backwardness.”

I still can’t believe I just read my talking points on the St. Louis Fed website. Thanks Charles, you my homie.

Ueada-Domo

To evaluate whether the BOJ has been dominated, let’s conduct a checklist exercise using the necessary conditions Charles gave us earlier.

Does the Japanese government have a very high debt-to-GDP ratio?

Yes – at 226%, it is one of the largest in the developed world.

Can the government afford real rates at the long term average of 2%?

No. Japanese inflation for July was 3.3%. If we add on 2% (long-term average real yield of bonds) to that level, we get 5.3%. If Japan’s Ministry of Finance had to fund all debt at these levels, the interest expense would be multiples of tax receipts.

Has there been a failed government bond auction?

Yes. A 20-year Japanese Government Bond auction basically failed last week. It featured the largest tail in almost 40 years. That means private investors are revolting against purchasing long-term debt at these massive negative real yields.

Is the central bank prioritising keeping rates low rather than raising rates to fight inflation?

Yes. Japanese inflation is at its highest levels in almost 40 years. And yet, the BOJ continues to publish nonsense forecasts that all say it will return to below 2% in the “future”, and therefore they must continue easing. It makes no sense, because they have had >2% inflation for over a year. They haven’t defined how long inflation must be above 2% for them to declare success and stop printing money to suppress JGB yields by buying bonds.

The super low yields are spurring a resurgence of the “animal spirits” of the ordinary Japanese people. Some examples are a booming stock market (the Nikkei is close to recouping the 1989 bubble top), and the fact that metropolitan apartment prices in cities like Tokyo are rising rapidly. Anecdotally, I’m hearing from friends in Japan that workers are quitting jobs-for-life so that they can become contract workers with less benefits and get minimum 30% raises instantaneously.

As prices of everything real and financial pump, there is less incentive to leave money with the bank earning a low yield. The BOJ must act soon to have the largest possible deposit base on which to enact an inflation tax. One of the discussions at Jackson Hole might be for the BOJ to go first by mandating high bank reserve requirements and forcing those reserves to purchase government debt. That leaves the Fed and US Treasury to observe the policy’s impact on one of America’s vassals first, and tweak it if needed before similar action is taken on US soil.

Let’s Make Some Fucking Money

Dr. Calomiris’ paper presented a very solid “solution” to the Fed and US Treasury’s problems. I am going to bet hard on this being the likely path to finding a sucker to buy long-term US Treasuries at affordable yields for the government. The question now is how to position my portfolio to sit tight and wait for fiscal dominance to force the policy prescriptions described by Dr. Calomiris.

Right now, cash is great because on a broad basis, only big tech and crypto has beaten it in terms of financial returns. I gotta eat, and unfortunately I earn no income holding tech stocks or crypto for the most part. Tech stocks don’t pay dividends, and there are no risk free Bitcoin bonds to invest in. Earning close to 6% on my fiat dry powder is great because I can pay life expenses without selling or borrowing against my crypto. Therefore, I shall bench press my current portfolio barbell of fiat cash into a MMF and crypto.

I don’t know when the US Treasury market will break and force the Fed into action. And given the politics demand the Fed continue raising rates and reducing its balance sheet, it is a good assumption that long-end rates will continue rising. The 10-year UST yield broke out above 4% recently, and yields are at local highs. That is why risk assets like crypto are getting smacked. The market believes higher long-term rates harm infinite duration assets like stocks and crypto.

In his most recent note, Daddy Felix predicted an impending severe market correction across all assets, including crypto. It looks like he is as precious as ever. I must be able to earn income, and weather market-to-market losses on crypto. My portfolio is geared for just that.

I believe I have the right future prognosis because the Fed has already indicated that bank reserve balances must grow, and predictably, the banking industry was not pleased. The rising long-term US Treasury yields are symptomatic of a deep rot in the market structure. China, oil exporters, Japan, The Fed, etc. are not buying U.S. Treasuries any longer for various reasons. With the usual buyers on strike, who will step up at low yields to purchase the trillions of dollars worth of debt the US Treasury must sell over the coming months? The market is hurtling towards the scenario Dr. Calomiris predicted, in which there is eventually a failed auction that forces the Fed and Treasury to act.

The market doesn’t realise yet that the faster the Fed loses control of the US Treasury market, the faster there is a resumption of rate cuts and QE. We already proved this earlier this year when the Fed abandoned monetary tightening by expanding its balance sheet by hundreds of billions over a few trading days to “save” the banking system from the various regional bank defaults. A dysfunctional US Treasury market is beneficial for risk assets of finite supply, like Bitcoin. But that is not traditionally how investors were trained to think about the relationship between fiat risk-free yielding bonds and fiat-denominated risk assets. We gotta go down to go up. I’m not going to fight the market, but just sit tight and accept my stimmies.

I also believe that at some point, more investors will do the maths and realise that the Fed and US Treasury combined are handing out billions per month to wealthy savers. This money has to go somewhere, and some of it will flow into tech stocks and crypto. As apocalyptic as the mainstream financial media might sound vis-a-vis a sharp correction in crypto prices, there is a lot of cash that needs a home in finite-supply financial assets like crypto. While some think we are going to break back below $20,000 on Bitcoin, I tend to think we spend the beginning of Q3 chopping around $25,000. The ability for crypto to weather the storm will be directly related to the amount of interest income looking for a new home.

Instead of being afraid of this crypto weakness, I shall embrace it. Because I use no leverage in this part of my portfolio, I don’t care if there are massive wicks down in price. Using algos, I will be patiently buying a few glorious shitcoins that I believe are going to rock-em sock-em robots when the bull market returns.

I still owe readers my final essay on the AI + crypto upcoming mania. Alas, I am still accumulating the shitcoin I intend to talk quite heavily about in that essay. It’s down 99% from its 2021 all time highs and I want MOAR! I love bottom fishing in the depths of the bear market when I believe there is real quality. If you happen to be in Singapore for Token2049, please come to my keynote, where I will touch on my investment thesis for this shitcoin.

But for now, the Fed is fucked because it cannot focus on what matters. I, on the other hand, got better after a few lessons, and now it’s time to lean back, trust the kite, and rip it across the Atlantic.

Related

The post appeared first on Blog BitMex