Bitcoin margin trading is undoubtedly catching up to speed. In 2019, there was an outburst of different venues that started to offer high leverage on Bitcoin and other cryptocurrencies.

This is mostly made available through futures contracts. KuCoin, a well-known crypto exchange, didn’t stand on the sidelines for long.

KuMEX is the Bitcoin futures trading platform of KuCoin, and it offers a few different types of contracts. Besides, users can also take advantage of leverage rates of up to 100x.

Kucoin KuMEX

Pros

- Easy-to-use interface with seamless navigation across the board

- Security and stability of KuCoin – one of the well-known cryptocurrency exchanges

- Lite version to make trading even simpler

What Is KuMEX?

KuMEX, short for KuCoin Mercantile Exchange, represents an advanced cryptocurrency trading platform. It allows traders to use various leveraged contracts. They are bought and sold in Bitcoin.

Unlike traditional cryptocurrency exchanges, KuMEX currently handles Bitcoin only. All of the profits and losses are denominated in Bitcoin.

It’s worth noting that KuMEX allows the trading of cryptocurrency contracts. There’s a fundamental difference between spot trading and contract trading. While the former represents the exchange of two different cryptocurrencies at spot price, with the latter, users trade financial contracts with others.

A contract in KuMEX represents an agreement to buy or sell a particularly cryptocurrency at a predetermined price at a specified time in the future.

Additionally, KuMEX allows Bitcoin margin trading with different leverage for the various contract types. However, it’s essential to know that margin trading carries high risks of capital losses, and it should be exercised with extreme caution and by experienced traders.

Different Types of Contracts At KuMEX

There are two types of contracts at KuMEX. These include:

- Bitcoin Perpetual Mini Contract (XBTUSDM)

This is a perpetual futures contract that has no expiry date. It means that users can open and close their positions at will. One contract is worth $1 of Bitcoin. The funding interval is every 8 hours. Traders can use a leverage of up to 100x.

- Bitcoin Mini Contract 3-Month Settlement

This is a cash-settled Bitcoin futures contract that expires every three months. The contract is also worth $1, allowing more people to receive exposure to Bitcoin’s price. Traders can use a leverage of up to 20x.

How To Open An Account And Deposit At KuMEX?

Opening an account on KuMEX is relatively straightforward. Either if you already have a KuCoin account, or else, you will need to open a KuCoin account here, and then navigate to KuMEX on the main menu.

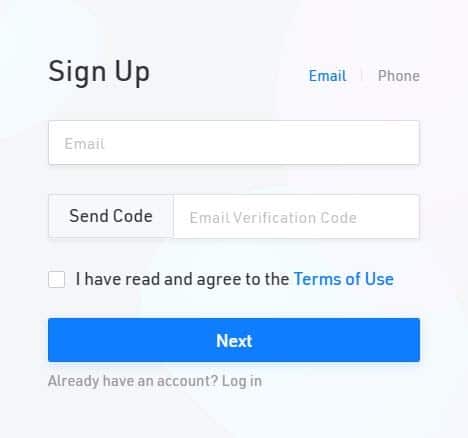

Upon hitting the sign-up button on KuCoin, the user will get the following screen:

All that is needed is an email or a phone, where the user will receive a verification code. Upon confirming it, he’d have to set up his password, and that’s it.

The benefit of KuMEX is that it requires no KYC verification, which adds more to the anonymity – something that a lot of cryptocurrency traders are looking forward to.

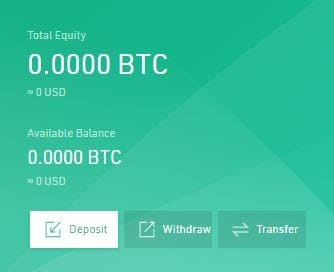

As soon as the account is set up, the next step is to deposit some funds. To do so, however, the user has to set up his two-factor authenticator and a complicated trading password, both of which can be done quickly and will contribute to the security of your digital assets

Then, in account settings, users will be able to deposit Bitcoin. They can do so either by sending BTC to their KuMEX address or by transferring some from their main account on KuCoin. Unlike asset transfer at other exchanges, transferring between KuCoin and KuMEX will be completed instantly.

How To Open and Close A Position On KuMEX?

Opening a Position

Opening a position on KuMEX is relatively easy. There are three different types of orders that users can choose from.

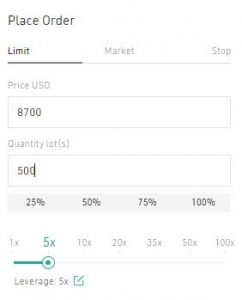

- Limit Order

Limit orders are used when traders want to enter the market at a price different than the current spot price.

For example, if Bitcoin is currently trading at around $8,650, a trader might want to enter the market later, at $8,700. The limit order above is set up to purchase 500 contracts ($1 each), once the price reaches $8,700. There is also leverage of 5x, so the user would receive 500 contracts, worth $500 while posting a margin of only $100.

- Market Order

This is the most basic and straightforward type of order. They are placed when a trader wants to buy at the current market price.

In the above example, we’ve set up a regular market order to buy 500 contracts ($1 each) at market price. Again, there is a leverage set at 5x.

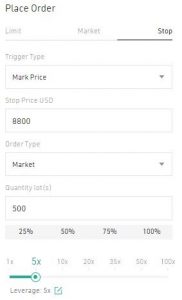

- Stop Loss/Take Profit

These orders are used to optimize trading performance. They are set to either mitigate losses or to maximize profits and reduce risk.

There are a few things that have to be considered here. First, users have to determine the trigger – it could be either the market price, the index price, or the last price. Then, they’d have also to determine the order type – it could be either limit or market order.

In this example, we’ve set a stop-loss order which would see a regular market order for 500 contracts with 5x leverage placed and executed as soon as the market price reaches $8,800.

Alternatively, users can also prefer to use a stop-limit order. In this case, once the trigger condition is met, the limit order will be placed in the order book, and when the limit price is reached, it will be executed.

KuMEX also provides Take Profit and Stop Loss mechanisms for position operation. In the Take Profit & Stop Loss pop-up box in the position list, users can open the corresponding switch, enter the direct Profit or Stop Loss price or a percentage, and set the order up.

Closing a Position

Closing a position is also relatively simple. Once opened, all of the positions appear right below the charts, alongside all the information about them.

Here, users can track all the essential indicators such as the entry price, current market price, liquidation price, margin, realized and unrealized profit and loss, and so forth.

This is also where they can put stop-loss or take-profit orders like the one in the example above. Moreover, this is where they can close their positions using the “close position” button.

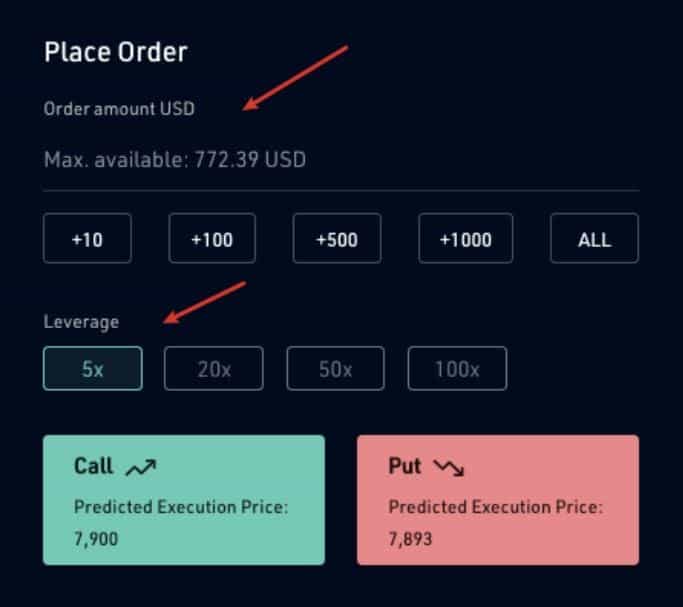

KuMEX Lite

To make things even more comfortable, KuCoin has released KuMEX Lite. This is a simplified version of the KuMEX platform. Its goal is to improve the user experience and to minimize complexity when it comes to contract trading. It supports English and Chinese Languages.

Logging into the KuMEX Lite platform is done with the user’s regular account information. This is how the overall trading layout looks like:

To enable contracts trading, the user needs to click on the button on the right side of the screen. From there, placing orders is notably simplified.

Placing long orders happens through the “long” option while shorting assets happens through the “short” option. Everything the user has to do is input the amount that he wants to trade with and select a level of leverage.

Of course, as it is with the regular platform, the Lite version also has Liquidation prices, which should be carefully monitored in order not to lose one’s position.

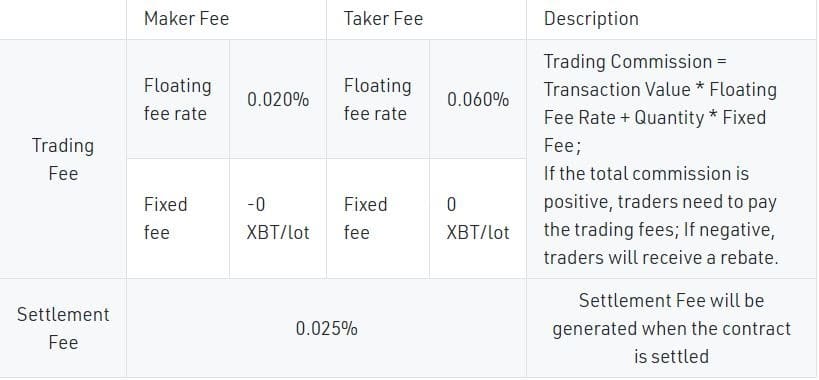

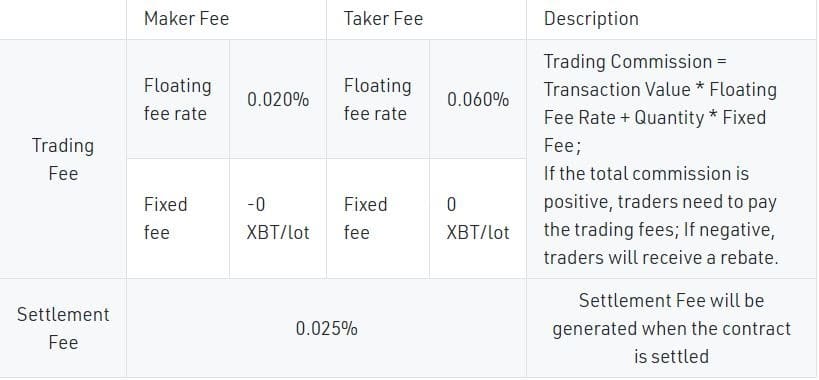

KuMEX Trading Fees

The trading fees in KuMEX are properly detailed in their designated contracts section. The table below outlines what users have to keep in mind.

A Market Maker – A market maker is someone who places an order which isn’t traded immediately, but it stays and waits for someone to fill or match it at a given point.

A Market Taker – A market taker is someone who places an order which is instantly matched with an existing order on the order book.

In terms of deposit and withdrawal fees, there are none. However, therm has a live chat that is relatively responsive. There is also a very comprehensive help center that contains information about the different types of contracts, how to use them, frequently asked questions (FAQs), and so forth.

If the matter is more complicated, KuMEX offers the option to open a ticket, where the support team gets back to the user relatively quickly.

KuMEX Security

It’s safe to say that KuMEX is a reliable platform. In terms of account security, users can generate a two-factor authenticator, as well as a unique trading password, which enhances security.

At the same time, KuCoin, the central platform, is considered to be somewhat safe, and it hasn’t been hacked yet. Their website is protected by an encryption protocol that protects the privacy of the information stored.

In terms of margin trading, KuMEX has employed the so-called Auto-Deleveraging System (ADL). This means that when a position is taken over by the liquidation engine, the insurance fund will be used to cover the extra cost of the liquidation process – for example, if the position has been closed at a price lower than the liquidation price.

Conclusion

In conclusion, KuMEX provides a somewhat simplified user interface as well as enough tools for traders to choose from. The experience is seamless and intuitive.

It’s also reassuring that the exchange belongs to an already established organization that has managed to prove its reputation since it was first introduced.

Unlike a lot of the other Bitcoin futures trading exchanges that only provide perpetual contracts, KuMEX also has 3-month and 6-month cash-settled Bitcoin futures contracts, adding more versatility.

It regularly enjoys serious trading volume on its Bitcoin perpetual contract, giving traders the liquidity they need. Of course, it has a long way to go until it catches up with some of the established market leaders, but it seems that the exchange is headed in the right direction.

The post appeared first on CryptoPotato