The cryptocurrency market has been known, at large, for the fact that there’s a lack of regulation in certain aspects. Whether or not one considers this as a positive or negative feature, the fact of the matter is that slowly but surely, market regulators are inserting their views and rules.

With so many different sorts of regulations being forced on the crypto market, let’s dive into what’s to come, what could be the change, and ultimately – is it good or bad for Bitcoin and the community?

Regulations Summary

The U.S. was among the first countries to submit some basic forms of regulations for the cryptocurrency market back in 2013. However, digital assets have come a long way since then, implementing numerous changes in its method of operation.

Moreover, a lot of new cryptocurrency-related businesses appeared, and the country is forced to enforce stricter AML regulations, according to the director of the Financial Crimes Enforcement Network (FinCEN), Kenneth Blanco. He recently said that all crypto exchanges would have to verify the identities of each customer, a part of a process called Know Your Customer (KYC). They will also need to identify the original parties and beneficiaries of transfers for over $3,000.

The E.U. is not far behind; in fact, as recently as January 10th, the Union introduced an updated version of its 5th Anti-Money Laundering Directive (5AMLD). It includes the KYC process again but also reads that all transactions will be monitored, and companies will have to file suspicious activity reports (SARs) with law enforcement.

It affects every cryptocurrency-related business that is currently based in E.U. countries, including some of the largest exchange – Binance, Bitstamp, Bibox, Coindeal, and OKEx. The aftermath can already be seen, as Deribit exchange, also based in Europe, has recently announced that it will be moving from the Netherlands to Panama from February this year.

Additionally, as a result of stringent anti-money laundering regulations, Qatar’s Financial Center issued a ban on cryptocurrency-related services within the country. It also applied to other digital assets that can be used as substitutions for traditional fiat.

It’s also worth noting that Hong Kong is catching up as well, publishing KYC rules that will supposedly help with more security by enabling “virtual asset trading platforms to be regulated by the SFC.”

The Good

As some people noted the lack of regulations on the cryptocurrency market as a negative feat, the implementations of such could deliver more mainstream adoption. Furthermore, the inclusion of KYC and AML in crypto-related businesses and services should provide more security, as well.

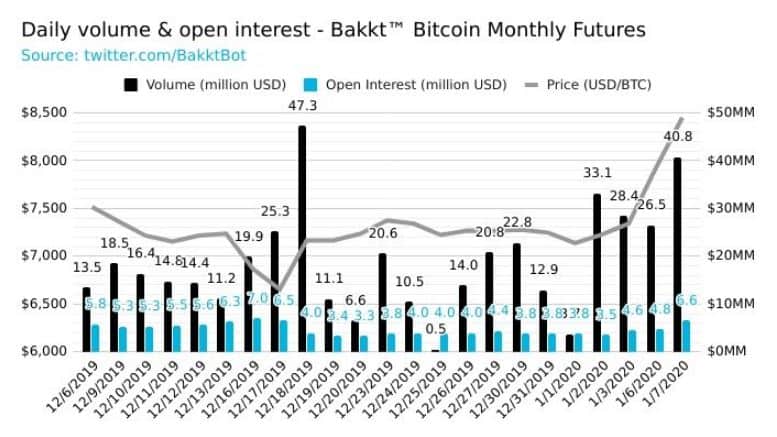

When one combines the increased security and regulations, the result could bring more institutional investors to the scene. One such example can be extracted from Bakkt – the Bitcoin Futures trading platform of the Intercontinental Exchange (ICE). Due to its regulated warehousing and federally regulated price discovery, Bakkt’s launch was one of the crucial steps in 2019 for bringing institutional investors.

Even though it started with minimal volume, it continues to improve, which could be regarded as an indication that regulated services have a spot in the crypto community.

BakktTradingVolume. Source: BakktBot

The Bad

While all reasons listed above could be valid, enforcing so many regulations on the crypto market might also contain several adverse trademarks. For years, the lack of similar regulations meant more anonymity, which brought a large number of fans. However, with KYC/AML, the cryptocurrency anonymous nature will no longer be the case, as users will have to prove their identities when registering on some services.

Here’s where the most significant contradiction comes into play. For the crypto market to receive mainstream adoption, it needs regulations and more institutional investors. Yet, the last two will lead to loss of anonymity, which has been crypto’s backbone for the last several years.

The Conclusion

Whether the community likes it or not, KYC and AML regulations are entering the market, starting from the U.S. and the E.U. The trend is likely to continue and to absorb most countries, which is supposedly going to lead for more security, institutional investors, and mainstream adoption, but it could also harm the anonymous nature of the market and the community.

You might also like:

The post appeared first on CryptoPotato