Coinbase is one of the most highly secure and reliable exchanges on the market, supporting directly purchase cryptocurrencies with fiat, but this security and convenience come with a cost.

Coinbase is also known for its high fees, and if you are a trader that makes frequent withdraws and trades, these fees can really take a large chunk out of your profits.

So, what is there to do? Well, there is a trick on how to avoid paying Coinbase fees, and it involves using Coinbase Pro.

Coinbase Fees

Coinbase applies a fee of based on trading volume, with an additional 0.5% spread fee for all crypto transactions:

- ≤ $10 – a fee of $0.99;

- ≤ $25 – a fee of $1.49;

- ≤ $50 – a fee of $1.99;

- ≤ $200 – a fee of $2.99.

Withdrawals and deposits have a more complicated structure. The charges vary depending on what payment method you use and your country of residence. There is also a conversion fee if you deposit in other fiat currencies than the ones supported.

Source: Coinbase

Source: Coinbase

The Effective Rate of Conversion Fee Payment Method for Purchasing (after waiver):

- US Bank Account – 1.49%, with a $0.15 minimum;

- Coinbase USD Wallet – 1.49%;

- Credit/Debit Card – 3.99%.

The Effective Rate of Conversion Fee Payout Method for Sale (after waiver):

- US Bank Account – 1.49%, with a $0.15 minimum;

- Coinbase USD Wallet – 1.49%;

- PayPal – 3.99%.

Fees USD Deposit Method:

- ACH Transfer – Free;

- Wire Transfer – $10 ($25 outgoing);

- Using Coinbase Pro.

Coinbase Pro Fees

There are no fees incurred for withdrawing and depositing crypto on Coinbase Pro or through ACH bank transfer.

| Deposit Fee | Withdrawal Fee | |

| Digital Assets | Free | Free |

| ACH | Free | Free |

| Wire (USD) | $10 USD | $25 USD |

| SEPA (EUR) | €0.15 EUR | €0.15 EUR |

| Swift (GBP | Free | £5 GBP |

The Coinbase Pro trading fees are based on a maker-taker system, with fees ranging between 0 and 0.5% based on trading volume.

How to Avoid Coinbase Fees: Guide

Coinbase and Coinbase Pro are actually two separate platforms owned by the same entity. Coinbase was designed to cater to beginner traders with no experience.

As more and more people started getting into cryptocurrencies, the company launched another platform aimed at professional traders. This platform was initially called GDAX – Global Digital Asset Exchange, but it was later rebranded into Coinbase Pro.

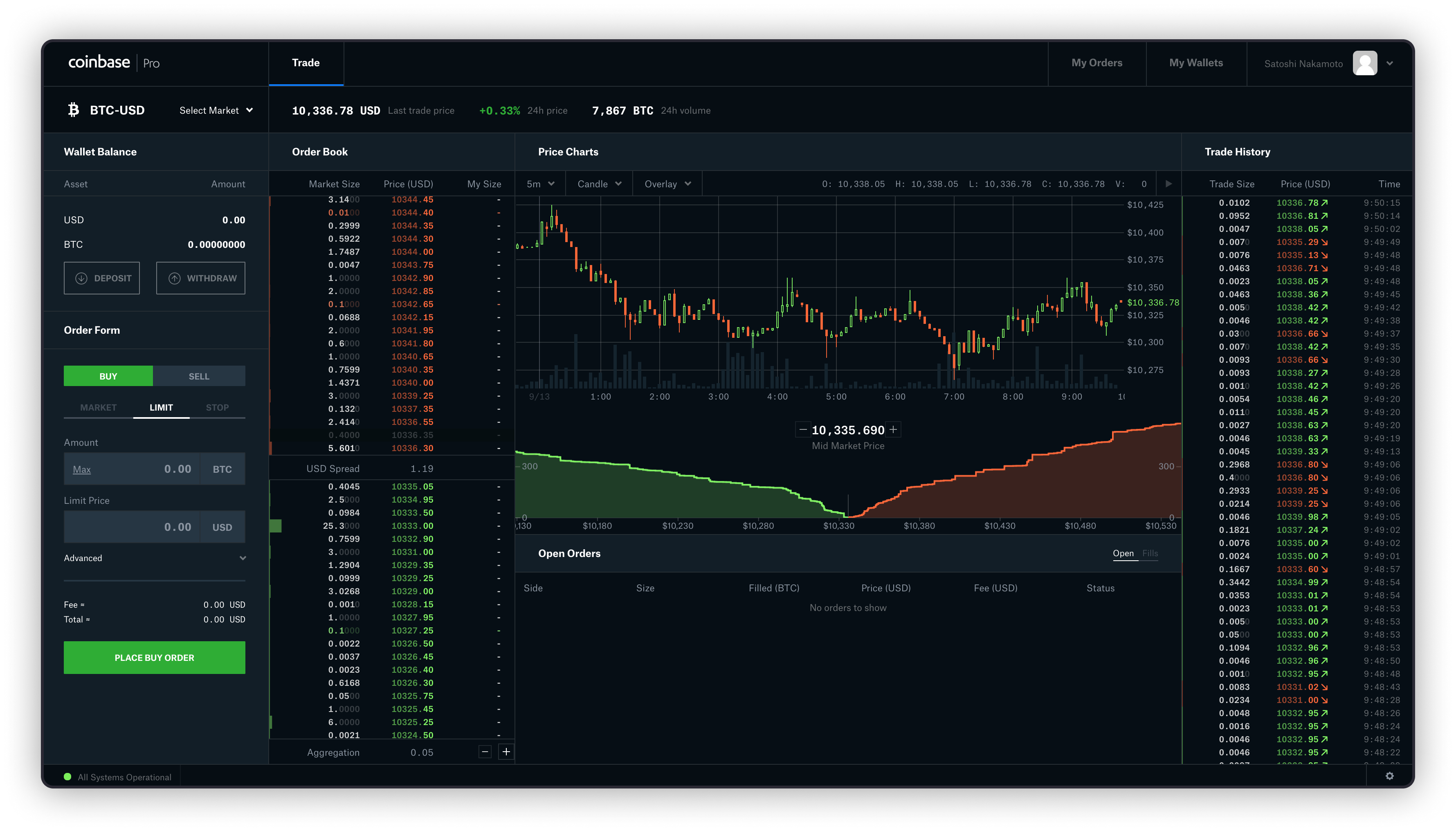

Source; Bitcoinist

Source; Bitcoinist

The major difference between the two platforms is that Coinbase is actually a broker, meaning you buy the crypto directly from Coinbase, and thus pay a fee for its services, while Coinbase Pro is an exchange where you find on your own market orders.

By allowing you to freely buy and sell cryptocurrencies on the market, Coinbase Pro does not charge any fees for deposits and certain trades.

Even if Coinbase Pro and Coinbase are owned by the same entity, there are some differences in fees that you can exploit to your advantage.

Withdrawal Fees

Coinbase does not have a direct withdraw fee, but you will be charged a network fee at the time of withdrawing, which varies depending on the network of the crypto.

To avoid paying withdraw related fees, you will have to first transfer your funds to Coinbase Pro.

- First, sign in to pro.coinbase.com and log in with your Coinbase account;

- Create an account on Coinbase if you do not have one;

- Next, link your bank account with your Coinbase account;

- Sign up for Coinbase Pro and wait for your account to be verified;

- After transferring your bank funds to your Coinbase account, move them to your Coinbase Pro account;

- Next, click on “My Wallets;”

- Click “Deposit;”

- Enter the amount of cryptos or funds you want to transfer from Coinbase to Coinbase Pro.

Buying Fee

If you want to purchase crypto with a debit card, keep in mind that you will have to pay higher fees. But if you are not pressed by time, opt to transfer your funds via a bank account to avoid paying the associated fees. As we mentioned earlier in our “How to Avoid Paying Coinbase Fees” guide, Coinbase Pro does not apply any deposit fees, as it is not a broker.

Trading Fees

Even though Coinbase Pro has trading fees, you can reduce them if you buy cryptocurrency through limit purchase or limit orders.

Coinbase Pro makes use of the maker-taker system to establish its trading fees. The Maker order is the one that adds liquidity to the market. This means your order will be entered in the order book as either a buy or sell order.

As a maker, you make your own offers, and you should place your price lower than the current selling price in the limit order.

A “taker” is the trader that removes liquidity from the order book, meaning you either buy or sell a trade that’s been recorded in the order book.

Here’s how to avoid paying Coinbase fees by placing order trades on Coinbase Pro:

- Move your funds to Coinbase Pro;

- Go to your Coinbase Pro dashboard to the left side of the screen and place an order;

- The default option is a “market order.” The order has a fee of 0.3%;

- To not pay this fee, place a “limit order.” The limit order enables you to put in the buy bid for your order. Limit buying is when you place an order with certain conditions, such as the amount and at what price the order executes;

- Scroll down through the list of orders and select a price in the middle;

- Enter that price in your order;

- An open order for that price will be displayed in your window;

- Even if you will not have to pay any fees if you have placed this order, but this does not guarantee that your order will be executed for certain.

Source: Coinbase

Source: Coinbase

While it looks like you have effectively bypassed the high fees of Coinbase, you should know that there are some downsides to using this method.

CONS:

- The process takes a longer period of time to execute;

- Limit orders can be confusing to inexperienced traders;

- Longer waiting times for bank deposits;

- Depending on the market demand, your order might not get executed;

- You have to create two accounts.

Conclusion

We hope that today’s guide has been of use in showing you how to avoid paying Coinbase fees by using its sister platform, Coinbase Pro.

Note: This post was originally published on 13 November 2018 and has been totally updated for the completeness and veracity of the content on 8 December 2019.

The post appeared first on Coindoo