Middle East’s Lebanon is a country with well-known economic issues, deepening for years and peaking during the COVID-19 pandemic.

With the nation’s unfavorable situation, numerous prominent economists have offered widely-ranging solutions to the depreciating local currency and USD dependence. Nevertheless, a recent report explored the possibility of a more untraditional solution – Bitcoin.

Lebanon: How Did It Get Here?

The country’s economy is primarily based on services with the tourism sector responsible for a large portion of Lebanon’s GDP. The nation had failed to develop self-sustaining domestic industries, and some reports indicate that it imports approximately 80% of its products. Those include oil, meat, grain, and other supplies.

In 1997, the Central Bank of Lebanon decided to introduce more stability for the national currency (the Lira) by pegging it 1,507 to 1 to the US dollar. Consequently, the country also started receiving inflows through tourism, remittances, loans, and foreign aid in the USD, instead of the Lira.

While having its currency pegged to the US dollar provides some merits as mentioned above, the increased dollarization of Lebanon led to substantial wealth inequalities. Not only the nation expanded its debt massively, but the top 1% of citizens earned approximately 25% of the GDP.

The Great Banking Ponzi Scheme

When most people think of a Ponzi scheme, they automatically refer to some shady MLM operations or even cryptocurrency-related shams. Only a few conspiracy-theorists believe that a respected country’s central bank would ever employ such activities. Yet, something quite similar occurred in Lebanon.

By justifying that the nation’s central bank reserves have been declining and need more deposits to supports its sustainability, Lebanese banks started offering suspiciously high interest rates on large sums blocked for (at least) three years.

“We will see an improvement in deposit growth on the one hand, and an improvement in the foreign currency reserves of the central bank as a result of those operations.” – said chief economist and head of research at Bank Audi, Marwan Barakat.

Head of Research at Blominvest Bank Marwan Mikhael noted that it will stabilize the reserves because “what we are passing through is a deterioration of confidence and the main task of the government now is to be able to restore confidence.”

Banks initially demanded minimum deposits of $20 million but reduced the amount to $5 million. In return, they offered staggering annual interest rates of 14%.

Needless to say, the unsustainability of offering such massive interest rates inevitably led to severe issues with the Lira-Dollar collaboration in the country. The first red flag came in 2019 when the head of the Central Bank of Lebanon Riad Salameh issued an order requiring all money transfer offices, such as Western Union and MoneyGram, to pay cash out in Lira rather than USD. The request affected even transfers, which were specifically denominated in dollars.

As citizens began noticing these discrepancies throughout the rest of 2019, the demand for dollars skyrocketed. Currency exchange booths and banks couldn’t handle the influx of people wanting to get rid of their Lira and receive dollars instead.

Although the Lira remained officially pegged at 1,507 to 1 with the USD, the rising demand and lack of dollars led to the creation of black market exchanges where locals bought US currency at a much higher price. On some occasions, the rate on these exchanges quickly exploded to as high as 10,000 Lira per dollar, leading to currency crisis and hyperinflation. Banks limited USD withdrawals firstly to $300, then to zero.

The situation worsened when Fitch downgraded Lebanon’s credit rating from B- to CCC, and US sanctions hit the Jammal Trust Bank for allegedly funding Hezbollah.

October 17th, 2019

Despite all those issues, what set off the public was a proposed tax on WhatsApp phone calls. It was the last straw locals could endure before initiating nation-wide peaceful protests. Started on October 17th, 2019, they continued for months, despite the government cutting power almost daily to its communities.

Prime Minister Saad Hariri resigned eventually, but that wasn’t enough for the Lebanese. However, while they were making progress and catching the world’s attention, the COVID-19 pandemic broke out, and the government had legitimate reasons to keep them off the streets.

By imposing extensive quarantine periods, authorities managed to calm the situation on the surface, but the consequences on the economy were devastating. The lockdowns led to a surge of unemployment and, ultimately, a lack of funds to purchase necessities.

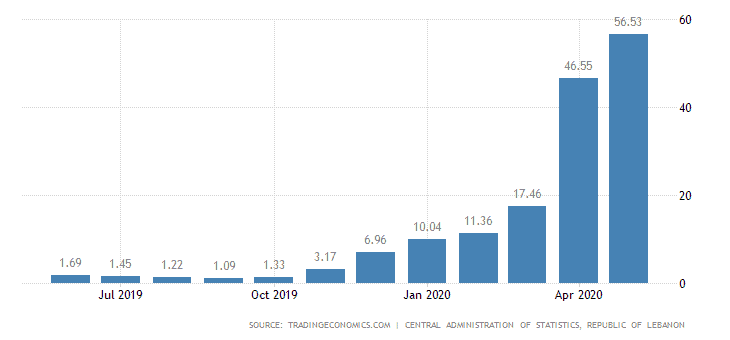

The inflation rates in 2020 alone surged from 11.4% and 17.5% in February and March to 46.6 in April, and a record-high of 56.5% in May. While June’s numbers are not public yet, most estimations expect an even higher percentage.

Possible Solutions

With proposed taxes being quickly scrapped, Lebanon lacks a proper solution. Protestors demand a profound transformation that can put back some sanity into their ecosystem.

The most widely-discussed solutions include going back to a commodity-pegged Lira. Gold sounds like the most reasonable choice, as it used to serve in precisely that position in numerous countries until the middle of the last century. However, Lebanon could think outside the box, as a commodity can be anything from grain, oil, or even cigarettes – as it happened in Germany after World War II.

Another plausible solution could be increasing dollarization. Similarly to Zimbabwe adopting the USD in 2009 after massive hyperinflation, Lebanon could follow its steps. Moreover, the country already has extensive experience with using the dollar for internal and external transactions, which could facilitate the transition.

However, this would ultimately give control to the stability of the US. Lebanon will be entirely dependent on how the US handles its operations and if it decides to impose sanctions as it has done before.

Untraditional Solution: Bitcoin, Anyone?

Lebanon could also head towards an unexplored and perhaps far-fetched sounding route, as suggested in this Forbes article. Adopting Bitcoin would be something entirely unimaginable, at least for some critics, but could be what the Asian country needs.

Being referred to as the “people’s money” by some, Bitcoin falls under the “commodity” category, according to the US CFTC.

Although imperfect, the primary cryptocurrency allows sending funds from one place to another rapidly and cheaply. It doesn’t shut off on the weekends, and it only needs an internet connection to work.

One of the most significant merits of BTC is its decentralized nature. In other words, there’s no central authority to impose sanctions, to control the inflow and outflow, or to ban withdrawals.

In fact, Bitcoin already has a useful utilization within Lebanon. Numerous reports tell the stories of various Lebanese, which are continually moving funds with BTC or other digital currencies.

Such is the story of Maher – an engineer working abroad, who came home to find despair in his country. Or, as he put it – “nothing can prepare you for the shock of this,” referring to the financial crisis, the protests, and the lack of proper solution. After depositing his dollars into supposedly safe banks, he was forced to withdraw them in Lira and lost nearly 40% of the value in mere weeks.

Yet, it seemed that he found such a solution in the largest cryptocurrency by market cap. Using Bitcoin, Maher said that “suddenly everything turns upside down and all the options are open.”

Another citizen Mahmoud Dgheim, who said he began utilizing BTC in 2015, added:

“Right now, Lebanese are interested in escaping tight restrictions on cash withdrawals and transfers. They basically want financial freedom. If you want to go around the banking system, Bitcoin is a solution.”

In conclusion, Bitcoin is far from being the obvious choice. Operating for “only” a decade, it still has to prove itself as a sustainable payment option. It has never been employed in such a responsible position as having an entire nation depending on it.

However, it was created during the last major financial crisis to blossom precisely in similar adverse conditions. Or, to use more Hollywood terms – it may not be the hero Lebanon deserves, but it could be the hero it needs if the country indeed decides to look for a profound transformation.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato