[Featured content]

Cryptocurrency derivatives are becoming more and more popular as the market continues to enjoy increased retail attention.

Back in June, CryptoPotato reported that the monthly trading volume for cryptocurrency derivatives hit a new all-time high (ATH) with over $602 billion traded in a month. In the first quarter of 2020, Bitcoin-oriented products accounted for 78% of the entire derivatives market.

One of the more exciting things to consider is the increasing interest in Bitcoin options trading. Some of the leading cryptocurrency exchanges support these contracts as well.

With Light.CX, however, users can enjoy trading short-term Bitcoin options contracts and receive serious exposure to the asset’s price.

What is Light.CX?

Light.CX is a relatively new cryptocurrency derivatives trading platform that’s headquartered in Seychelles. Its primary focus is short-term Bitcoin options. More specifically, the exchange offers Bitcoin options contracts with a 5-minute expiration window, for now.

The overall interface of the platform looks very straightforward, and there’s nothing challenging when using it.

There are a few benefits that come with using LIght.CX, such as:

- Pricing Transparency

When using any cryptocurrency platform, it’s essential to be aware of how the prices for its assets are formulated. Light.CX calculates the official index prices in a way that makes price manipulation rather difficult. Moreover, they also publish their algorithm, as well as the historical data in the interest of full transparency.

- Risk is Predefined

The platform’s interface calculates the potential profits and losses before the user enters into a trade. This makes risk management a lot easier.

- There are no Liquidations or Margin Calls

Since all of the positions on the platform are fully collateralized, there’s no deleveraging, margin calls, or liquidation.

Bitcoin Options and How They Work

Put simply, an options contract is an agreement between two parties to do a transaction for the underlying asset at a preset price, also known at the “strike price” at a predetermined time in the future.

Bitcoin options on Light.CX have a 5-minute expiration date. In other words, users can speculate on the price of BTC in a relatively short time frame.

There are a few main terms that you’d have to be aware of. These include:

- Strike Price

The strike price is the price at which the contract is entered into effect. This can be the current market price or a different price, depending on whether you’re using a market or a limit order.

- A “Bid”

This is an offer to buy an option. This means that the user thinks the price of BTC will be higher at the time the contract expires relative to the strike price.

- An “Ask”

This is an offer to sell an option. It’s the exact opposite of bidding – here, the trader thinks the price of BTC will be lower than the strike price at the expiration time.

There are also two types of orders on Light.CX. Namely, these are market and limit orders. The market order is used when you want to buy or sell an option at the best available market price. The limit order, on the other hand, allows the user to set a precise limit price, which, if reached, will be the strike price of the options contract.

A Clear Example with Light.CX

The important thing to consider is that the options contracts at Light.CX will only expire at $0 or $100, depending on the price at the expiration time.

For example, if you bid for an option contract at a strike price of, let’s say, $11,000 with a 5-minute expiration time, you “reserve” the right to buy at $11,000 in 5 minutes. So, if the price is higher than $11,000, you would have made a profit.

With Light.CX, however, each contract will expire to $100 or $0, depending on how the price develops. If you buy one contract to bid for $50 and the price ends up closing above the strike price, the contract will expire to $100, and you would make a $50 profit. If the closing price is lower than the strike price, however, you would realize a $50 loss.

The opposite is true for options to sell.

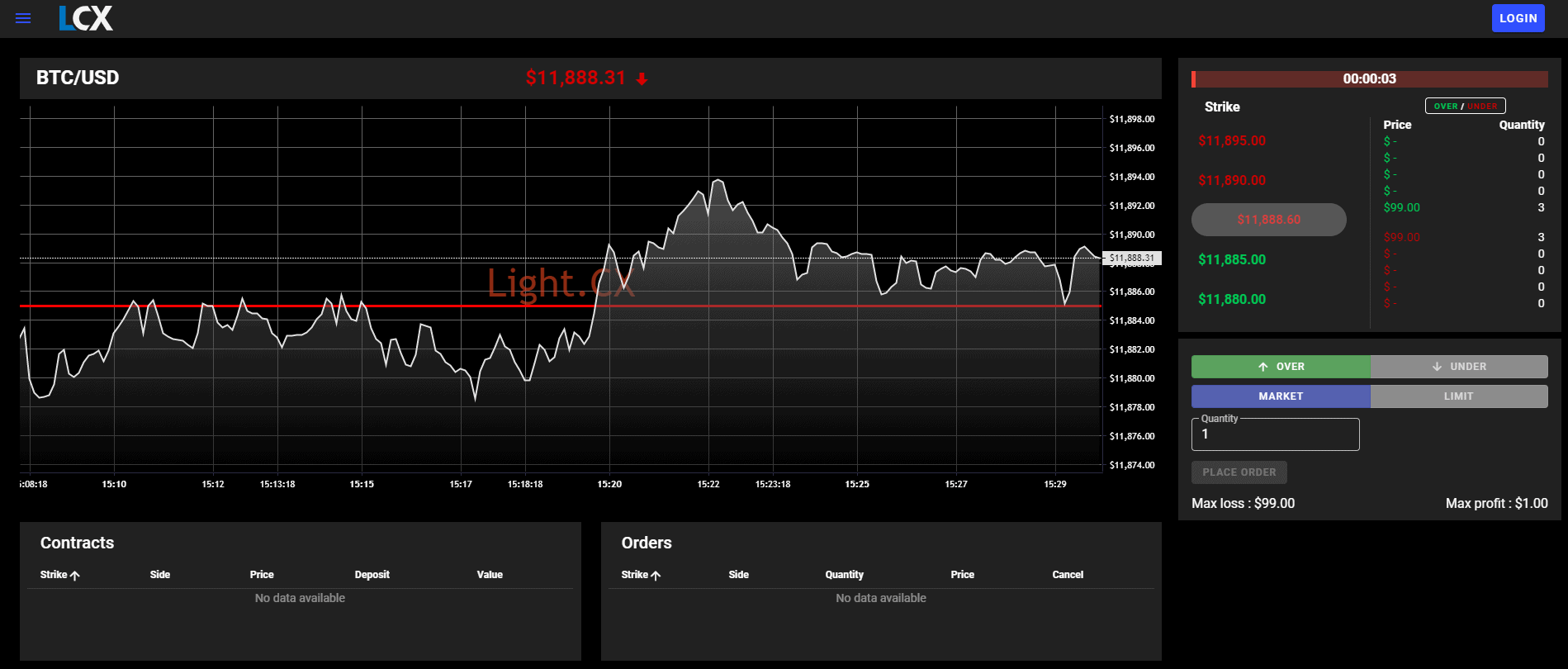

This is how the trading interface looks like:

On the left side, there’s a general BTC/USD trading chart where the bolded red line shows the strike price for the current contract.

In this case, there are only three seconds left to its expiration and one available contract priced at $99. So, if a user is to purchase this contract, he would have to click on the “over” or “under” button, which indicates whether the price will go above or below the strike price. Below the orders, one can see the maximum profit and loss for buying just one contract.

Conclusion

All in all, Light.CX provides an easy to use interface and a rather simple way for users to trade Bitcoin options.

The platform is intuitive, and it doesn’t require any serious previous experience for traders to get accustomed.

On the flip side, there’s only one available asset at the moment, which is Bitcoin, and users can only trade it against the USD.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato