LINK/USD: Descending Trend-line Can Prevent Further Bullish Action?

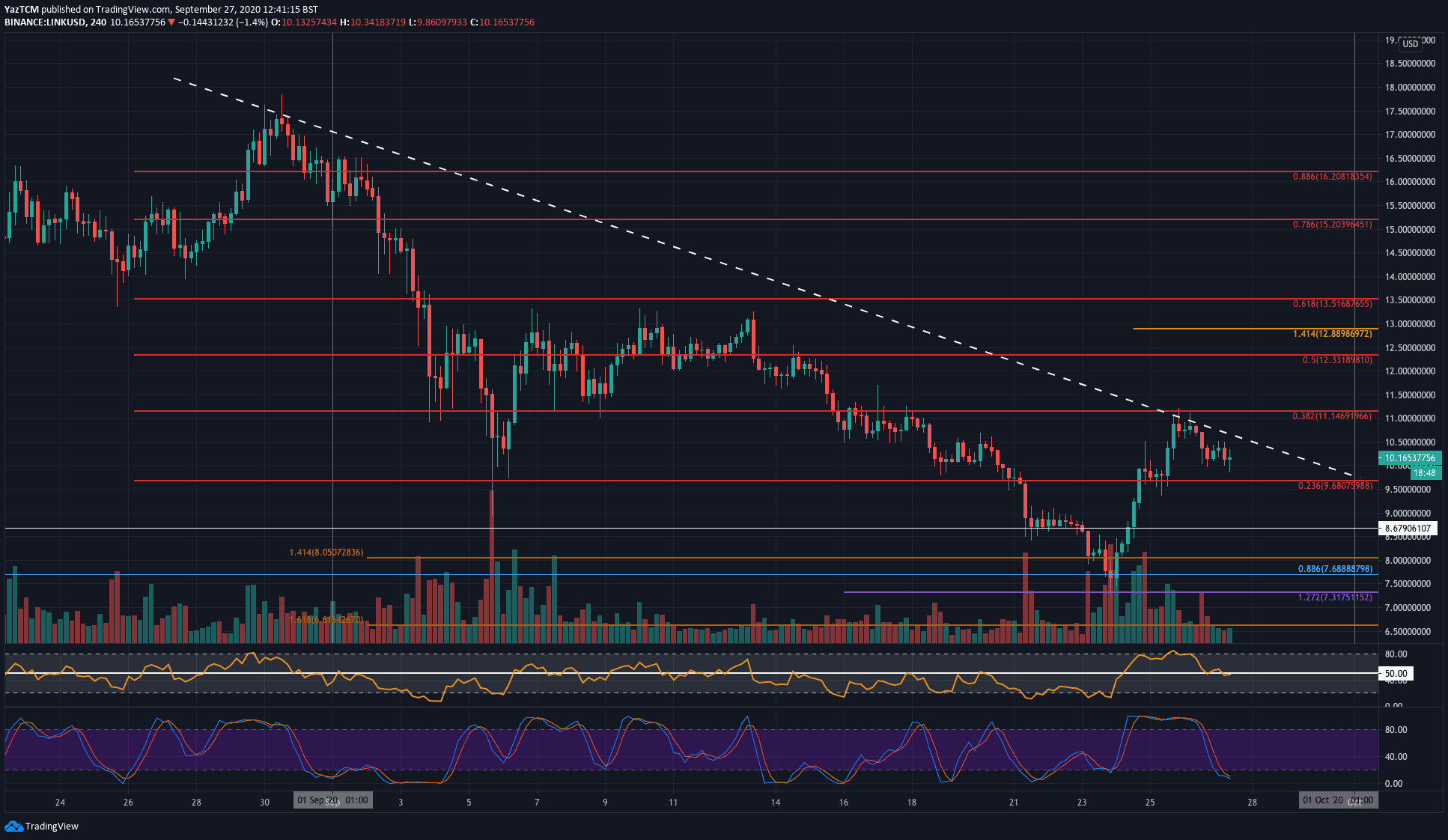

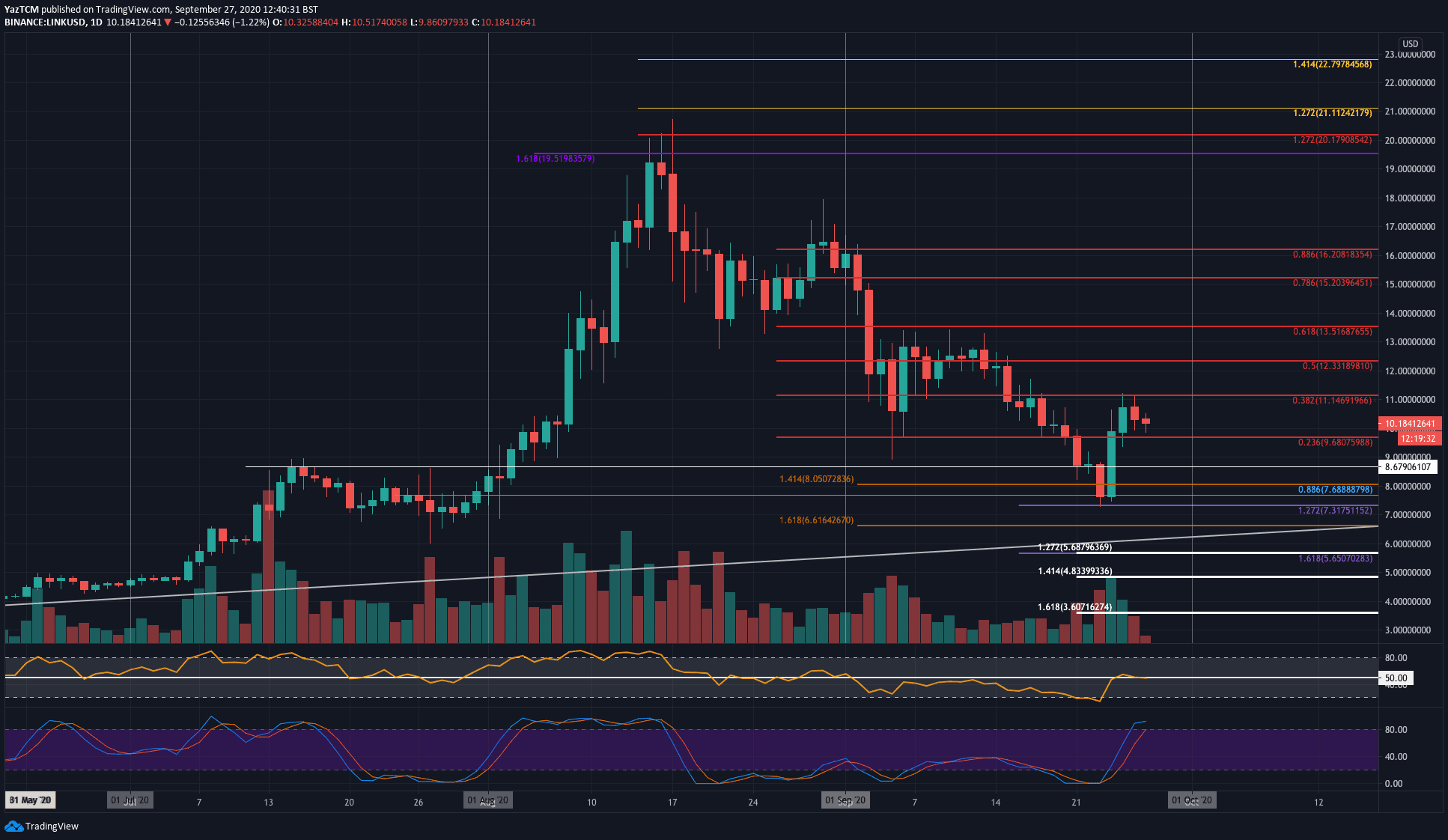

Key Support Levels: $10, $9.70, $9.24.

Key Resistance Levels: $11.15, $12.33, $12.88.

LINK dropped into the support at $7.30 (downside 1.272 Fib Extension) earlier this week, and since then, the coin had seen a mini bull run. Through the bounce, LINK climbed back above the $10 level as it reached as high as $11.15 (52% ROI), where it ran into resistance at a bearish .382 Fib Retracement.

This bearish Fib Retracement was further bolstered by a falling trend line, which is highlighted on the following 4-hour chart;

The marked descending trend line added resistance around $11.15, and it seems that for now, LINK’s run had stopped. As a result, LINK dropped back to the current trading zone around $10.16.

LINK-USD Short Term Price Prediction

Looking ahead, if the bulls can break above the mentioned 4HR trend line, then the first level of resistance is located at $11.15 (bearish .382 Fib Retracement). Following this, resistance is expected at $12.33 (bearish .5 Fib Retracement), $12.88, and $13.50 (bearish .618 Fib Retracement).

Alternatively, if the sellers push lower, the first level of support lies at $10. Beneath this, support lies at $9.70, $9.24, and $9.00. Added support lies at $8.70, $8.10, and $7.68 (.886 Fib Retracement).

The Stochastic RSI is at oversold conditions on the lower timeframe, the 4-hour chart, and a bullish crossover signal might help to push LINK higher.

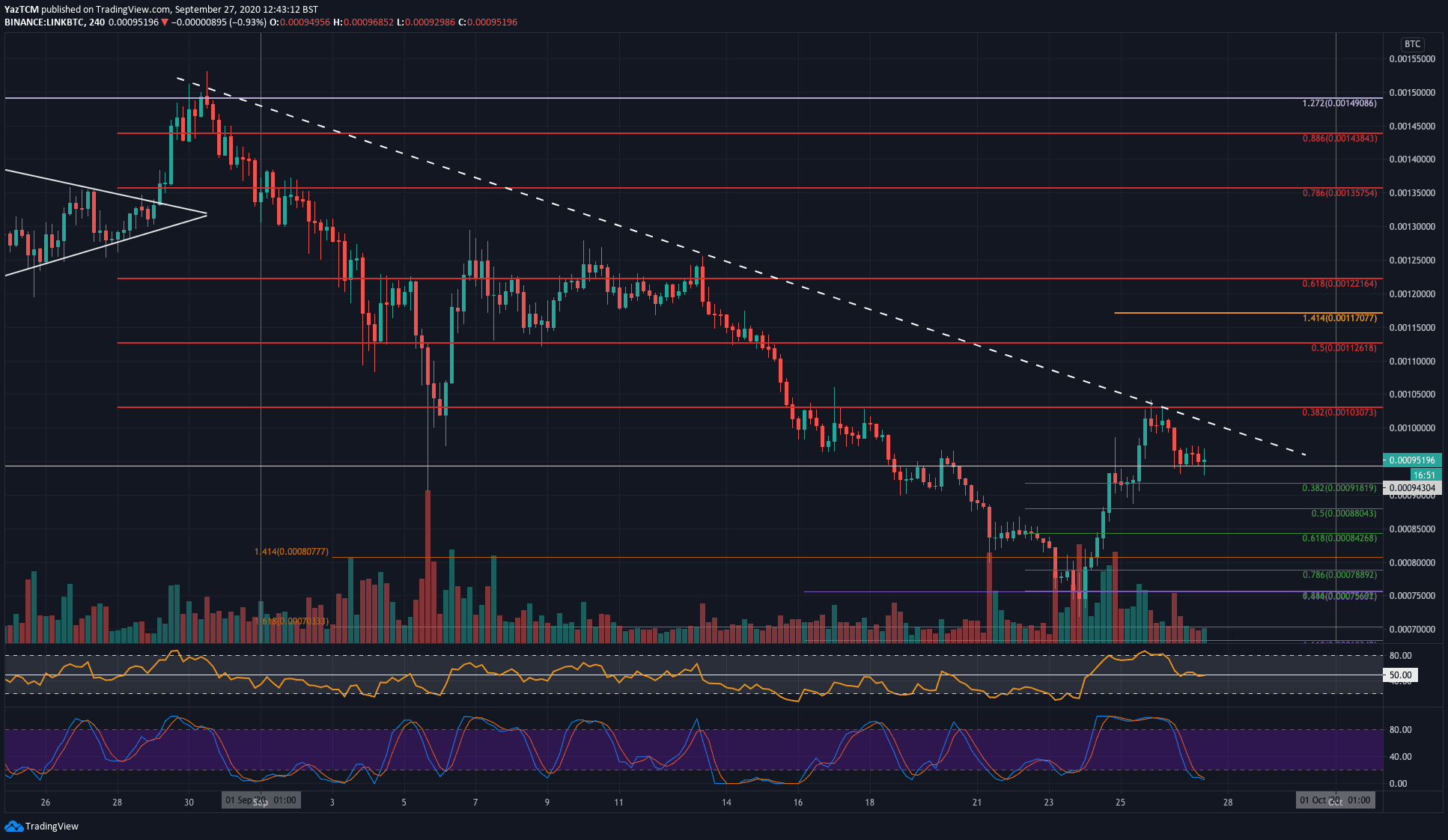

LINK/BTC – Similar Resistance Appears For LINK Against Bitcoin

Key Support Levels: 0.00094 BTC, 0.000918 BTC, 0.00088.

Key Resistance Levels: 0.001 BTC, 0.00103 BTC, 0.0011.

Against Bitcoin, the situation is quite similar as the buyers run into resistance at the bearish .382 Fib Retracement at 0.00103 BTC. A falling trend line also bolsters this level of resistance.

After hitting the 0.00103 BTC resistance, LINK dropped slightly and is trading at the 0.000943 BTC support level.

LINK-BTC Short Term Price Prediction

Looking ahead, the first level of resistance lies at the falling trend line at around 0.001 BTC. Above this, resistance is found at 0.00103 (bearish .382 Fib Retracement), 0.0011 BTC, and 0.00112 BTC (bearish .5 Fib Retracement).

Additional resistance lies at 0.00117 BTC (1.414 Fib Extension) and 0.00122 BTC (bearish .618 Fib Retracement).

On the other hand, if the sellers push beneath 0.00094 BTC, support lies at 0.000918 BTC (.382 Fib Retracement), 0.00088 BTC (.5 Fib Retracement), and 0.00080 BTC.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato