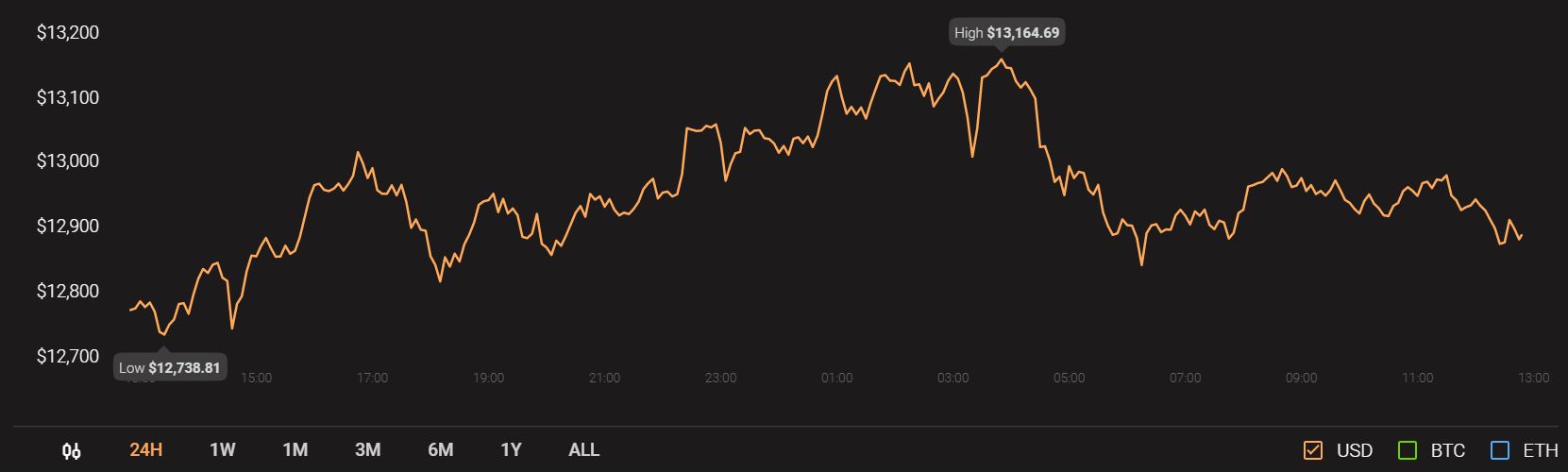

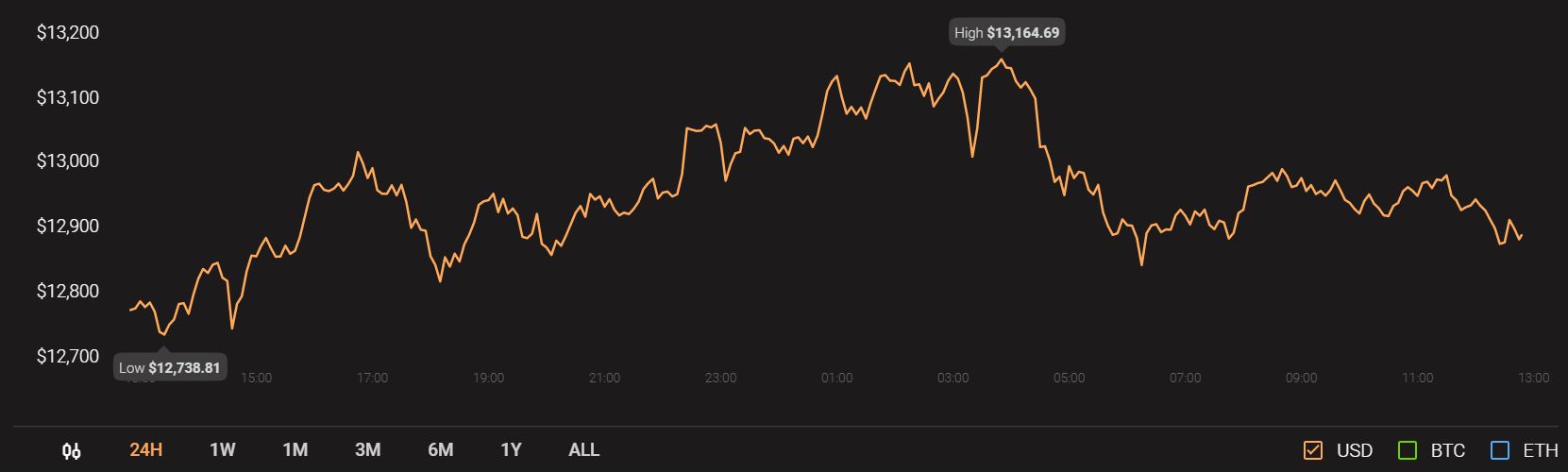

The last five days have been very bullish for the crypto-market, with the world’s largest cryptocurrency, Bitcoin, pumping by over 15% over the aforementioned time period. In fact, BTC’s latest pump had the crypto climb by over $1,500 on the charts, with BTC even breaching the psychological resistance of $13,000, albeit briefly.

Source: CoinStats

While corrections soon ensued on the charts, the altcoin market, at the time of writing, was still noting signs of bullish behavior. This was evident when Litecoin, IOTA, and VeChain’s price charts were examined.

Litecoin [LTC]

Source: LTC/USD on TradingView

Litecoin, the so-called silver to Bitcoin’s gold, has for long shared a strong correlation with the world’s largest cryptocurrency. The strength of this correlation was evident over the past few days after LTC took Bitcoin’s lead to pump on the charts. In fact, Litecoin was up by over 15% over the past 7 days, with the altcoin trading at $54.71, at press time. While Litecoin was still some way away from its mid-August local top, an uptrend seemed to be taking shape on the charts.

This uptrend was evident when Litecoin’s technical indicators were taken into consideration. While the dotted markers of the Parabolic SAR were observed to be under the price candles, a sign of a bullish market, the MACD line was well over the Signal line.

It can be argued that Bitcoin’s recent pump, and by extension, Litecoin’s, was fueled by the news that PayPal will now be supporting Bitcoin, Litecoin, Ethereum, and Bitcoin Cash.

IOTA

Source: IOTA/USD on TradingView

Once a popular mainstay in the top-10 of the cryptocurrency market, IOTA, over the past year, has steadily fallen on the charts, with the cryptocurrency ranked 28th, at the time of writing. Like Litecoin, IOTA too surged on the back of the PayPal announcement and Bitcoin’s hike, with IOTA gaining by over 7% over the week. Despite the said hike, however, the cryptocurrency was still trading within a tight price channel, a channel that has been the norm for the past 2 weeks now.

IOTA’s technical indicators, as expected, highlighted the recent bullishness. While the Chaikin Money Flow noted a sharp uptick to suggest that capital inflows were finally higher than capital outflows in the market, the Awesome Oscillator pictured minimal positive momentum.

IOTA was in the news recently after the IOTA Foundation confirmed that Coordicide will be released as scheduled.

VeChain [VET]

Source: VET/USD on TradingView

VeChain, the cryptocurrency ranked 27th on CoinMarketCap, has had a decent 2020, with VET noting YTD returns of over 127%, at the time of writing. Like most alts, VET too topped out in mid-August, before a sharp downturn pulled the crypto down to its June 2020 levels. However, following Bitcoin’s PayPal pump, many of these alts that were previously on a downtrend, including VeChain, had the opportunity to note sustained gains of their own.

It should be noted here that it is too soon to predict whether VeChain will sustain its brief uptrend as while the Bollinger Bands seemed to be tightening around the price candles in favor of price stabilization, the Relative Strength Index had leveled off after an uptick.

VeChain was in the news recently after it released its Financial Executive Report, a report that revealed that VeChain had partnered with Sam’s Club in China to launch a DLT-based traceability solution.

The post appeared first on AMBCrypto