Disclaimer: The findings of the following article attempt to analyze the impact of emerging trends in Litecoin’s long-term market and its impact on the price

The digital silver to Bitcoin’s gold, Litecoin [LTC] has for long been highly correlated with Bitcoin, the world’s largest cryptocurrency. In light of the recent volatility in the market, LTC has been closely following BTC’s trend, while its correlation with real gold also noted a slight increase on the charts.

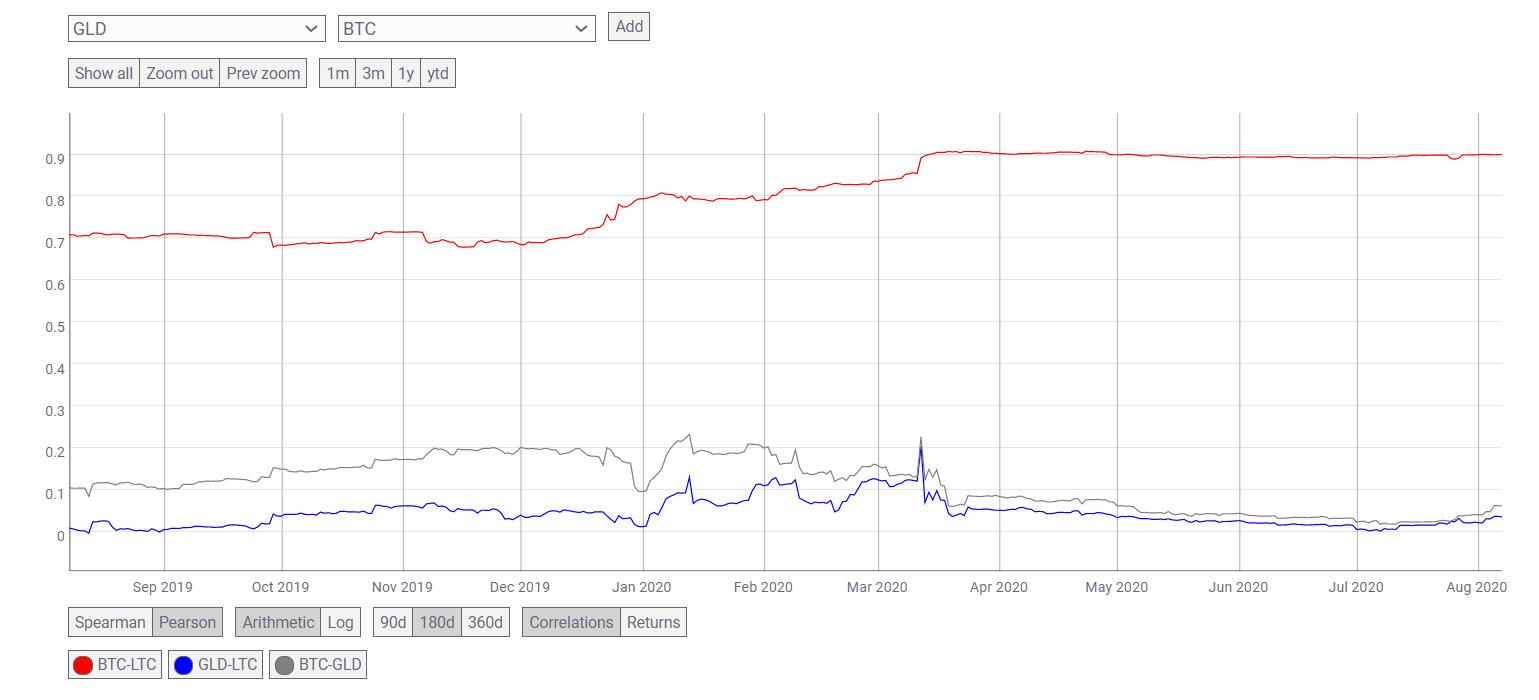

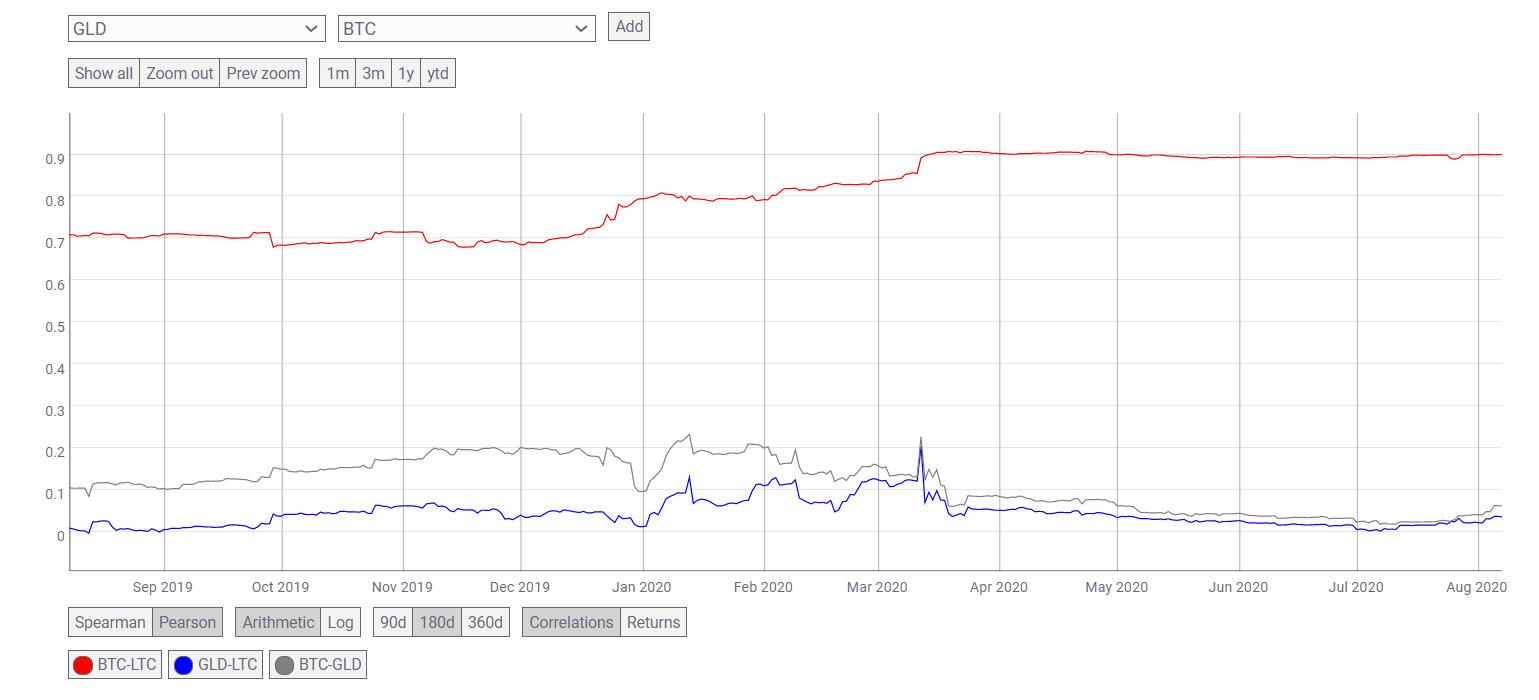

Source: CoinMetrics

The correlation charts provided by data provider CoinMetrics highlighted the strong correlation between BTC-LTC and the correlations shared between LTC-GLD and BTC-GLD. Being highly correlated with BTC, Litecoin has been sharing a similar correlation as the one shared by Gold and Bitcoin, with the same registering a slight rise. With its correlation metrics moving up, the value of the seventh-largest crypto-asset was found to be $58.17, at press time.

Source: LTC/USD on TradingView

As per Litecoin’s attached chart, LTC was noting an uptrend in its price, with the same forming part of a long, extended ascending channel pattern. The price has been escalating within the two parallel lines, connecting LTC’s higher highs and higher lows. As the price moved further along the channel, the volatility reduced, as highlighted by the convergence of the Bollinger Bands.

On the contrary, the Signal line which was previously pointing at a bullish trend in the market had now snuck under the candlesticks, implying that the price of the digital asset may fall soon. As the price moved along the channel, a breakdown in the pattern was becoming imminent. With the price fluctuating, the Relative Strength Index [RSI] was heading from a zone of equilibrium to the overbought zone.

Source: LTC/USD on TradingView

If the price of the digital asset marches up again, its next resistance will be marked as high as $65. However, the bearish pressure created in the market could cause LTC to slip to its support at $53.72. If the digital silver is able to hold on to this level, it may bounce back, but due to lack of testing of the support, it could slip further down to $50.54.

The post appeared first on AMBCrypto