More than half of the total circulating of 63,842,239 LTC has not moved in more than a year now, i.e 40 million LTC have remained dormant which amounts to nearly $2.036 billion, at press time.

This was pointed out by Franklyn Richards, Litecoin Foundation Director, who stated that a majority of these Litecoin appears to have been locked up from November -December 2018. It was speculated that the whales fed on the lowest price and started hoarding Litecoin.

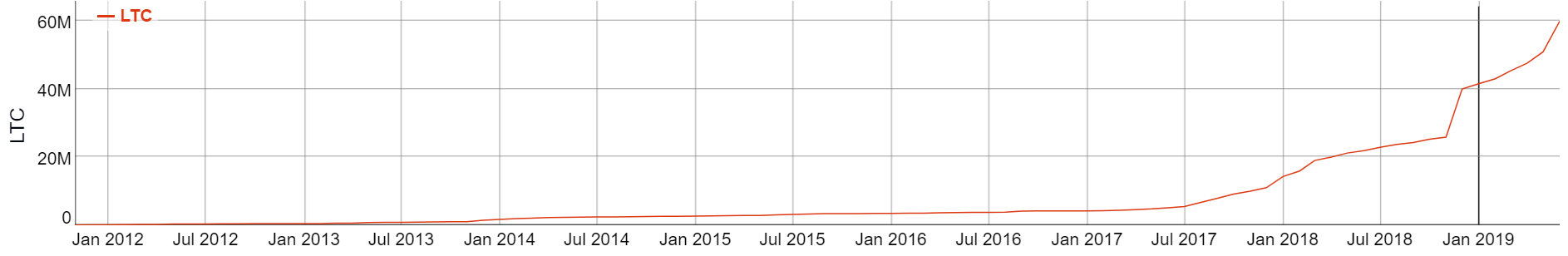

Source: BitInfoCharts | Cumulative sum in dormant Litecoin addresses

While the above argument could be a mere coincidence, Richards stated that the price correlation appeared “to support the idea that a lot of accumulation occurred during this time” when Litecoin hit its lowest after the bubble and was hovering just above $23.

Source: CoinMarketCap | Litecoin

Interestingly, among the top 100 Litecoin Addresses which were dormant for one year, 45 addresses have started accumulating between November and December 2018, according to data on BitInfoCharts.

Richards stated,

“We know that at least 12M of these coins are held by Coinbase on behalf of its users. We are not aware of any other addresses listed being owned by other large services or exchanges although it is highly likely they are.”

He further added,

“Going back 2 years to the climax of the last bull market we can see that almost 15M Litecoin have remained inactive. Even looking to the start of 2017 from now, over 4M Litecoin have remained unmoving, while an unknown number are probably burned, the rest are likely in the unshakeable hands of early adopters.”

Notably, intotheblock had recently revealed that 128 whales own 47% of Litecoin while 39 addresses own 11.1% of Bitcoin. This could also mean a positive macro trend for Bitcoin with the ‘hodlers’ viewing it as a long-term investment since there were no movements despite the fact that there was a 70% increase in its price, as noted by a researcher called, Rhythm.

While it is unclear if this would mean a positive sign for Litecoin, however, according to the LF exec, these on-chain data of coins could possibly hold the key to “more long term confidence and direction” while analyzing its price movements of the coin.

The post appeared first on AMBCrypto