The volatility across the cryptocurrency landscape has skyrocketed ahead of the U.S. election. Amid this, Litecoin (LTC) has reached a make-or-break level that could potentially lead to the liquidation of millions of dollars in traders’ positions.

Litecoin (LTC) Technical Analysis and Upcoming Level

According to expert technical analysis, Litcoin (LTC) is trading within a bullish channel pattern and is currently at the lower boundary, which acts as a support level. Historically, whenever the LTC price reaches this level, it experiences buying pressure and an upward rally. This time, however, traders and investors are expecting a similar upside movement.

Based on recent price action, if LTC holds itself above the $64.5 level, there is a strong possibility the asset could rally by 16% to reach the $77 level in the coming days.

On the other hand, some believe that LTC may fail to hold this support level due to strong volatility across the cryptocurrency market. If this occurs, the asset could experience a 15% price decline, reaching the $55 level in the coming days.

As of now, LTC is trading below the 200 Exponential Moving Average (EMA) on a daily time frame, indicating a downtrend. Meanwhile, its Relative Strength Index (RSI) suggests a potential upward rally in the coming days, as it is currently in the oversold zone.

On-Chain Metrics

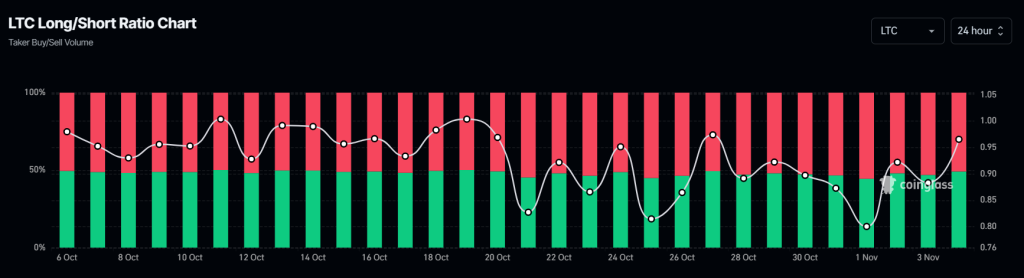

LTC’s mixed sentiment is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, LTC’s Long/Short ratio currently stands at 1.001, indicating equal participation from both bulls and bears over the past 24 hours.

Additionally, LTC’s open interest has remained unchanged over the past 24 hours, indicating that traders’ positions are still secure as the price hovers at a critical level. Currently, 50.01 % of top traders hold long positions, while 49.95% hold short positions.

Current Price Momentum

At press time, LTC is trading near $66 and has experienced a modest price surge of 0.55% over the past 24 hours. During the same period, its trading volume dropped by 10%, indicating lower participation from traders and investors compared to the previous day.

The post appeared first on Coinpedia