During the development of cryptocurrencies, events like BTC halving, LTC halving, and DASH’s emission reduction have gained much spotlight in the market. Mining rewards per block have dropped in these halvings or reductions, potentially squeezing miners’ pockets. Conversely, market traders see these halving events as indicators of new market trends.

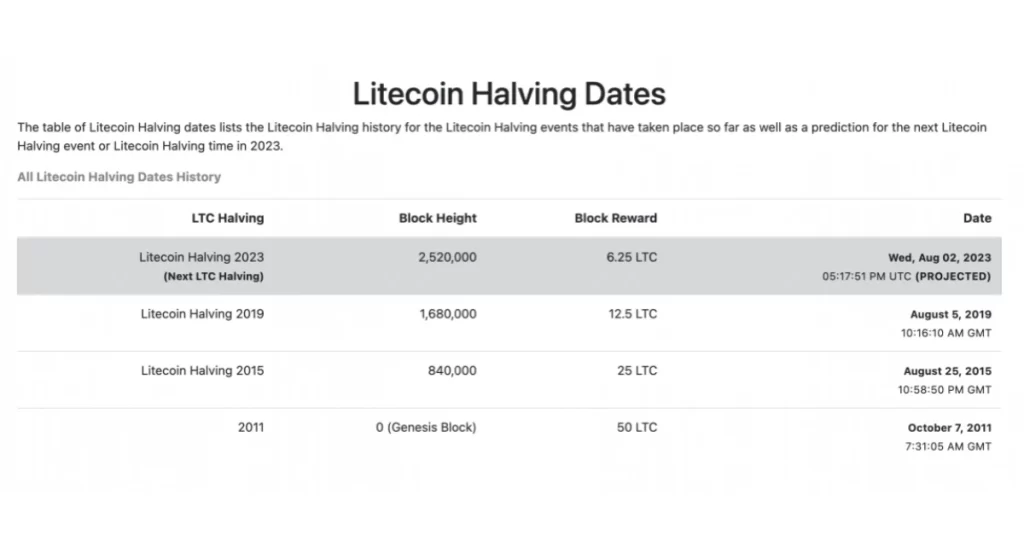

Based on data from LITECOIN HALVING, as of July 25, 2023, Litecoin’s block reward is set to halve from 12.5 LTC to 6.25 LTC on August 23, 2023. There are still 4,845 blocks remaining until the next LTC halving event.

With the LTC halving approaching, LTC has gained considerable market attention. Both miners and traders are closely following this event as it may present new investment opportunities during the halving period.

Similar to BTC, LTC has its block rewards halved every four years. In the history of cryptocurrency development, LTC has already experienced two halvings: the first one happened on August 25, 2015, reducing the miner’s block reward from 50 LTC to 25 LTC, and the second one occurred on August 5, 2019, cutting the reward to 12.5 LTC. The upcoming LTC halving this August will further reduce the reward to 6.25 LTC. Based on relevant data, LTC halving will continue until approximately 2142 when the block reward reaches 0.

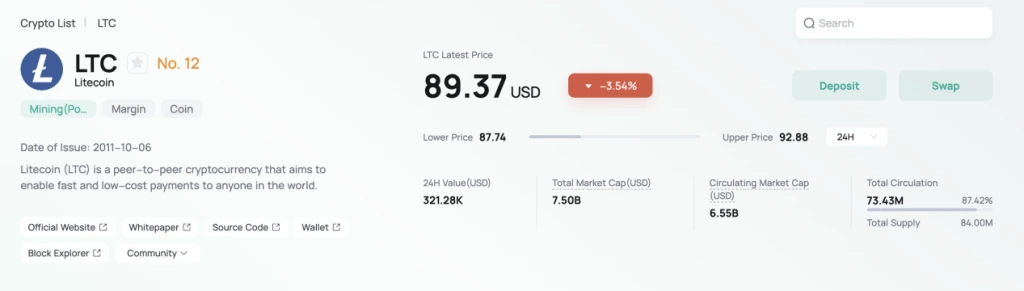

Following the LTC halving in August 2023, the supply of LTC will decrease, resulting in short-term price fluctuations in the market. For traders, this may present an investment opportunity as they can profit from the price fluctuations of LTC. As of July 25, 2023, market data from CoinEx shows that LTC is currently priced at $89.37 with a total market cap of $7.50 billion. Over the past month, the price has decreased by 0.41%, to $113.47 on July 3 before fluctuating downwards.

As the LTC halving event draws near, LTC witnessed a notable price increase in early July, but it failed to sustain the upward momentum and began fluctuating downwards. Given the reduction in miner rewards and its impact on the security of the LTC network, investing in LTC demonstrates investors’ trust in network security.

Despite the challenges it poses for miners, the LTC halving also contributes to stabilizing the coin’s value and preserving its scarcity. This could make LTC appreciate in value and offer more appealing returns to miners. Considering the past BTC halving events, which garnered market recognition and stimulated long-term growth, the LTC halving is still an opportunity for investors, regardless of the current market performance. However, it is essential to note the risks involved in investments. Traders should analyze market data objectively, manage trading risks, and avoid blindly following market sentiments or going all-in on LTC.

CoinEx’s Market Data feature gathers real-time data on various cryptocurrencies on the exchange, integrating coin rankings, order distribution, price change distribution, and historical market value to satisfy users’ diverse needs for information. With this feature, users can access valuable market data, track real-time price changes and trading volumes of different cryptocurrencies on CoinEx, and stay updated with market trends. Moreover, by analyzing market data, everyone can make more informed trading decisions and mitigate trading risks. During the LTC halving period, users can monitor LTC’s price fluctuations and trading status in real-time on CoinEx as a reference for their investments.

The post appeared first on Coinpedia