Summary:

- The Luna Foundation Guard has bought an additional 37,863 Bitcoin worth $1.5 billion

- The purchase is in line with Do Kwon’s goal of backing UST with digital asset reserves worth $10 billion

- The Luna Foundation Guard now holds 80,394 BTC

The Luna Foundation Guard has acquired an additional 37,863 Bitcoin worth $1.5 billion to further back its popular stablecoin of UST.

The recent purchase of Bitcoin was carried out in two transactions: $1 billion with Genesis Trading and $500 million worth of Bitcoin through 3 Arrows Capital (3AC). With this purchase, the Luna Foundation Guard now holds 80,394 Bitcoin worth an estimated $3.2 billion at the time of writing.

UST is Attempting to Observe the Bitcoin Standard – Do Kwon

The recent purchase of $1.5 billion worth of Bitcoin is in line with the vision of Terra’s founder, Do Kwon, of backing TerraUSD (UST) with $10 billion worth of BTC and other digital assets.

Mr. Kwon further elaborated his vision to CNBC by stating ‘For the first time, you’re starting to see a pegged currency that is attempting to observe the bitcoin standard. It’s making a strong directional bet that keeping a lot of those foreign reserves in the form of a digital native currency is going to be a winning recipe.’

He also added that time is the only element left to test out the TerraUSD (UST) project. Additionally, the stablecoin project is particularly important given ‘that we live in a time where there’s excess money printing across the board and when monetary policies highly politicized that there are citizens that are self-organizing to try to bring systems back to a sounder paradigm of money.’

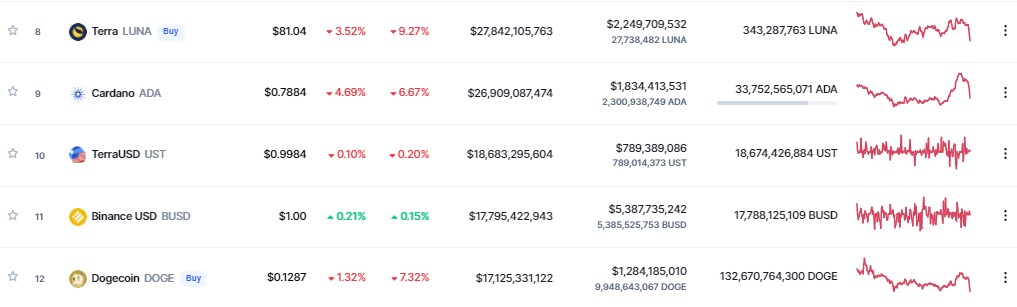

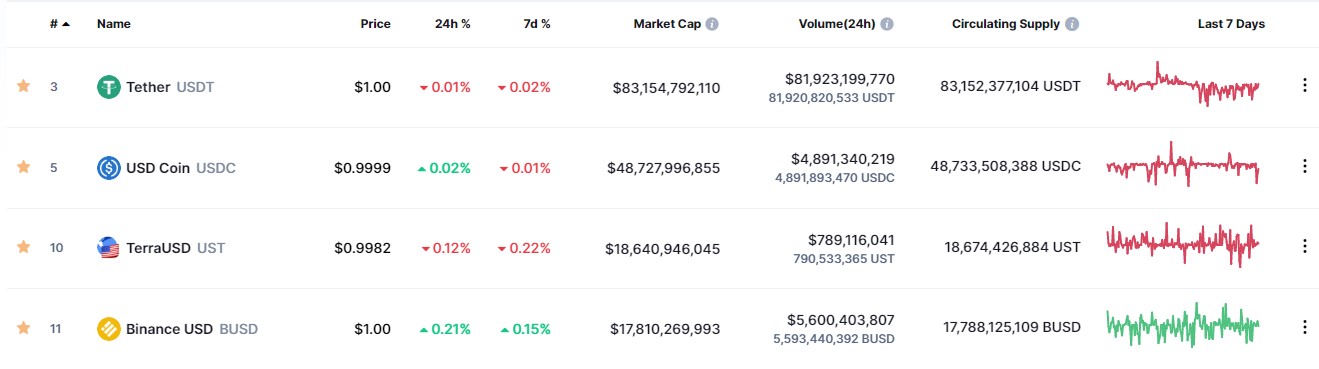

TerraUSD (UST) Makes an Entry into Coinmarketcap’s Top 10

At the time of writing, TerraUSD (UST) is ranked tenth on Coinmarketcap with a market capitalization of $18.683 billion. UST is also now also ranked third in the stablecoin category after Tether ($83.154 billion) and USDC ($48.7 billion). It has also eclipsed Binance USD (BUSD) which has a market capitalization of $17.8 billion.

The post appeared first on Ethereum World News