Decentralized Finance or DeFi has evolved into one of the most active sections of the blockchain industry and Ethereum projects have been at the forefront in establishing an ecosystem with global network effects and interoperability. While offering bank-like features with lending and borrowing, payment, derivatives, and others, DeFi applications are built on Ethereum blockchain and Ether has been benefiting by this relationship as it recorded 2.932 million locked in DeFi.

Even though the progress of decentralized finance in 2019 can be traced back to MakerDAO, it is no longer the only important DeFi protocol. According to Messari’s new report, MakerDao will likely face steep competition on the lending and stablecoin fronts. Synthetix and Compound have evolved as a competition to the industry’s important protocol, MakerDao.

MakerDAO

Maker’s stablecoin, Dai supports majority of DeFi ecosystem and has remained the largest and most battle-tested collateralized stablecoin solution. The rise of DeFi protocols began around July 2019, and in the first seven months of the year, MakerDao contributed to leading the growth in value locked in DeFi.

According to the report:

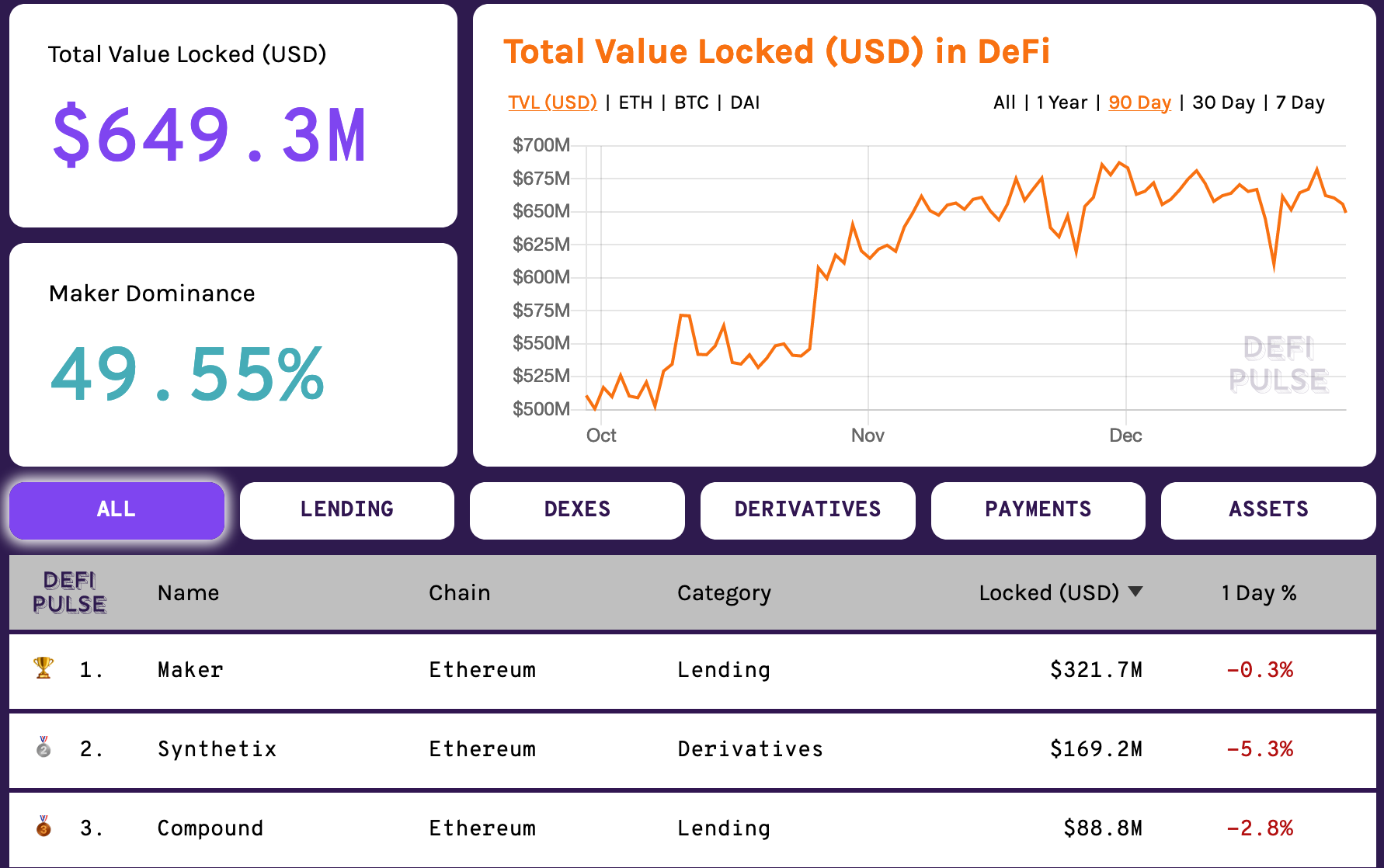

“MakerDAO led much of the growth in value locked in DeFi through the first half of the year, doubling from ~$250 million in January to ~$500 million in July.”

At press time, Maker locked $321.7 million of ETH in DeFi, while Synthetix and Compound noted a combined value of $258 million. As per the report, Maker’s “dominance” dropped from 90% at the beginning of the year to just below 50%, at press time.

Source: Defi Pulse

With the launch of Mult-Collateral Dai [MCD], Maker will support new collateral types besides ETH and Dai Savings rate [DSR], a “risk-free rate” on Dai to help ensure Maker stability fees are kept in check. With these two additional features, Maker has an option to increase Dai demand and help attract new collateral base in 2020 to spark growth.

Synthetix

Synthetix noted exponential growth in its volume from $1 million in August to $10 million in December. The competing project to Maker introduced its new stablecoin, Synthetix USD [SUSD] and has been noting tremendous growth. Even though the market cap of SUSD [~$11 million] was a minuscule figure when compared with Dai’s $41 million market cap, it might garner more attention as it soared 3300% in 2019. Despite some concerns regarding the Synthetix token’s reflexivity, the project appeared as a force in the making.

The report claimed on this issue:

“…the value locked in Synthetix while minting new types of synthetic tokens is the SNX token itself, which screams “systemic risk.”

The post appeared first on AMBCrypto