Bitcoin has stayed above $10,000 for a record period of time; its price sustained above the 20MA and it has seen increased volume and institutional adoption. This was all amidst the FUD experienced by the markets in the past few months, with the drama around major crypto exchanges like KuCoin, Bitmex, and OKex, which surprisingly had little to no impact on the price of Bitcoin.

With volatility at one of the lowest reported levels, and all the positive on-chain fundamentals, the next question is – Could mainstream retail be next for Bitcoin?

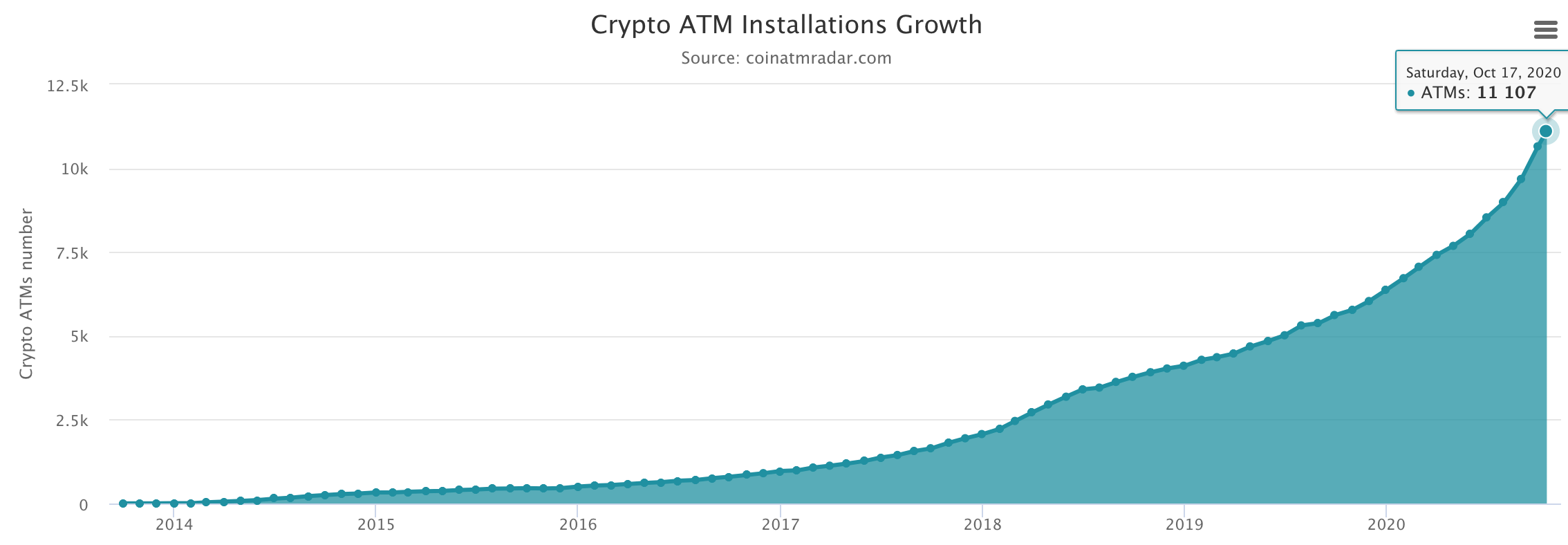

According to data from coinatmradar, Bitcoin ATM installations reached a record high of 11,107 as of October 17 – an increase of 75% since the beginning of the year.

Of these, over 8000 ATMs are located in the USA alone, dominating the share of Bitcoin ATMs worldwide. Europe accounted for 11.3% of the market share and Asia accounted for only 1.3%.

However, the concept of ‘Physical Bitcoin’ is an oxymoron in itself and evidence suggests that most people would prefer to keep their virtual currency virtual.

This is especially true when the fees charged at ATMs are considered with 741 ATMs charging buy fees between 15-20% and 679 ATMs charging between 5-15% to sell BTC. This is far from the whole picture as well, considering information about the fees charged can only be collected if ATM operators have API reporting enabled. So far, only 29.8% have enabled this facility.

Another signal of Bitcoin’s potential at mainstream retail adoption is with regard to crypto debit cards. Visa and Mastercard are arguably the world’s most dominant forces in the electronic payments industry, and their recent partnerships with Coinbase and Wirex respectively have gone a long way in the space of crypto payments.

According to Raoul Milhado, CEO of crypto card company Elitium,

“Without crypto cards, crypto will not survive the greater market.”

However, challenges still remain, with many citing security breaches and misuse of funds as some of the biggest hurdles.

Although the increased ATM presence and advancements in the crypto debit card space are advancing rapidly, they are not quite achieving the levels that would qualify as widespread retail adoption just yet.

However, this increased presence will build awareness that will surely help bring crypto out of the perception of being ‘a currency for the dark web’.

The post appeared first on AMBCrypto