The crypto industry is almost 2 weeks into August, and since the colossal surge on August 1, Bitcoin‘s price has been tepid again. With the price sustaining between the range of $11,500-$12,000 for the majority of the time, optimism is currently pinned on other factors for the bull run to continue.

Multiple arguments have been carried out in the space over the past 10-days and investors were currently on their heels to witness market fruition.

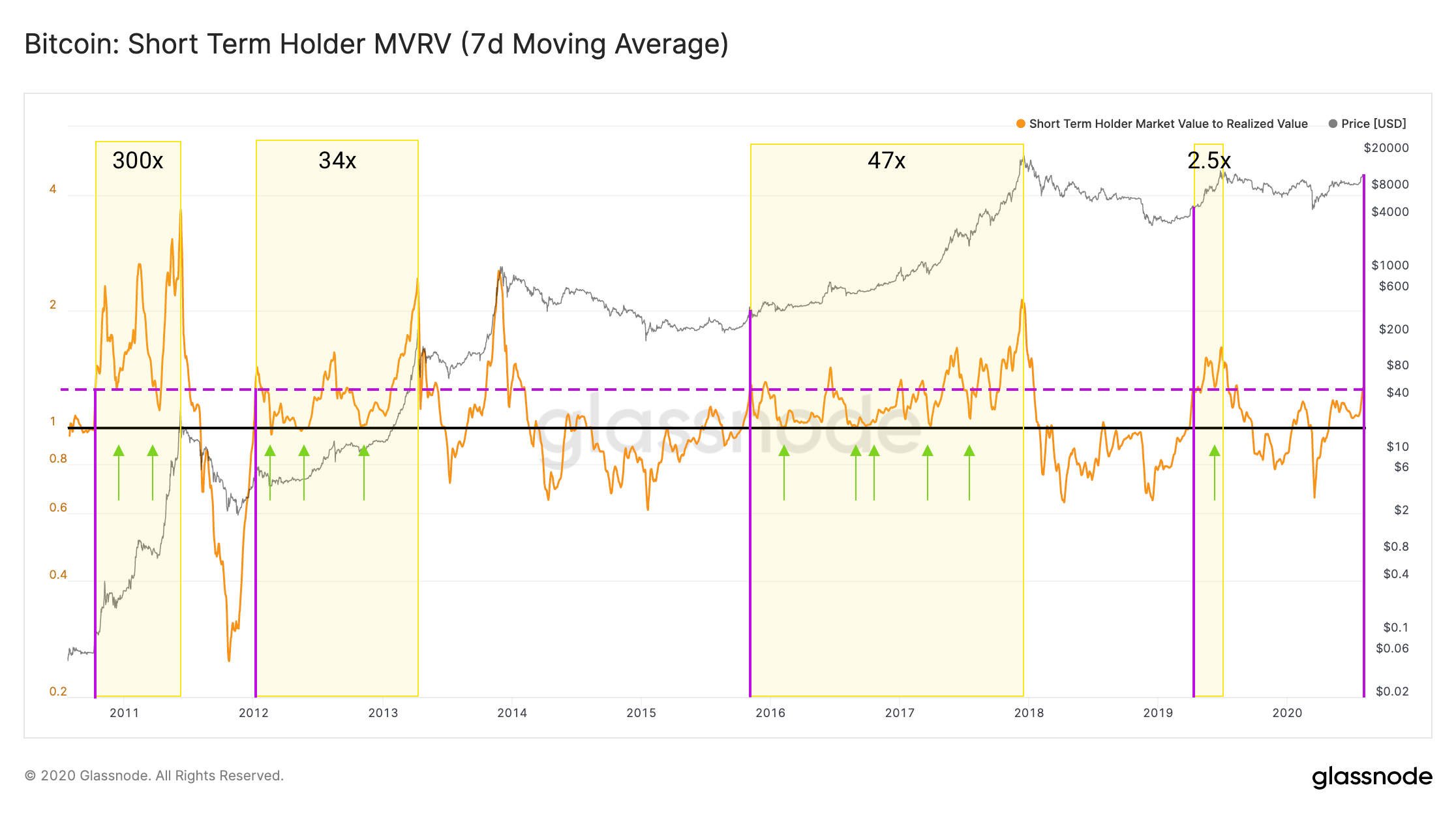

In line with on-chain fundamentals, Glassnode’s recent weekly reported suggested that Bitcoin’s Short-Term MVRV(Market Cap to Realized Cap ratio) is currently supporting the bull-run hypothesis.

Now, the MVRV ratio measures the “fair value” of the asset and the ratio is usually helpful to detect the market top and bottom in the charts. From the above chart, it can be observed that the MVRV ratio is keeping above 1, and historically that is a bullish sign. Before the start of previous bull-runs in the industry, BTC has always sat around 1.25 and above, hence indicating a bullish signal. At the moment, the MVRV ratio is just under 1.25.

The report added,

“As long as STH-MVRV stays above 1 (as demonstrated by the green arrows above), the bull market has historically tended to stay in effect. As such, it is crucial to watch that we stay above 1 here. As long as this is the case, BTC should be in for a continued bull market.”

Bitcoin’s on-chain fundamentals were praised by Bloomberg as well. In their recent crypto outlook August edition, the organization indicated that the rally attained by Bitcoin over the past few weeks has been heavily dependent on the on-chain metrics and a higher correlation with gold is strengthening its digital gold narrative.

In the report, Bloomberg criticized Ethereum‘s development and termed the altcoin’s rise as “rather speculative”. They added that Bitcoin’s favorable demand and supply conditions were much more concrete that Ethereum, therefore for Ethereum, the trend might still reverse.

Is it wise to put your money on the board based on positive fundamentals?

If we were speaking from the perspective of traditional stocks, probably yes but as we all know, digital assets are a different ball game. A prime example is Bitcoin’s on-chain fundamentals from September 2019. The market deemed its metrics to be extremely positive but BTC went on to drop down from $9500 to $6600 at the end of the year. Back then, the crash possibly took place due to depleting market sentiment. July and August 2019 faced depreciation and lack of upside to Bitcoin’s price soured some of the bullish momenta.

Hence, it is not exactly wise to put all your chips in just based on fundamentals when market sentiment plays an important role in digital assets. However, further consolidation at $12,000 will change the trend in a few weeks and then, fundamentals might not matter, once again.

The post appeared first on AMBCrypto