Digital currency prices plummeted on Tuesday, as cryptocurrency markets lost billions during the morning trading sessions, New York time. BTC dropped well below the $7k range and other digital assets followed BTC’s path with sharp losses. Crypto prices haven’t been this low since May as the market valuation of the entire cryptoconomy is struggling to hold above the $175 billion range.

Also read: Mystery Surrounds DDoS Attacks That Have Downed the Darknet

Top 20 Crypto Markets Shed Billions

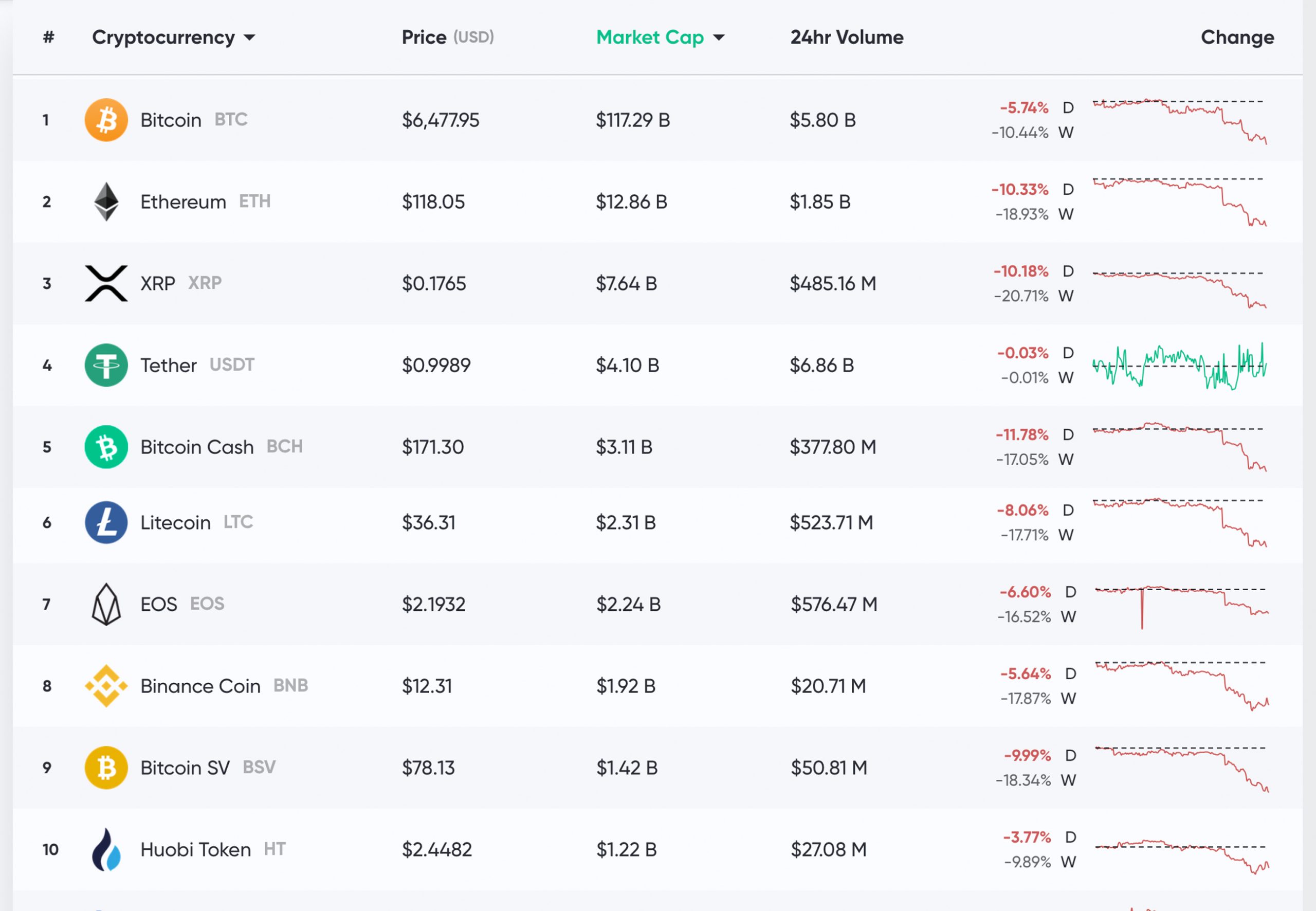

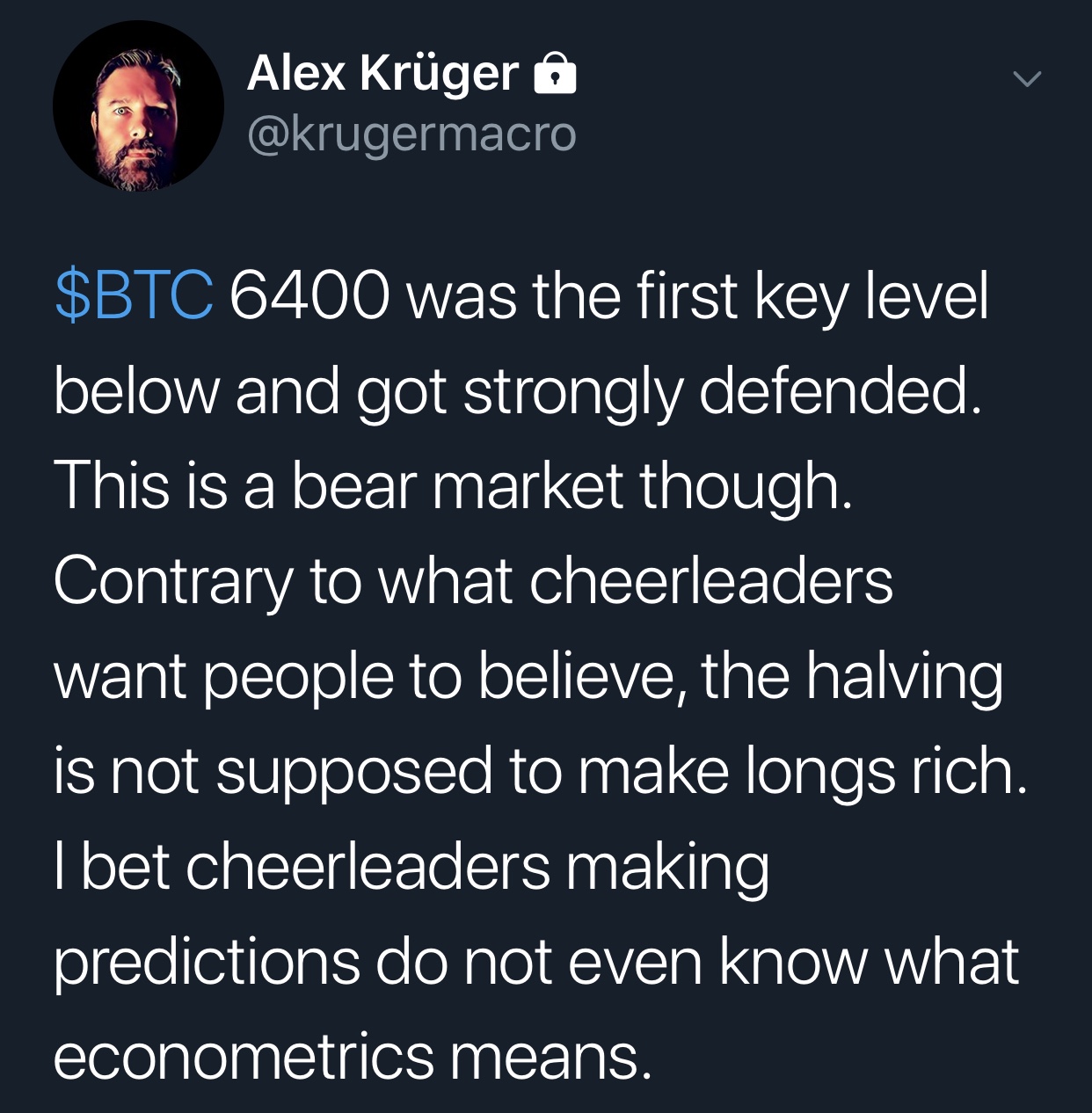

Crypto markets are in red on December 18, as the top 20 market caps have lost 4-15% in fiat value. On December 17, bitcoin core (BTC) dropped under the $7k range and is now hovering between the $6,400-6,600 zone. BTC lost 5.7% on Wednesday and the cryptocurrency is down over 10% for the week. Currently, BTC has a market valuation of around $117 billion which represents 67% of the entire cryptoconomy. At 8:55 a.m. EST, BTC defended the long-term $6,400 foundational support and quickly bounced back to the $6,700 range.

Top 10 market cap at 8:35 a.m. EST on December 18, 2019.

Top 10 market cap at 8:35 a.m. EST on December 18, 2019.

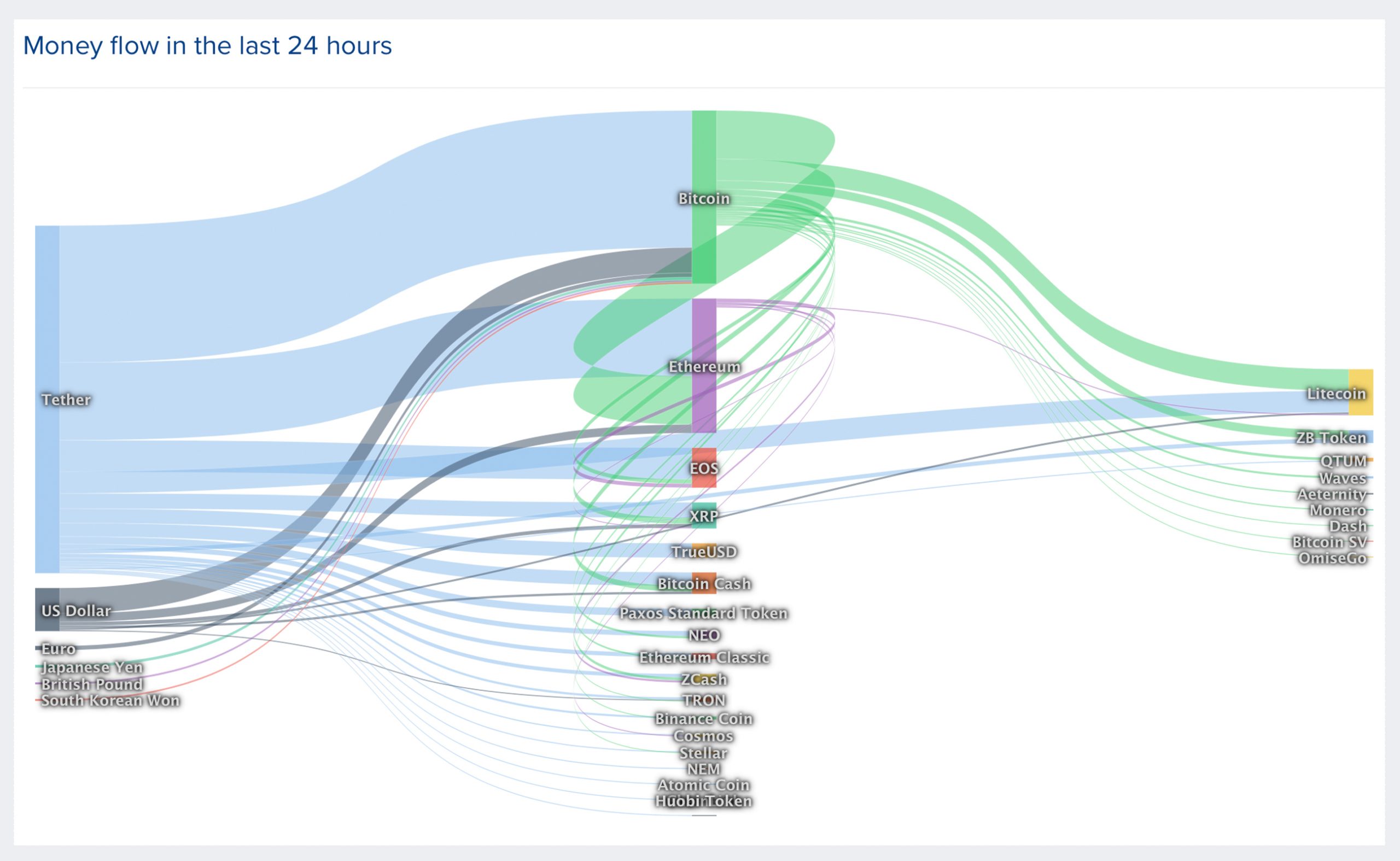

The second-largest market capitalization is held by ethereum (ETH), which is down 10.3% today and over 18% for the last seven days. One ETH is swapping for $118 per coin and the currency has a $12.8 billion market cap. Ripple, otherwise known as XRP, is trading for $0.17 per coin and XRP markets have lost 10% in the last 24 hours. The fourth position is held by the stablecoin tether (USDT) which is a dominant pair throughout the entire ecosystem. Tether represents well over two thirds of Tuesday’s trading pairs and the stablecoin has a whopping $22 billion in trade volume.

BTC prices on Wednesday, December 18, 2019.

BTC prices on Wednesday, December 18, 2019.

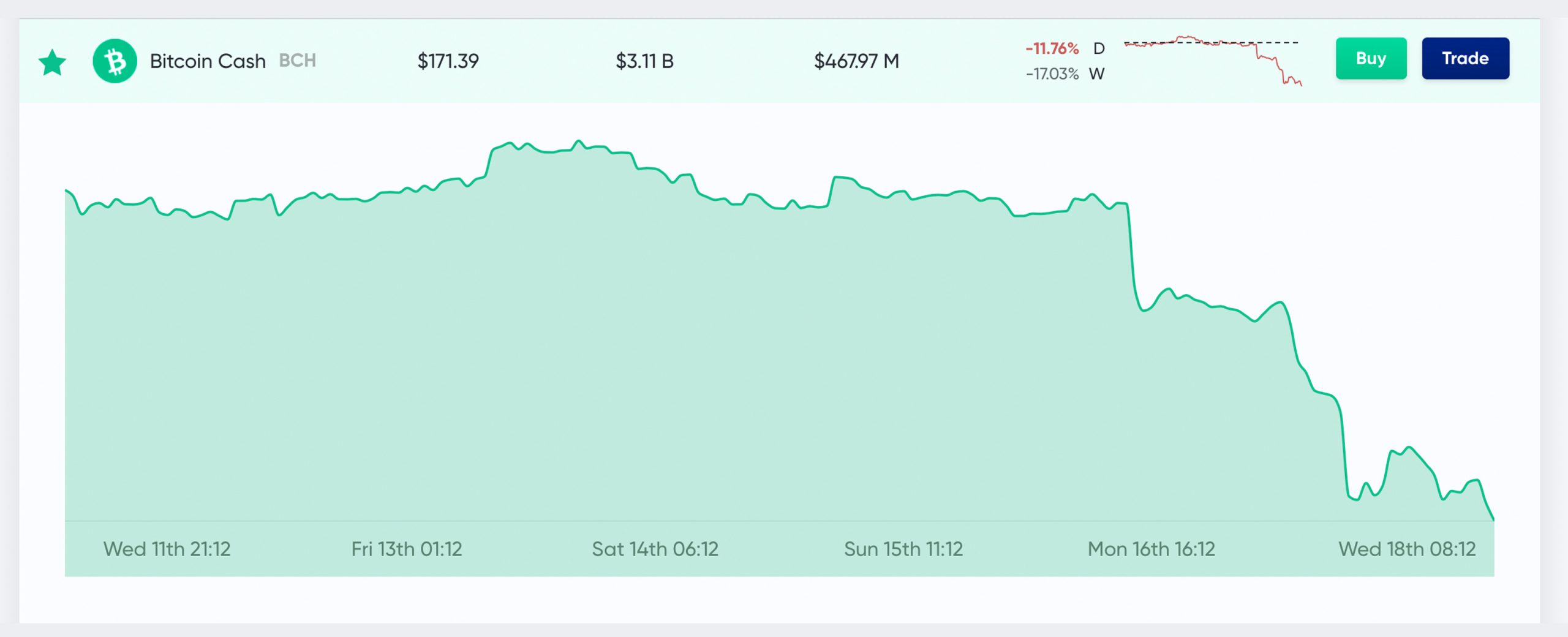

Bitcoin Cash (BCH) Market Action

Bitcoin cash (BCH) is down 9.9% for the last 24 hours and over 14% for the week. BCH is currently trading for $177 per coin and has an overall market valuation of around $3.2 billion at press time. Today’s top BCH pairs include tether (USDT) with 56% of all trades and BTC with over 20% of BCH trades. This is followed by USD (16.7%), KRW (2.3%), ETH (1.6%), and EUR (0.82%). Out of the 3,000+ cryptocurrencies in existence, BCH captures the seventh-highest trade volume as there’s currently $1.8 billion in global BCH trades.

BCH prices on Wednesday, December 18, 2019.

BCH prices on Wednesday, December 18, 2019.

Plustoken Scammers Might Be Bringing the Blues

Traders and analysts discussed the losses on Tuesday and people brought up the recent Plustoken speculation. On December 16, Chainalysis published a report that said the Plustoken scammers might be suppressing the price of BTC and other cryptocurrencies. “That’s certainly something to consider when you are thinking about where the price is going, at least in the short term,” Kim Grauer, senior economist at Chainalysis told the press. “It could be, according to our research, continued downward pressure.” News.Bitcoin.com reported on the Chainalysis research which disclosed there’s still around 20,000 BTC that could be dumped on the market.

Despite the Dumps, Morgan Creek Executive Still Envisions $100k BTC

Even though markets have been diving, many speculators and investors wholeheartedly believe a bull run is due in the next year or so. Morgan Creek Capital Management executive Mark Yusko believes $100k BTC could be on the cards by 2021. “Between now and 2021, we’re likely to see $100,000 bitcoin,” Yusko explained on December 11. “By 2025, we’re likely to see $250,000 bitcoin, and then some time out, 2030, we could see $400,000 or $500,000 bitcoin as it reaches gold equivalence.” Yusko detailed that he was once a cryptocurrency skeptic but he’s now a strong believer. “It really is about the growth mindset and focusing on the venture capital upside or the asymmetric upside of the asset at this point,” Yusko added.

Santa Claus Rally or Bumpy Roads?

Over the last few years, BTC has experienced what traders call a ‘Santa Claus Rally.’ However, even though there’s definitely been some consistent price spikes during the months of December, BTC has also been extremely volatile during the holiday season. In 2013, BTC rallied hard on the trading platform Mt. Gox throughout the months of November and December.

One of the most volatile months of December was in 2017. At the time, the public witnessed the introduction of BTC-based derivatives products stemming from Cboe and CME. The price of BTC jumped to its all-time high on December 17, 2017, rising extremely close to $20k per coin. However, the last few months of volatility have crushed the hopes of many crypto traders and a few analysts believe a bull run is still a lot further than most think. “There is no question that its series of lower highs/lows over the past six months has not been good,” Equity strategist at Miller Tabak & Co, Matt Maley, said in an interview on December 16.

Overall, traders don’t know what to expect after crypto prices keep draining. Observers can see that there is a lot of interest in digital currencies coming from institutional entities. News.Bitcoin.com recently reported on Fidelity Investments launching crypto services in Europe because of “significant interest.” On December 3, Bakkt’s open interest touched an all-time high with $6.54 million in open interest and 2,328 ($17.02 million) traded contracts.

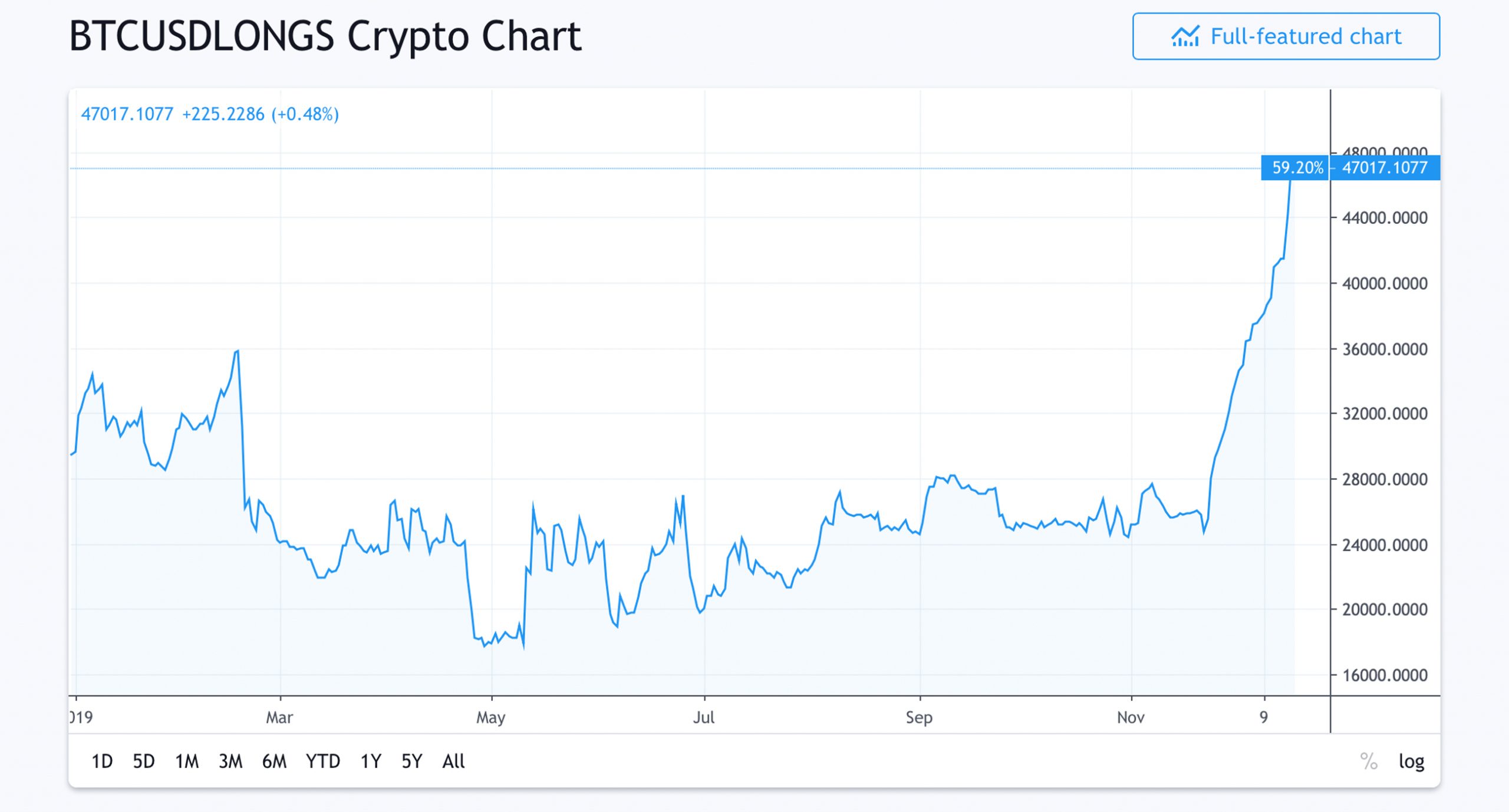

BTC/USD long positions on Bitfinex on December 18, 2019.

BTC/USD long positions on Bitfinex on December 18, 2019.

Moreover, during our last market update, BTC/USD long positions were skyrocketing with 38,802 longs registered. Long positions have continued to rise on Bitfinex exchange as there are 47,017 registered on December 18. If BTC falls significantly lower than the $6,400 drop on Tuesday then those long traders are sure to get squeezed.

Where do you see the cryptocurrency markets heading from here? Let us know what you think about this subject in the comments section below.

Disclaimer: Price articles and market updates are intended for informational purposes only and should not be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.” Cryptocurrency prices referenced in this article were recorded at 8:55 am EST on December 18, 2019.

Images via Shutterstock, Trading View, Bitcoin.com Markets, Twitter, Bloomberg Finance, Coinlib.io, Wiki Commons, and Pixabay.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

Please enable JavaScript to view the comments powered by Disqus.

The post appeared first on Bitcoin News