Most of the cryptocurrency market has been relatively calm in the past 24 hours. Bitcoin trades around $11,000, and Ethereum jumps by 2% to $385.

Most of the attention went to Uniswap’s governance token (UNI) that launched yesterday. After listings on the most prominent digital asset exchanges, UNI trades at $5.3.

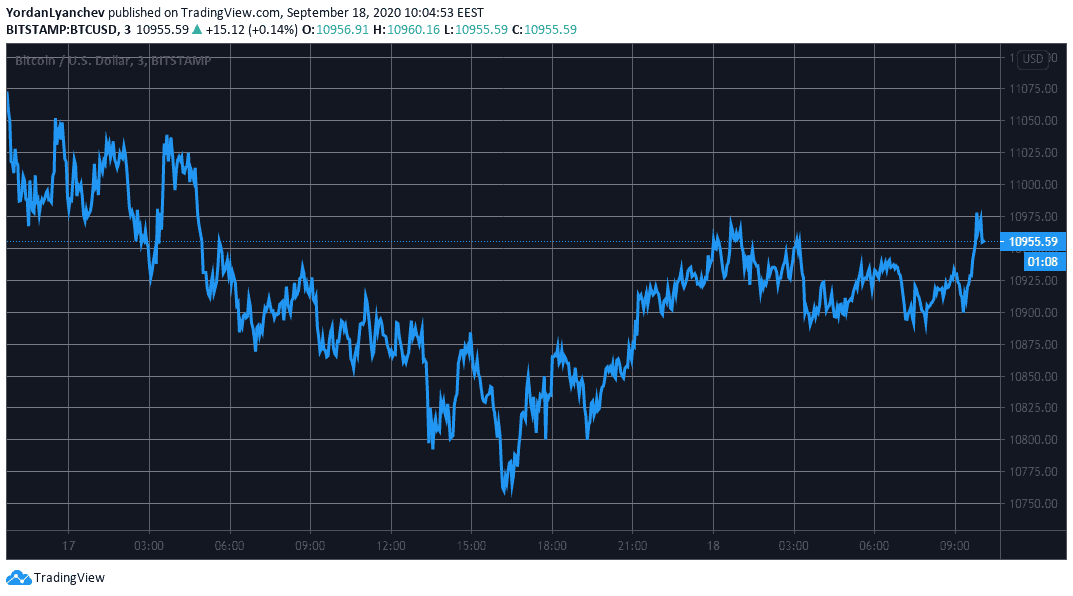

Bitcoin Remains Below $11K

As reported yesterday, the primary cryptocurrency attempted to overcome the $11,000 mark. It seemed successful initially, but the move rapidly reversed, driving Bitcoin’s price below the coveted level.

The price dip continued in the next few hours, and BTC reached its intraday low of $10,750. However, the asset has recovered since then and trades at $10,950.

Bitcoin still has to overcome the first resistance at $11,000 decisively before having a chance to further rise in value. If successful, BTC has to fight off the next resistance lines at $11,150 and $11,400.

In contrast, if the support at the 0.382 Fibonacci level ($10,800) can’t contain Bitcoin in case of a price breakdown, the asset can rely on $10,660, followed by $10,450.

UNI Gains Traction While Larger-cap Alts Chill

Most larger-cap altcoins have remained stagnant on a 24-hour scale. Ripple, Litecoin, and Binance Coin are less than 1% up, while Polkadot, Bitcoin Cash, and Chainlink are about 1% down.

Ethereum’s 2% increase to above $385 is the most impressive price move in the top ten. This could be attributed to the developments with Uniswap’s governance token launched yesterday.

Upon the UNI release, the popular DEX protocol announced that it will airdrop 15% of the token’s total supply to anyone who has used the platform. Thousands of users received 400 free UNI tokens each. However, to claim the coins, the user had to utilize the Ethereum network. This rush for free tokens led to record-high fees.

Those who lacked ETH tokens to pay the gas fees had to purchase some, increasing the demand, and ultimately driving ETH’s price higher.

In any case, most eyes were on UNI yesterday (and today). The protocol’s popularity urged exchanges such as Coinbase Pro and Binance to list the native token almost immediately. This brought massive attention and a price surge. At the time of this writing, UNI trades at $5, and its total market cap of $850 million places it in the top 30 coins.

Other impressive price increases include ABBC Coin (28%), SushiSwap (18%), Solana (15%), Neo (15%), and Loopring (13%).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato