Bitcoin has overtaken the $16,000 price tag after struggling to remain above it during the weekend. Large-cap altcoins have fallen behind with slight decreases, while the DeFi field sees high volatility once more.

Bitcoin Reclaims $16K

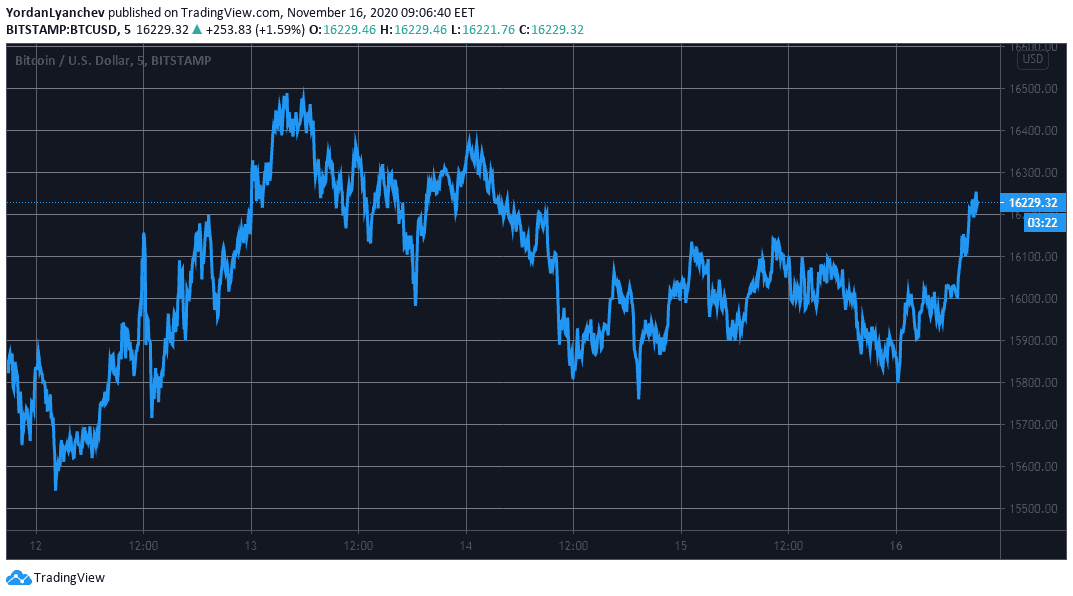

As reported last Friday, Bitcoin’s impressive performance as of late took the asset towards a fresh yearly high of $16,500. After conquering this significant milestone, however, the primary cryptocurrency slumped.

The weekend didn’t produce any further price jumps. Just the opposite, BTC dived beneath $16,000 on a few occasions. The lowest point painted was around $15,750.

Despite losing $750 from its new YTD high, it seems that the bulls have taken charge once more. Bitcoin has overtaken the $16,000, gaining around $500 while doing so. At the time of this writing, it’s trading around $16,250.

The technical indicators suggest that Bitcoin has to fight off the first resistance lines at $16,380 and $16,475 before registering a new yearly high.

On the other hand, the support levels at $16,000, $15,700, and $15,410 could prevent a potential price drop.

Stalling Altcoins, Volatile DeFi Tokens

Most of the larger-cap altcoins have been decreasing in value in the past few days. Ethereum neared $480 during the price boom on Friday, but it has gradually declined since then. Another 1.5% drop since yesterday has resulted in a price tag of beneath $455.

Bitcoin Cash went through a successful hard fork that split the network into two new blockchains. Data from coin.dance indicates that Bitcoin Cash Node (BCHN) has received almost all of the hash power, as Bitcoin Cash ABC (BCH ABC) remains without any. The price of Bitcoin Cash dived by nearly 10% prior to the hard fork.

Binance Coin (-1%), Chainlink (-2.4%), Polkadot (-0.5%), and Cardano (-2.5%) are also in the red from the top ten. Litecoin is the only exception with a 5% increase. LTC is among the few gainers on a weekly scale as well (10%) and trades above $65.

DeFi tokens have displayed higher volatility, as it has happened in the past several days. THORChain (15%) has surged the most. Solana (14%), SushiSwap (11%), Waves (10%), and NXM (10%) follow.

ABBC Coin has lost the most value – 13%. The Midas Touch Gold (-12%), Ampleforth (-9%), and Uniswap (-6%) are next.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato