After some minor fluctuations from $11,750 to nearly $12,000, Bitcoin lowered its volatility level and trading around $11,900. Is BTC getting ready to conquer $12K? We will see.

At the same time, most altcoins continue to be volatile again with some massive gains from EOS, Yearn Finance (YFI), and Kava and another all-time high from Chainlink.

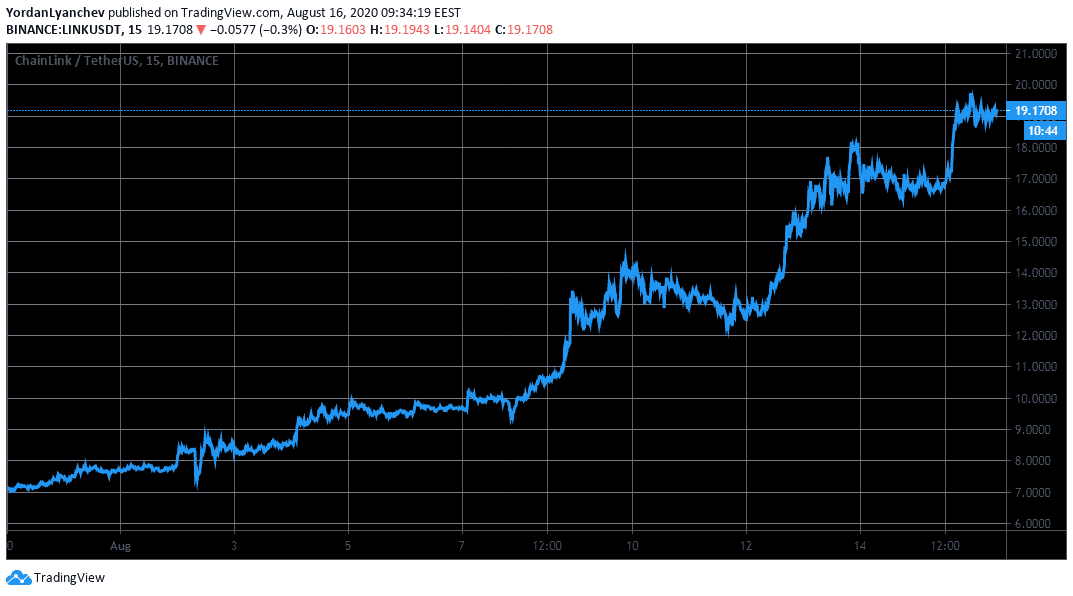

Chainlink (LINK) At ATH Again

The altcoin market hasn’t been boring for a long time now, and the past 24 hours reaffirmed it. No words can describe Chainlink’s year.

Its native cryptocurrency (LINK) has pained numerous consecutive all-time high ever since it broke above $6 in early July. Then it conquered the coveted $10, which now seems like a lifetime ago.

Just a few hours back, LINK charted a fresh ATH of $19.75 (on Binance). With these latest price developments, it’s safe to assume that it’s only a matter of time before LINK overcomes $20 as well.

The native digital asset of the Chinese blockchain protocol, EOS, increased by 12% and approaches $4, which is the highest level EOS has charted since early March.

Tron is also up by over 6%, thus doubling-down on its recent price increases following the strategic partnership with Waves to enhance mass adoption in the DeFi space.

However, the most impressive gains are evident among lower-cap altcoins, and especially DeFi-related. Reserve Rights is up by 40%, Kava by 24%, and Yearn Finance (YFI) by 22%. Status (13%), Ren (12%), and Band Protocol (10%) are also increasing by double-digit percentages.

In contrast, Swipe (-8.6%), 0x (-7.5%), THORChain (-6.5%), and Kyber Network (-5.5%) are the most substantial losers.

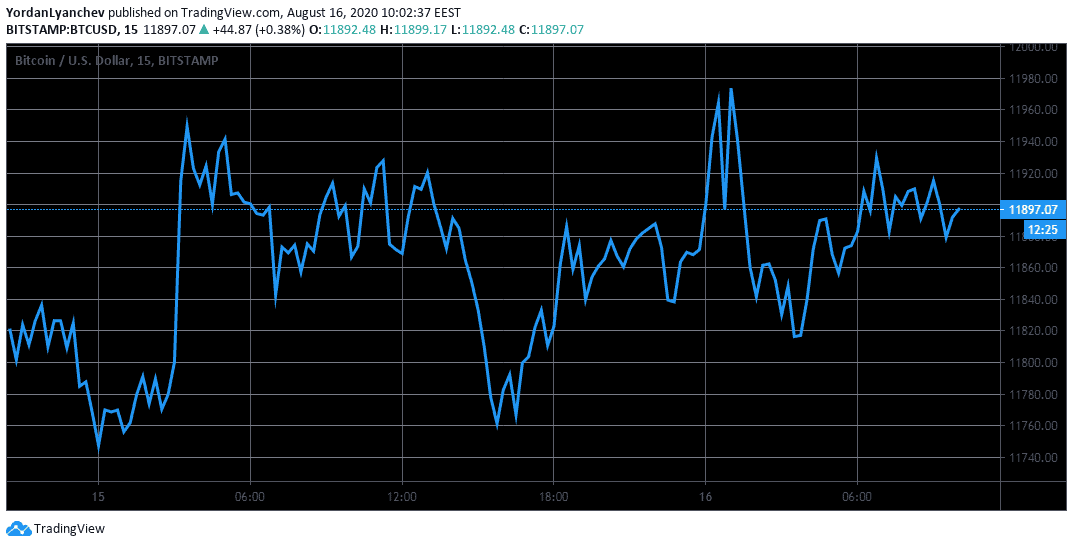

Bitcoin Remains Calm

And while alts keep fluctuating, Bitcoin has remained mostly calm apart from a few sharper moves. The primary cryptocurrency had elevated from its daily low of $11,750 to $11,950 in a matter of minutes. It later even made another attempt to challenge $12,000 but with no success, as of writing these lines.

At the time of this writing, Bitcoin trades between $11,800 – $11,900 -still pretty close to its 2020 high at $12,100. Alternatively, if another rejection comes and the asset heads south, it can rely on $11,400, $11,000, and $11,000 as support.

As Bitcoin hasn’t gained any significant chunks of value in the past 24 hours, while some altcoins have increased theirs, BTC’s dominance over the market has decreased slightly to 58.7%.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato