The value of ETH stored on its own Ethereum blockchain has been continuously decreasing in the past year, new research shows. While numerous ERC-20 tokens operate on the network, the growth of stablecoins presents the most substantial threat to cause a future “flippening.”

ETH’s Role On Ethereum Blockchain Decreases

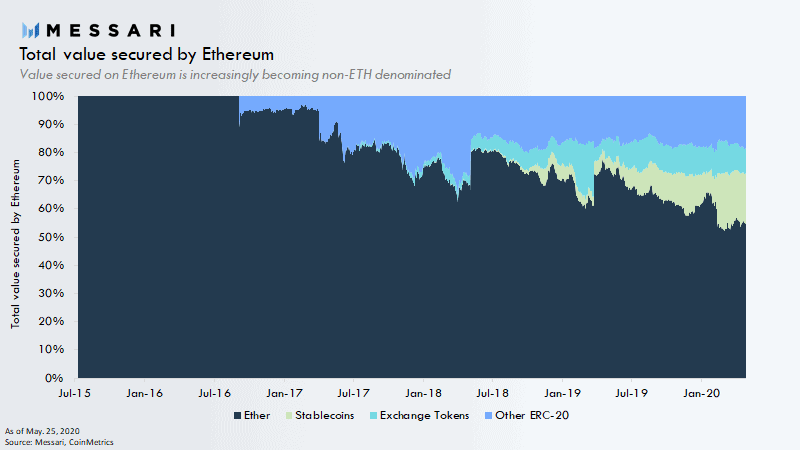

Per the research provided by Messari’s Ryan Watkins, ERC-20 tokens are rapidly approaching 50% of the total value stored on the Ethereum network.

Until mid-2016, the ETH token comprised 100% of the value stored on the blockchain. Since then, however, the platform specialized for creating smart contracts has adopted numerous ERC-20-based projects, along with the ICO boom of 2017.

And as their number and value are rising, the position of Ethereum’s native cryptocurrency steadily declines. Consequently, Watkins noted that “ETH is increasingly close to being flipped on its own blockchain.”

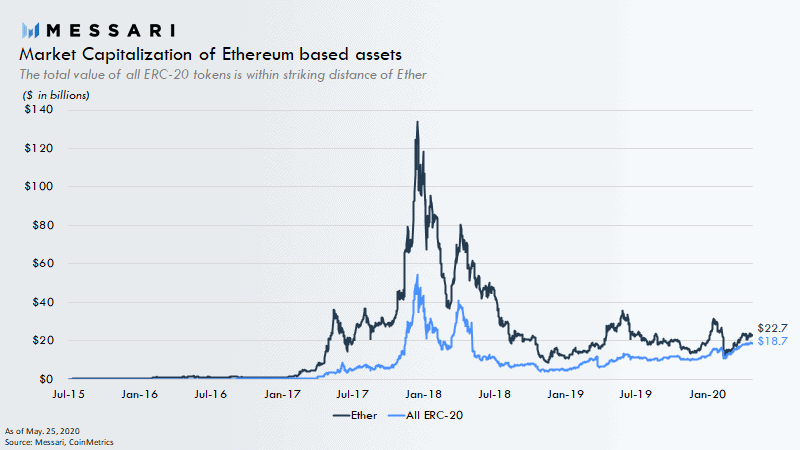

As the graph above illustrates, the total value of ETH on the Ethereum blockchain stands at $22.7 billion, while all other ERC-20 tokens are at $18.7 billion.

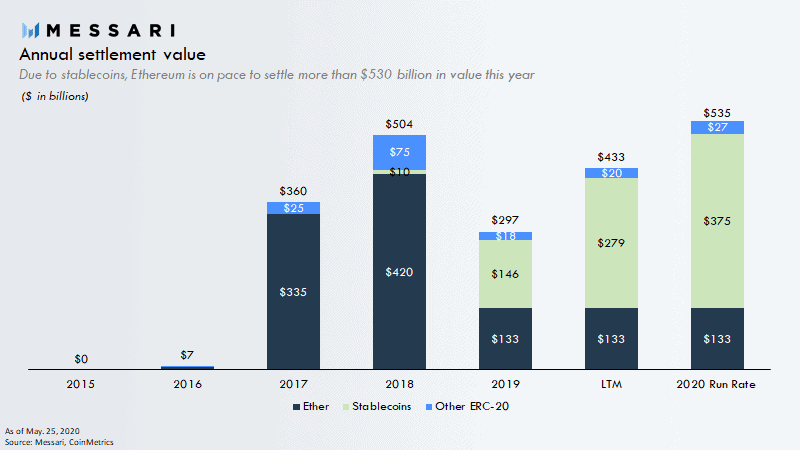

Over the last two years, the cryptocurrency community is witnessing the significant growth of stablecoins and their role in the market, many of which utilize the Ethereum network. As a result, another sort of “flippening” occurred recently when the transfer value of stablecoins on the Ethereum blockchain surpassed ETH.

Since then, the gap between the two has only been increasing. Massari exemplifies it in the graph below. It displays that “Ethereum is on pace to settle more than $530 billion in value this year,” but only $133B is attributed to ETH and $375B to stablecoins.

The combined efforts of all ERC-20 tokens on the Ethereum blockchain recently caught up with Bitcoin in terms of total value transferred.

Ethereum: Used More Than Ever

The research concluded that “Ethereum is being used more than ever. In just two years, Ethereum has evolved from a blank canvas to an agglomeration of novel forms of value and use cases.”

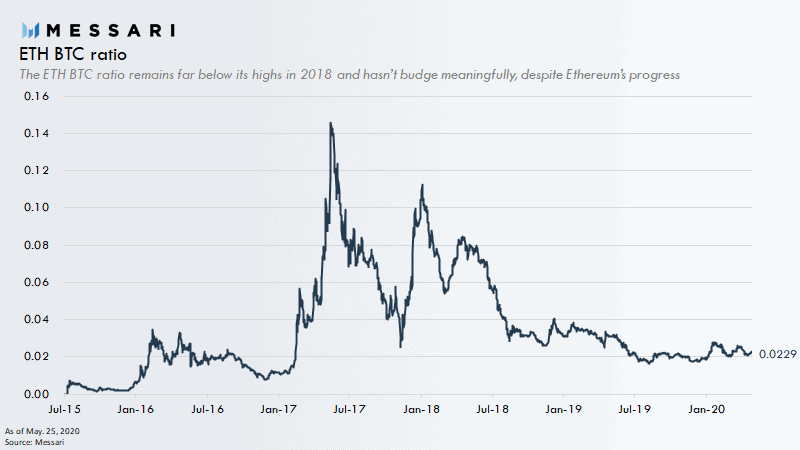

With the significant number of developments and growth in the past few years, Messari also brought up the price of ETH. More specifically, if investors “will eventually be rewarded or if the market will continue to shrug it off.”

ETH’s price movements on a macro scale have been rather adverse since its all-time high of over $1,400 in early 2018. The second-largest cryptocurrency by market cap has lost approximately 85% of its value against both the dollar and Bitcoin in a bit over two years.

Another recent report argued that the price of the asset had been significantly undervalued for a considerable period. It outlined (again) Ethereum’s latest developments, the HODLling mentality of both investors and miners, and the increased usage of gas.

Ultimately, the paper indicated that “Ethereum’s progress and several further indicators are very promising” for the future of the network and the asset price.

The post Messari: ETH Share On Ethereum’s Blockchain Contentiously Decline, Might Soon Tumble Below 50% appeared first on CryptoPotato.

The post appeared first on CryptoPotato