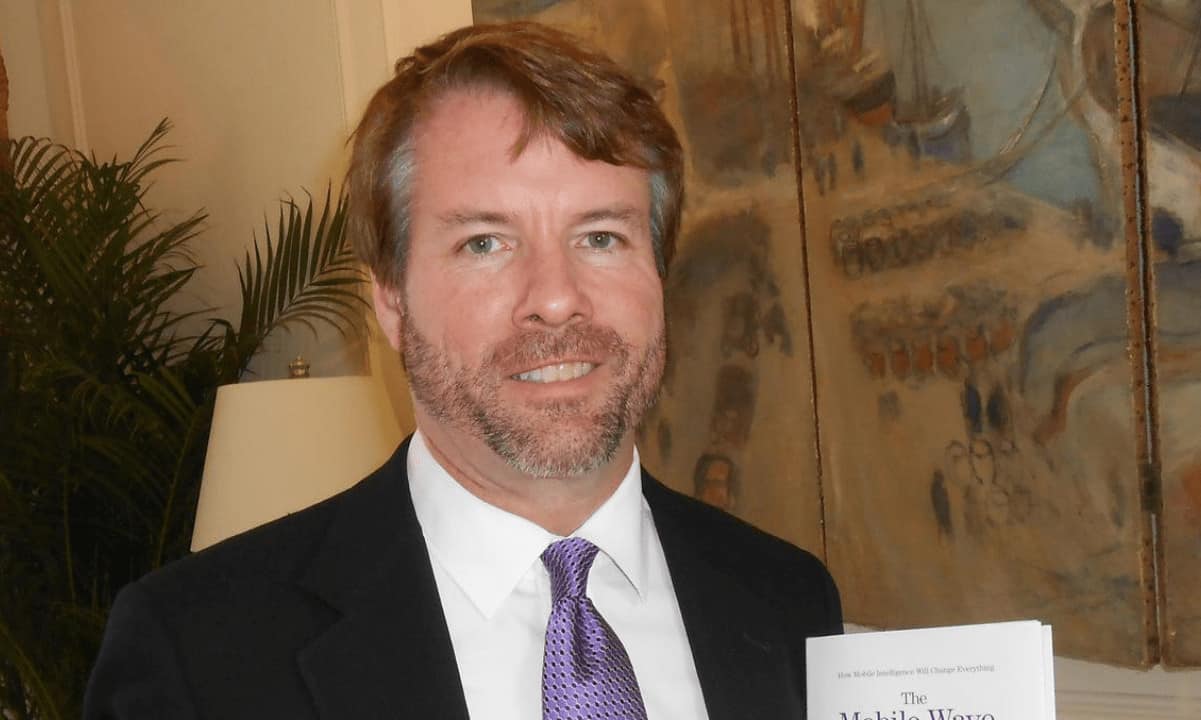

Michael Saylor – CEO of the software platform MicroStrategy – said investing in his company is almost like allocating funds in the still nonexistent in the USA – Bitcoin spot ETF. His organization is known as one of the most prominent BTC HODLers as it owns over $5.5 billion worth of the primary cryptocurrency.

MicroStrategy Could Count as Bitcoin Spot ETF

The long-awaited Bitcoin spot exchange-traded fund still waits to see the light of day in the United States as the SEC keeps rejecting such applications from numerous firms. However, according to MicroStrategy’s Michael Saylor, investors should not desperately anticipate it but allocate some of their wealth to his company.

“We are kind of like your nonexistent spot ETF,” he maintained.

A Bitcoin spot ETF invests directly in BTC, meaning that buyers will have exposure to the leading digital asset without holding and storing it on platforms or in private wallets. Keeping in mind that MicroStrategy owns over 129K BTC, worth more than $5.5 billion, people who seek such exposure could simply invest in the company:

“If you want to be 2% exposed to bitcoin, you’d put 2% of your portfolio into MicroStrategy, and the other 98% of your portfolio, you can invest in whatever you want. They don’t want the CEO of a publicly-traded company to be unpredictable and random.”

Last week, Saylor – an outspoken bitcoin evangelist – assured that his intelligence company has no intentions of pivoting from its BTC strategy. Moreover, he said it will continue to accumulate and hold the asset on a macroeconomic level.

The executive believes this concept is appropriate since his company generates considerable revenue, which should not be held in depreciating assets such as the American dollar. It is much wiser to convert the cash flows into bitcoin, which has the potential to increase its valuation in time, he argued:

ADVERTISEMENT

“As we generate gash flows, we think that the responsible thing to do for our shareholders is we convert currency which is devaluing, into an asset which is appreciating.”

Saylor Has High Hopes for Bitcoin

MicroStrategy’s CEO reiterated his optimistic BTC stance earlier in April. “People ask me if I’m still bullish on Bitcoin. I am more bullish than ever on Bitcoin. The future is bright,” Saylor said back then.

He touched upon Biden’s executive order on cryptocurrencies, opining it means a “green light” for the leading digital asset:

“Bitcoin has been embraced. The administration has given a green light to Bitcoin. Politicians are now competing who’s the most pro-bitcoin.”

Speaking about the future price of the asset, he envisioned it to reach $1 million.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato