Abstract: We take a look at MicroStrategy’s outstanding bonds and look at their structure and convertibility options. We comment on the possibility MicroStrategy could be required to sell Bitcoin, in order to pay back bondholders in the event of cash redemptions. We argue that these forced liquidations appear highly unlikely, based on the current debt structure. However, Bitcoin can be volatile and anything is possible.

Overview

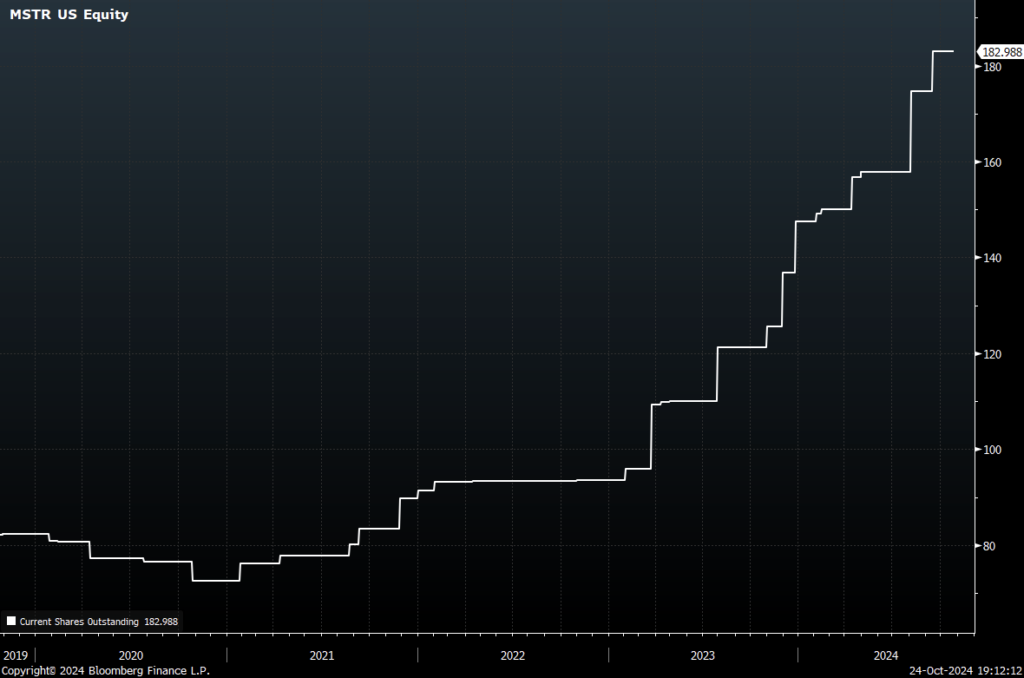

MicroStrategy owns over 250,000 BTC and the stock trades at a massive premium to its NAV. This is somewhat reminiscent of The Grayscale Bitcoin Trust [GBTC US], in previous Bitcoin cycles. Before GBTC converted to an ETF, it also had a large premium to NAV and attracted giant inflows. As to why these two instruments trade or traded at such a large premium to NAV is an issue that has dumbfounded us and we are unable to provide a coherent explanation in either case. MicroStrategy has even been able to issue significant numbers of shares at premium valuations, buying more Bitcoin and increasing the book value per share, in a so-called “infinite money glitch”. MSTR has announced five equity offerings since the Bitcoin strategy was launched, raising a total of up to $4.4 billion.

MSTR Shares Outstanding (Millions)

Source: Bloomberg

In another example of history rhyming, the individual who controls MicroStrategy, Mr Michael Saylor is regarded as a “bad actor” by a significant minority of people in the space, for some of his controversial stances he has taken. These views may include apparent hostility to supporting Bitcoin developers, opposition to privacy technology and his apparent short lived opposition to self custody. The individual who controlled Grayscale, Mr Barry Silbert, also became somewhat controversial in the space, for being the principle organiser of the “New York Agreement” in 2017, which resulted in a doomed proposal for the industry to abandon Bitcoin for an alternative “SegWit2x” coin, based on a flawed and buggy BTC1 client.

With MicroStrategy accumulating so much Bitcoin and the market capitalisation approaching $50bn, some are starting to ask questions. In particular, MicroStrategy has debt and we have been asked if this debt could result in MicroStrategy being forced to sell its Bitcoin into the market, causing a downward price spiral. Unfortunately, due to the complexities of the debt, there is no simple yes or no answer, but we have read the relevant documentation and will answer the question as best as we can in this piece.

Caveat

We would like to caveat this article by saying that we are not bond traders, bond market experts or lawyers. The corporate debt market can be murky and it can be difficult for non-experts to navigate. It is likely that we have got many things wrong in this article. This article also oversimplifies the products and does not comment on many of the conditions and intricacies. Please do not rely on any information in this article and please correct us if we have made a mistake.

Microstrategy’s Bonds

As far as we can tell, MicroStrategy has issued seven publicly traded convertible bonds since it announced its Bitcoin strategy. The seven bonds are listed below.

| Status |

Amount raised $m |

Interest Rate |

Issue Date |

Maturity |

|

Active |

1,050 |

Zero |

Feb 2021 |

Feb 2027 |

|

Active |

1,000 |

0.625% |

Sept 2024 |

Sept 2028 |

|

Active |

800 |

0.625% |

March 2024 |

March 2030 |

|

Active |

800 |

2.250% |

June 2024 |

June 2032 |

|

Active |

600 |

0.875% |

March 2024 |

March 2031 |

| Called |

650 |

0.750% |

Dec 2020 |

Dec 2025 |

|

Called |

500 |

6.125% |

June 2021 |

June 2028 |

The first thing to note is that two of the bonds have been fully called and they do not therefore relate to debt outstanding. MicroStrategy therefore has five outstanding bonds, with a principal value of $4.25 billion. It is therefore these five bonds we will examine.

Redemption and Conversion Options

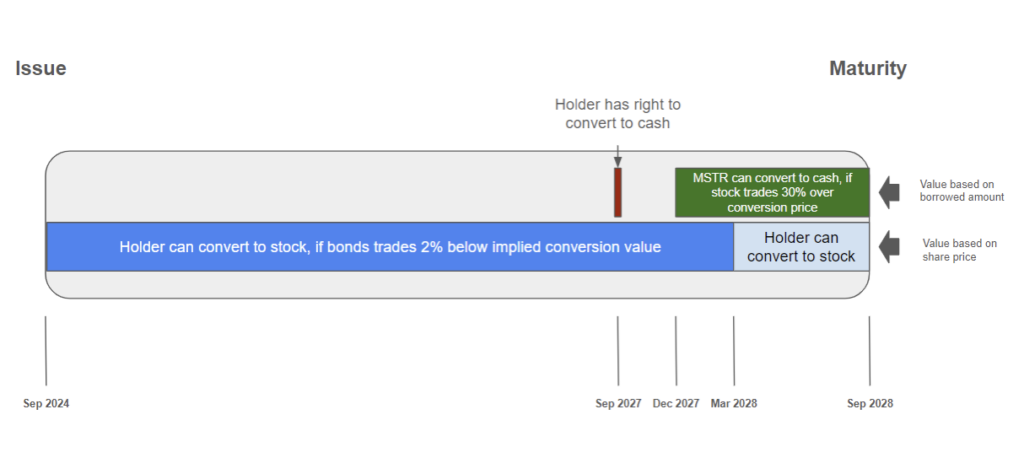

The structure of the bonds is relatively complex, with, as far as we can tell, four different types of conversion options before maturity. These conversion options are summarised in the below diagram for the most recent instrument, the bond maturing in 2028.

MicroStrategy 0.625% 2028 bond timeline

Source: Bond Offering Documents

Summary of Convertibility Options

|

Who has the option? |

Bondholders |

|

What can they convert to? |

MSTR shares at a specific conversion ratio |

|

Description |

Bondholders have the right to convert their bonds for stock in MSTR. This right exists throughout the lifetime of the bond. However, in the initial period, the right can only be exercised if the bond trades a 2% discount or more to the implied conversion value based on MSTR’s share price. If such a discount does not exist, the bondholder can always sell the bond in the market. Towards the end of the life of the bond, this 2% rule no longer exists and the bondholder can convert to stock regardless of the market price of the bond. |

|

Who has the option? |

Bondholders |

|

What can they convert to? |

Cash, based on the amount borrowed plus any unpaid accrued interest |

|

Description |

At a specific date, bondholders have the right, but not the obligation, to demand cash from MicroStrategy. The bondholders may demand this if the Bitcoin price has been weak. The zero coupon bond does not have this early conversion option. |

|

Who has the option? |

MicroStrategy |

|

What can they convert to? |

Cash, based on the amount borrowed plus any unpaid accrued interest |

|

Description |

On or after a specific date, the company has the right, but not the obligation, to redeem the bonds and pay the holders cash. This right can only be exercised if the stock trades over 30% above the conversion price, for any 20 days (consecutive or not) in any rolling 30 day trading window. If the Bitcoin price is strong, the company may want to exercise this right. In the event of strong Bitcoin prices, bondholders may wish to convert their bonds for stock, to avoid this early cash redemption system. |

As far as we can tell, the conversion options are essentially the same (except for different prices and dates) for four of the five bonds, with the exception being the zero coupon bond. Holders of the zero coupon bond do not have the right to redeem for cash at a certain early date, unless there is a “fundamental change” in the business. In the event of falling Bitcoin prices, this could be a significant distinction.

The below table has the key dates in relation to the cash conversion options for the five bonds.

|

Amount raised $m |

Interest Rate |

Maturity |

Holder Cash Option Date |

MSTR Cash Option Date* |

|

1,050 |

Zero |

Feb 2027 |

n/a |

Feb 2024 onwards |

|

1,000 |

0.625% |

Sept 2028 |

15 Sept 2027 |

Dec 2027 onwards |

|

800 |

0.625% |

March 2030 |

15 Sept 2028 |

March 2027 onwards |

|

800 |

2.250% |

June 2032 |

15 June 2029 |

June 2029 onwards |

|

600 |

0.875% |

March 2031 |

15 Sept 2028 |

22 March 2028 onwards |

Source: Bond Offering Documents

Note: *Stock must trade over 30% above the conversion price, for any 20 days (consecutive or not) in any rolling 30 day trading window

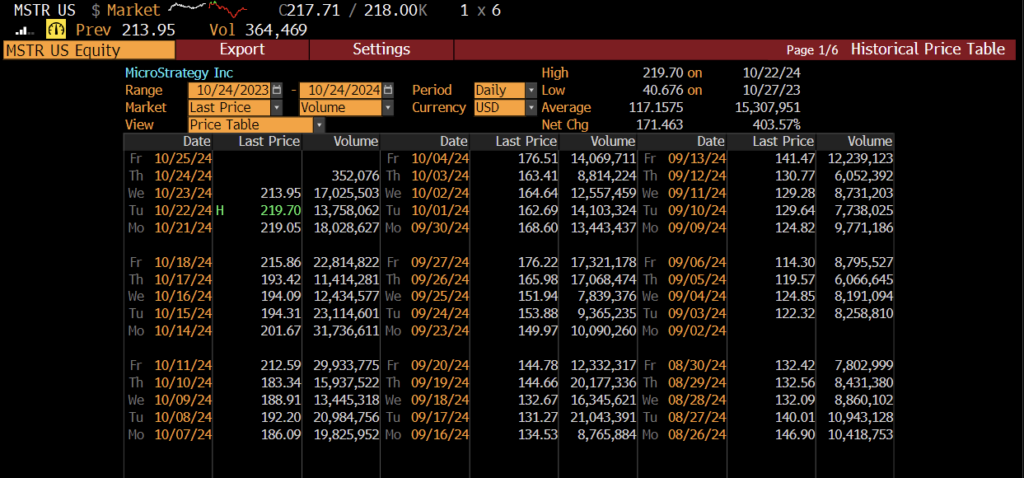

MicroStrategy’s Conversion Rights

It should be noted that with the zero coupon bonds, the Feb 2024 MSTR cash option date has already passed. The conversion price is $143.25 and a 30% premium to this is $186.23. The current MSTR stock price is $214, well above this. However, it has only traded above this price for 11 of the last 30 trading days. Therefore this option is close to coming into play, but not exercisable yet. Exercising this option would create value for MSTR shareholders, however, the bondholders are likely to be able to prevent this, by exercising their conversion rights.

These complexities all make valuing the bonds quite complex, with options in multiple directions. However, many of the holders of the debt are likely to be sophisticated specialist bond investors, who will have models to perform the calculations.

Bond Interest Payments

Four of the five outstanding bonds have interest payments. These coupons are cash liabilities, so it is technically possible that MicroStrategy could be forced to sell Bitcoin to pay these coupons. However, the interest rates are reasonably low and the legacy software business should easily generate enough free cash flow to pay these interest costs. Therefore, a crash in the Bitcoin price alone would not be sufficient to require the company to sell Bitcoin to pay bond interest costs. Therefore, we do not think the interest costs mean MicroStrategy may become forced sellers of Bitcoin.

Conclusion

MicroStrategy has $4.25 billion of debt, based on the amount of principal borrowed. This compares to the stock which currently has a market capitalisation of $43 billion and the Bitcoin holdings which are worth $17 billion based on the current spot price. Therefore the bonds are not a particularly large part of the capital structure. However, if the Bitcoin price declines significantly in value, perhaps to around $15,000 per coin and MSTR cannot raise more debt, then “forced liquidation” of the Bitcoin is something analysts might need to consider. However, the relevant periods for these potential forced liquidations are the maturity dates and the option dates mentioned in this article. The maturities and bondholder option dates are spread around, at very specific times, between 2027 and 2031. Therefore, even if Bitcoin does crash to around $15,000, forced selling to finance the cash redemption of the bonds is still unlikely, in our view.

Just because it is not likely that MicroStrategy will be forced to sell Bitcoin, what is much more likely to happen, in our view, is that it becomes in MicroStrategy shareholder interests for the company to sell Bitcoin. Right now the stock is trading at a huge premium to NAV. If this premium becomes a discount, which is pretty much inevitable at some point, and cash bonds repayments are due, then it would be in the best interests of shareholders to sell Bitcoin to raise the money. However, while the stock is trading at a premium, there is the “infinite money glitch” and no reason to sell Bitcoin. But this glitch will not last forever.

It should also be noted, that if the stock continues to trade at a premium and while there is appetite for more MSTR bonds, the company is likely to issue more debt. This could therefore increase the risk and increase the possibility of forced selling in the event of a Bitcoin price crash. But for now, the leverage is low and the liquidation risk is low.

Related

The post appeared first on Blog BitMex