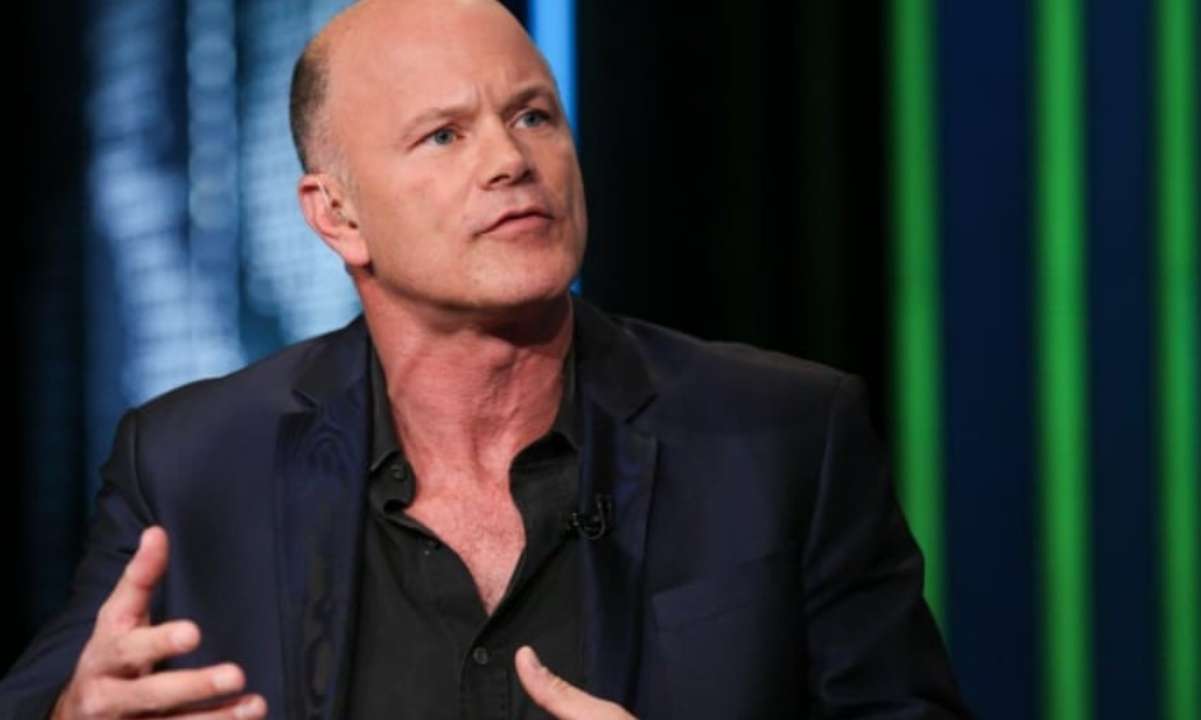

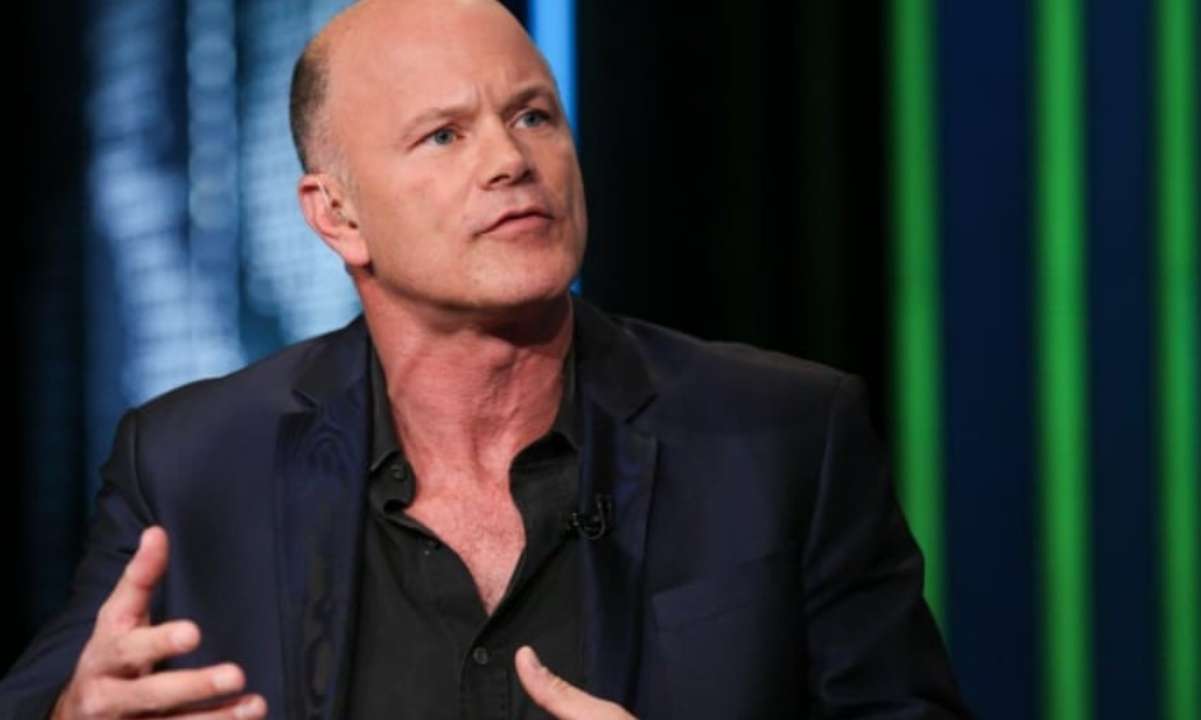

Mike Novogratz, a prominent Bitcoin bull and the CEO of digital asset investment firm Galaxy Digital, noted that cryptocurrencies are here to stay even though it will take a while for the market to turn bullish.

Novogratz: Bitcoin Isn’t Going Away

The billionaire told Bloomberg in an interview that assets, including crypto and stocks, that went up based on “cheap money forever” were under pressure due to the Federal Reserve withdrawing liquidity.

However, Novogratz believes the crypto market has suffered the most because of recurring negative events over the past month. These include a long list of market players with monster leverage, such as Celsius and Three Arrows, which has created fear, uncertainty, and doubt (FUD) among investors.

Although he is optimistic that Bitcoin and Ethereum will bottom at $20,000 and $1,000, he noted that it would take a while for the crypto market to regain a bullish narrative and confidence.

Mike Novogratz further stated that even though prices are down, over 130 million investors still see Bitcoin as a viable investment, and as such, the cryptocurrency is here to stay.

ADVERTISEMENT

“What happened with lots of great technologies, including Bitcoin, crypto, and web3, is that prices got ahead of themselves… I don’t think crypto is going away…”

Bitcoin Will Lead Other Markets

The Galaxy Digital CEO noted that global financial markets would start recovering once the Fed reconsiders its decision and stops hiking interest rates. But when that happens, Bitcoin will explode north, taking other assets out of the bearish trend.

According to him, many investors are already waiting on the “sidelines” to invest in Bitcoin, but global macro hedge funds will be the first buyers to fuel the next uptrend.

“I 100% think there are people on the sidelines waiting to build, but I think the first buyers actually from the traditional sense are going to be big global macro hedge funds. The moment the Fed flinches, I think you’ll see lots of traditional macro funds, who’ve had a great year, buy Bitcoin. We’ll add to our position at that point,” he said.

Meanwhile, Novogratz still maintains that many TradFi and crypto hedge funds won’t make it through the current bear markets.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato