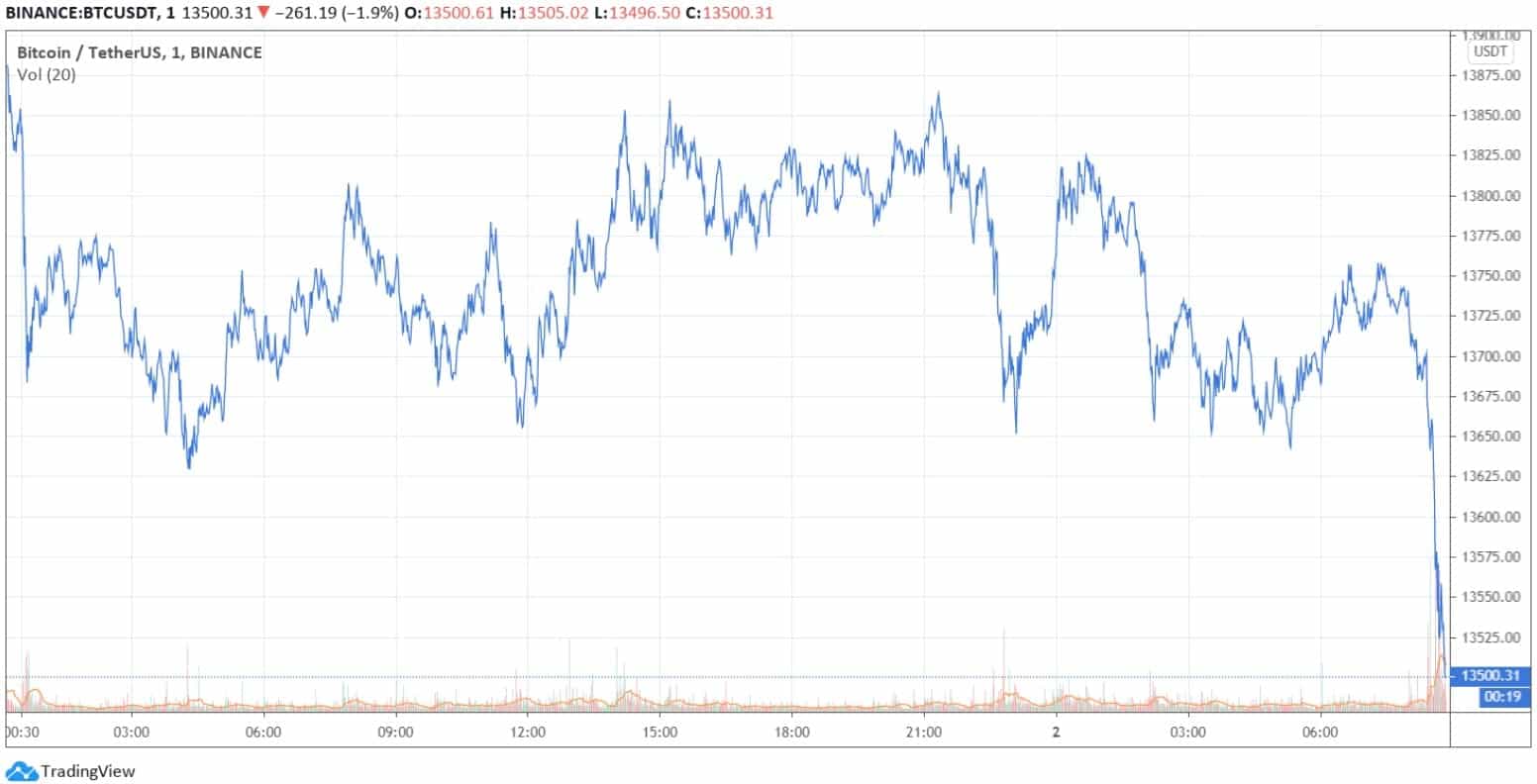

Bitcoin has failed to sustain its level above $14,000 after breaking it a few days ago. In fact, the cryptocurrency saw a sharp decline in just a few minutes as it lost about $300.

Bitcoin’s dominance has also decreased over the past 24 hours by almost 0.5% which means that altcoins are trying to claim new grounds.

Bitcoin Stalls Beneath $14K

The primary cryptocurrency made the headlines on Saturday as it finally broke the 2019 high. In fact, Bitcoin jumped above $14,000 for the first time since January 2018 and painted a new 1,000-high of about $14,100.

However, the bears intercepted the move and drove BTC south. As of writing these lines, BTC sits around $13,500. Moreover, its dominance over the market decreased by about 0.5% over the past 24 hours as well.

If Bitcoin continues to decrease, the most significant support levels are at $13,270, $13,190, and $12,970 if BTC tanks in value. Alternatively, should it reverse, there’s resistance at $13,800, $13,900, $14,170, and $14,380.

It’s worth noting that the final results of the US 2020 Presidential elections are just around the corner. History has shown that the outcome impacts the traditional financial markets. Most community members have speculated on how it could affect Bitcoin. Popular TV Host Max Keiser believes that no matter who emerges as the next US President, Bitcoin will be the ultimate winner.

Altcoins Paint Green, Reduce BTC Dominance

During the past few days, most alternative coins remained stagnant while BTC was charting new highs. As such, Bitcoin’s dominance over the market skyrocketed by nearly 6% in a few weeks.

At the time of this writing, Ethereum sits around $385. Ripple is below $0.24 while the majority of the larger cryptocurrencies are also struggling dollar-wise.

Ocean Protocol is the most significant gainer with a 14.5% surge. The increase comes after the leading cryptocurrency exchange Binance announced launching OCEAN/USDT-margined perpetual contract with up to 50x leverage.

Ampleforth (5.5%), 0x (4%), and Compound (5%) follow. There are a few notable losers such as CyberVein (-16%) and ABBC Coin (-9%).

In fact, throughout the past few hours alone, the total market cap lost about $6 billion.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato