Monero, the most important privacy coin in the crypto ecosystem, is having a great time, outperforming even Bitcoin in comparison.

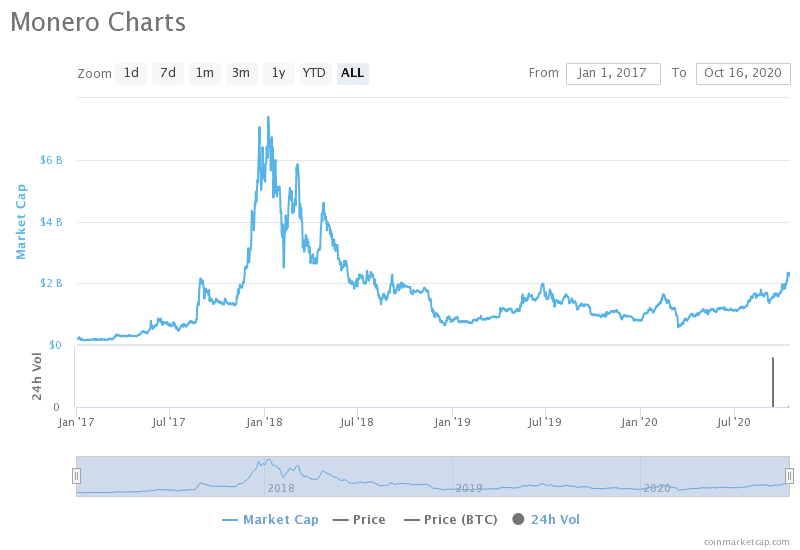

As of today, October 15th, 2020; XMR closed with a total market capitalization of $2.29 Bn. At a price of $129 per token, the crypto is showing a phenomenal performance, achieving a maket capitalization not seen since 2018, when the bearish sentiment took over the crypto-verse, draining the markets in general.

Bulls Are in Control, But for How Long?

Looking at things from another perspective —and considering that such capitalization was last seen during a bearish phase— in terms of sentiment analysis, Monero is breaking limits that were only observable in 2017, during the last bullish run of the crypto markets in general.

The Relative Strength Index —a number that tries to determine whether an asset is overbought, oversold, or in a state of equilibrium— shows that bulls are in control. The token is starting to move to an overbought zone, which means traders should be cautious and think ahead of a possible sell-off.

However, in general terms, a high RSI under current circumstances doesn’t look as scary as that of 2017. Other data show a balance in the market and a good place to grow in the short term.

The Monero Community has Plenty of Reasons to be Bullish

From the point of view of fundamental analysis, Monero has proven its value over time. Despite not having the blessing of law enforcement agencies around the world —especially in the United States— the blockchain has been able to remain intact, proving that, at least so far, it is undecipherable for even the most influential government agencies worldwide.

And although there are companies like Chainalysis working hand to hand with agencies and regulators to find a magic door for the authorities to invade the privacy of those who love using Monero, none have been successful.

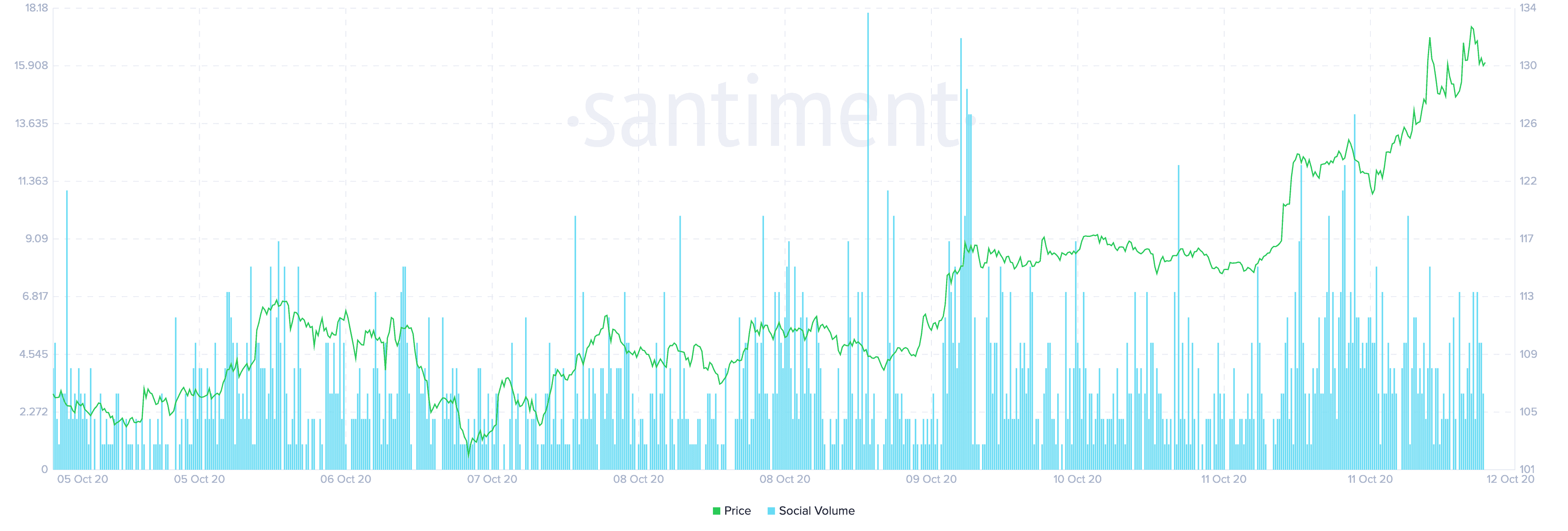

The concern of the authorities seems to be having a positive effect among investors. In fact, the US Department of Justice issued a statement calling on companies to collaborate with authorities to allow them access to private data, and in a sort of challenging attitude, the Monero community and privacy proponets responded fiercely, which of course translated into a price spike.

However, the cryptocurrency is still 73% below its ATH. Although it is performing better than other tokens in the top 10 by market capitalization, it is still far from occupying a place in that privileged list after tokens such as Polkadot, Chainlink, and Crypto.com’s CRO entered the scene to steal the show.

Too bad there are no DeFi projects on Monero… yet.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato