The recent mystery surrounding the incredible $80,000 worth of Ethereum transaction fee has been resolved. Instead of a complicated money laundering scheme compiled by a South Korean exchange, it actually turned out to be a human-mistake made by one of the employees.

656 ETH Paid for Syntethics Network (SNX) Transaction

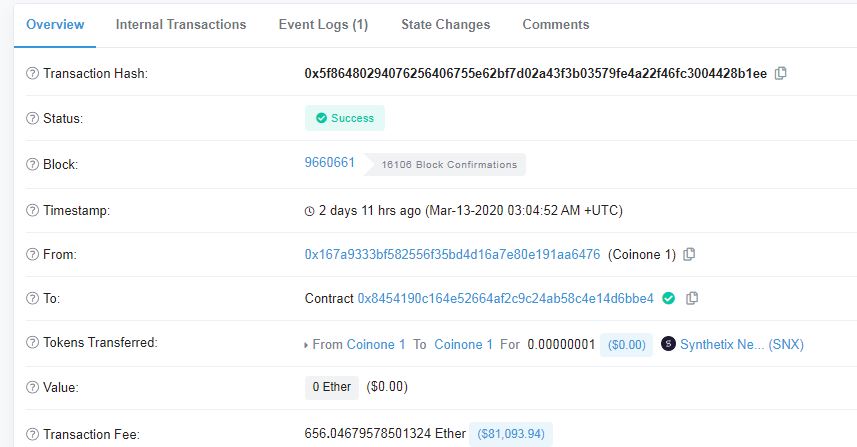

A few days ago, a suspicious Syntethics Network Token (SNX) transaction worth $0.00000001 had been sent on the Ethereum blockchain. The value of the token practically equals $0, but the transaction fee for sending it from one place to another was 656 ETH.

As Ethereum’s price at that time was approximately $123, the total value of the fee exceeded $81,000. Needless to say, such a record-breaking amount for a transaction fee raised some eyebrows.

Some speculations argued that it could be related to money-laundering. After all, the sender was one of the most popular South Korean cryptocurrency exchanges, CoinOne.

However, the mystery came to a quick solution following a recent report on behalf of the exchange. It denied any previous accusations that CoinOne has made illegal transaction attempts. Instead, it pointed out to a more simple solution – a human error when executing the transaction manually:

“It was a mistake due to changes in the eternal system recently. We have reorganized the protocols of the transaction testing process to avoid the same mistake.” – according to a CoinOne official.

Furthermore, the transaction was so little because CoinOne wanted to test the process as the exchange added the SNX token only recently.

It’s worth noting that this is not the first pricey transaction fee. Over a year ago, someone transferred roughly $19 worth of ETH but the fee he paid on the Ethereum blockchain was over $450,000.

Cryptocurrency Exchanges Make Expensive Mistakes

The cryptocurrency scene is not exempt from making similar, sometimes very costly mistakes. The leading exchange by trading volume, Binance, recently noted a Chainlink flash crash. The trading pair LINK/USDT plunged in a matter of seconds by 99%. It went from its regular level of $2.25 to $0.0136 before recovering quickly.

Interestingly, someone managed to take advantage as the crash triggered a very low buy order. According to Binance CEO Changpeng Zhao (CZ), a trader placed the order on the first day when LINK/USDT pair was added to Binance, back in January 2019.

In any case, mistakes happen everywhere, and it’s good to distinguish that in CoinOne’s case, the reason was not money-laundering.

The post Mystery Solved: CoinOne Record-Breaking Transaction Fee Of 656 ETH Worth $80,000 Was Human Error appeared first on CryptoPotato.

The post appeared first on CryptoPotato