From euphoria to depression: The crypto traders thought they are leaving off for Christmas in an optimistic mood; however, Bitcoin had other plans, as of now.

Two days ago, following accurately touching the critical resistance level of $7700, which was discussed here many times as the short-term first significant level, the cryptocurrency got poorly rejected.

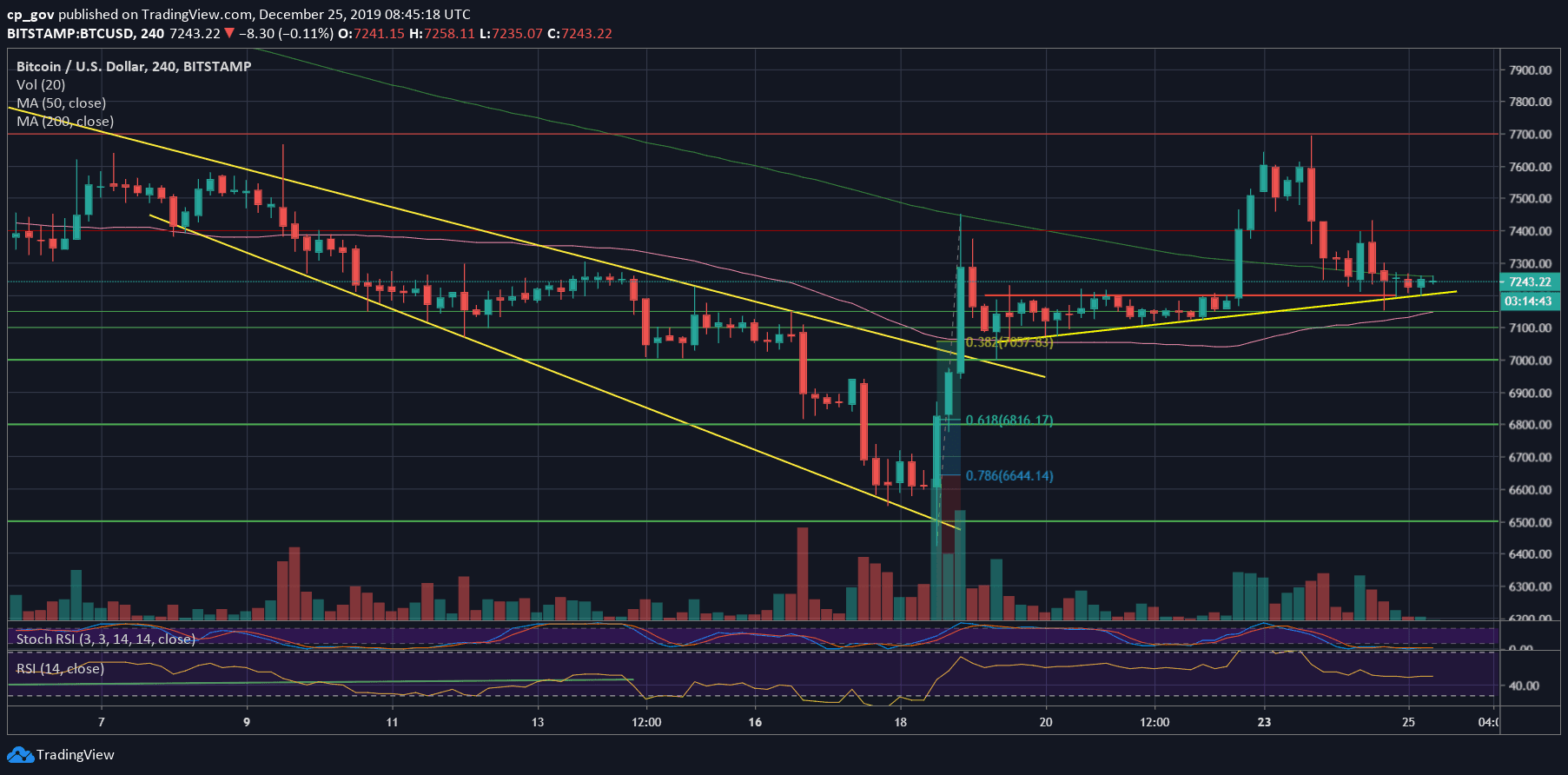

Less than 24 hours, and Bitcoin finds itself seeking support on top of the $7200 horizontal line, along with the mid-term ascending trend-line (on the 4-hour chart).

As proven once again, Bitcoin can be very volatile, and during days when the market doesn’t signal a clear direction, sometimes it’s advisable to trade less or not to trade at all. The only winners of such situation are the crypto margin exchanges.

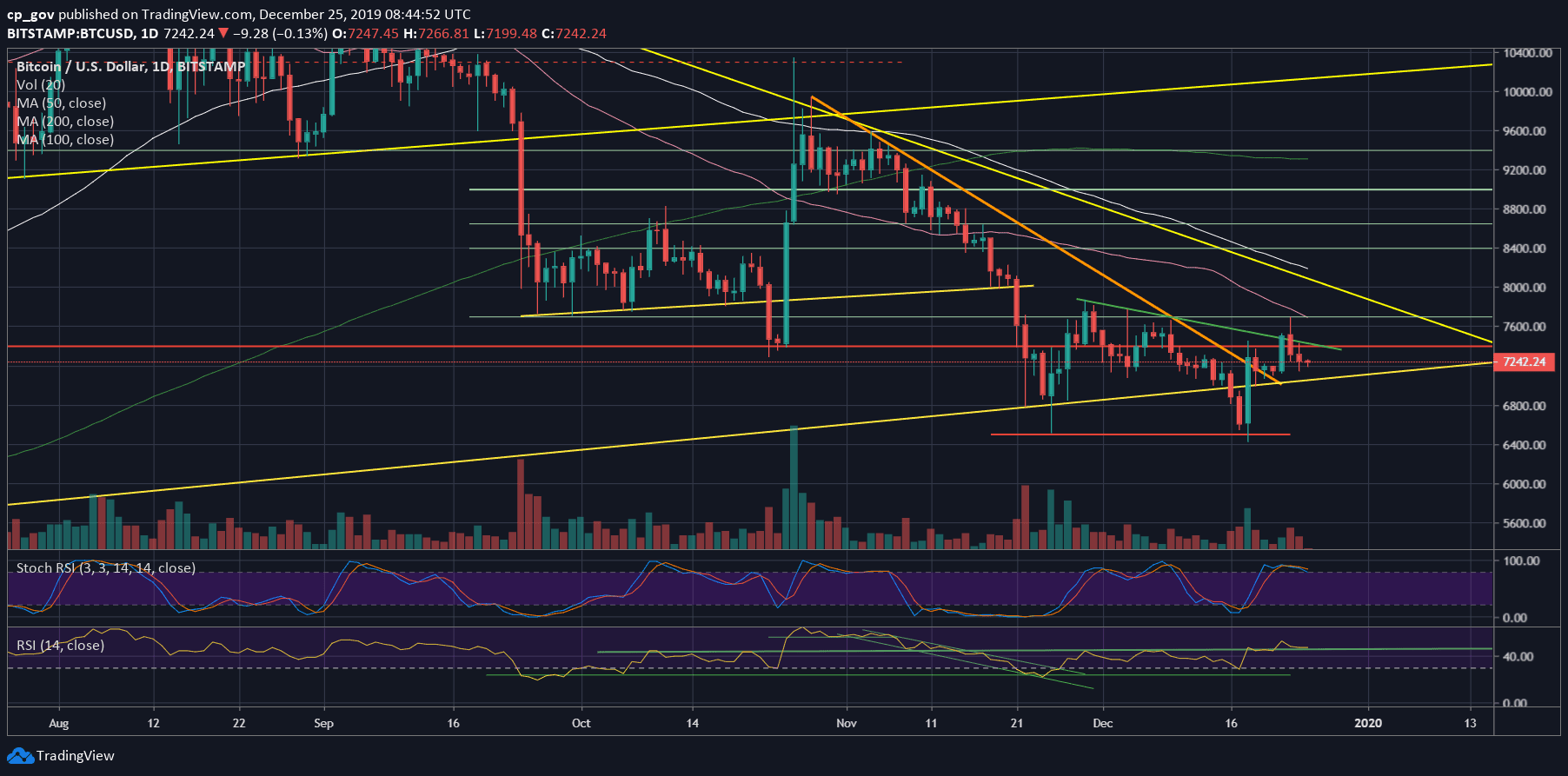

At the macro level, we can see that Bitcoin failed to close above the green descending trend-line, as can be seen on the following daily chart, together with the $7700 price level rejection.

Total Market Cap: $192.7 billion

Bitcoin Market Cap: $132.6 billion

BTC Dominance Index: 68.8%

*Data by CoinGecko

Key Levels to Watch

– Support/Resistance: After rejecting from the $7700 level, Bitcoin dropped severely down to the $7200 support; from there, the coin confirmed the crucial key-level of $7400 as support turned resistance before continuing down to where it trades now (~$7200).

For the past day, Bitcoin’s upper ‘fence’ was the 4-hour MA-200 (the light green line), roughly around $7250. From below is the $7100 – $7200 support area, which includes the 4-hour MA-50 (the pink line) along with horizontal support of $7200, the current daily low, and the long-term ascending trend-line on the daily chart (which started forming on April).

A short-term bullishness can only be approved in case of a higher low above $7400. Further above is the critical $7700.

From below, if the mentioned support area won’t hold, then we will likely see Bitcoin retesting the $7000 area once again. Further below is $6800 and last week’s low at around $6500, which is also the lowest price of Bitcoin since May 2019.

– The RSI Indicator: The breakout form the 44-45 RSI level had turned into a fake one. The recent price drop is reflected on the RSI, which is back to the 44-45 level. This is a deciding point for Bitcoin, whether it will hold or break.

– Trading volume: The recent days’ volume levels are far from the monthly highs. This can be explained because of the Holidays. Be aware that the market is easy to manipulate due to the low volume.

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Technical analysis tools by Coinigy.

You might also like:

The post appeared first on CryptoPotato