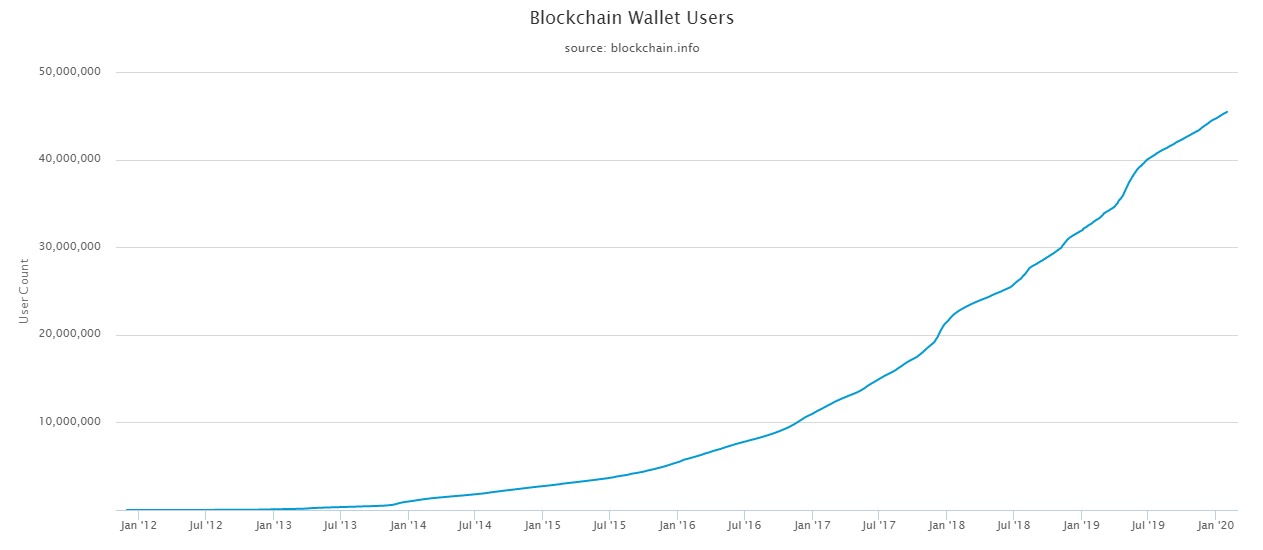

Over the years the number of cryptocurrency wallets has been increasing; latest data from Blockchain.com revealed an exponential increase and by the last week of January 2020, the number of cryptocurrency wallet users increased to over 45 million.

A sharp increase was noted in the second quarter of 2019 when the numbers shot above 40 million and the trend since then has been positive. Over the past couple of years, custodial platforms have noted significant growth in terms of its user base.

Source: Blockchain.com | Blockchain Wallet Users

As the numbers continued to rise due to the increasing market confidence, the age-old debate of custodial vs non-custodial still continued.

In the latest edition of Untold Stories podcast, Marco Santori President and Chief Legal Officer of Blockchain.com emphasized on the need for non-custodial solutions. While there are pros and cons, he believes that if there are no non-custodial solutions, then it is similar to “rebuilding Wall Street using different technology”.

He said,

“There will always be a need for custodial solutions and exchanges, for example, provide critical liquidity to the ecosystem. At the end of the day though if you do not have that option to self custodial, it’s difficult to really understand why we are all doing this. Otherwise, we are just sort of rebuilding Wall Street, using a different back-end technology and that is not exciting.”

Santori went on to add,

“If you do not have the right to self-custody, your funds, your crypto, I am not really sure why we are really here in the first place.”

One of the major pros of the non-custodial wallet is the fact that they are immune to online hacks. Users’ funds sitting in an exchange makes it vulnerable to attacks. A recent study conducted by non-custodial wallet platforms, Ambo and MyCrypto, found that 66.5% of cryptocurrency holders use a noncustodial solution.

While non-custodial solutions have started gaining traction, custodial services have also stepped up their game. Recently, crypto exchange Bittrex secured an insurance coverage of $300 million to protect crypto assets held in its cold storage system.

Additionally, Gemini had previously launched an insurance company with a coverage of $200 million for its cold storage.

The post appeared first on AMBCrypto