OKEx has become one of the largest cryptocurrency exchanges in the past several years. The company’s growth is continuously emphasized by the trading volume and the growing user base.

CryptoPotato recently had the opportunity to do an exclusive interview with the CEO of the company – Jay Hao.

Hao spoke of the challenges OKEx has to overcome, the current cryptocurrency landscape, Bitcoin’s growing adoption, the DeFi craze, and more.

Back to the Roots: Before OKEx

One of the first things that Hao shared with us was his background and where he comes from. Becoming a CEO of one of the world’s leading cryptocurrency exchanges is a daunting task and we were curious to find out more about his experience.

Hao has spent over 20 years in the semiconductor industry and there’s “zero-tolerance for faulty product design” over there.

At OKEx, we are very rigorous about ensuring that we provide the most reliable and secure exchange services. From my experiences in semiconductors, I have zero tolerance for faulty trading product features. No matter how minor a new feature is, we run multi-levels of QA tests on it before the release.

He has also spent years in the video streaming sector and owned his own companies before getting into blockchain. Hao thinks that this experience taught him how to be a better manager and to understand the macro factors influencing management, as well as the daily internal challenges a company faces.

He shared that he’s been exposed to Bitcoin very early:

“I found it extremely interesting and enjoyed watching its development from the early days when 10,000 bitcoins were used to pay for two pizzas.” Hence, joining OKEx was a “logical progression” because he already had developed high-tech products and was fascinated with blockchain.

The CEO also said that the industry has come a long way since back then and that he loves “the fast-paced environment and the constant innovation we see daily.”

The Current Market State and COVID-19: A Serious Shift

Discussing the current state of the market and the impact of the COVID-19 pandemic, Hao said that it “has undoubtedly had a big effect.”

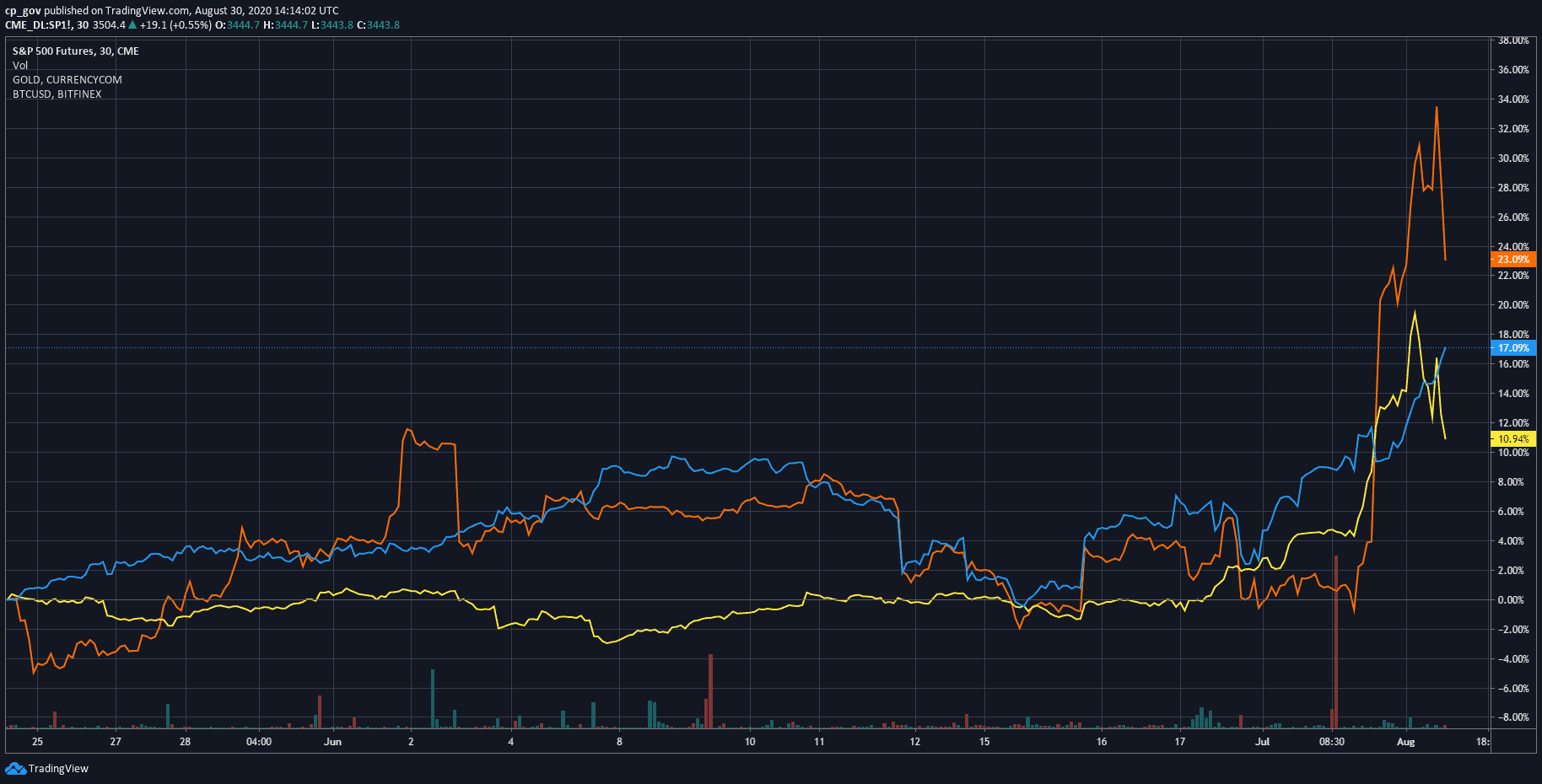

“As we saw from the huge sell-off in March this year, no market, including gold, was unaffected.

However, the market has resisted very well, and it would appear that the correlation between Bitcoin and the stock market is weakening again as we have seen very uncharacteristic volatility in equities while Bitcoin has remained flat and locked in a $9-10k trading range for two months.”

However, Hao also said that there’s still a long way to go “as far as COVID-19 is concerned and cannot yet assess the extent of the economic fallout that it will cause, particularly if there is a second wave in the fall.”

He outlined that this could cause further repercussions in the crypto market in the short and medium-term. In any case, he outlined the unprecedented QE that we are seeing, saying that the macro context looks bullish fro crypto in the longer term.

Touching on another particularly hot topic, Decentralized Finance (DeFi), Hao stated:

“the pandemic essentially accelerated a trend that was inevitable anyway, and more people will turn to sound money and the chance to make returns through DeFi as their currencies weaken.”

They begin to understand money creation and policy better.

Many People Will Lose Money In DeFi

Hao outlined that OKEx “has been watching the DeFi space with interest for a long time now and fully supports its development.”

“We are showing this in several different ways because we strongly believe that DeFi has the potential to achieve the goal of #FinanceAll and provide billions of unbanked people with access to financial services.”

He pointed out that OKEx became one of the first validators on the ETH 2.0 Topaz testnet with OKPool so that they can be at the forefront of this major development in the space. The exchange also allows “its users to generate a passive income through the C2C Loan future for which they can use BTC, ETH, and OKB for collateral with the lowest borrowing rates in the space, and we are developing OKChain which will be used to support a DeFi infrastructure.”

As for the DeFi craze itself, he pointed out that as with every altcoin season many people will lose money, while others will win. Yet, he pointed out some benefits for both BTC and ETH:

“If the DeFi bubble temporarily bursts, that will actually be good for BTC and ETH as they will see major capital inflows, and if the craze does fizzle out, it will only be short-term because the potential and promise of DeFi are simply too compelling to ignore.”

Bitcoin To ATH Levels In 1 – 1.5 Years

We asked Hao how he pictures the space in five years from now. He said that the ecosystem “will have grown massively, and more and more innovative products and solutions will be in a place that allows everyday people to use blockchain without realizing it.”

He added that the user interface side of the technology will be particularly enhanced. Still, he thinks that DeFi will be the “greater protagonist” by then.

I don’t know if all the world’s unbanked will be serviced by blockchain and DeFi over the next five years, but we will certainly be closer to reaching that goal.

Protocols such as Polkadot and others like it will allow for seamless interoperability of blockchains while ETH 2.0, OKChain, and other decentralized public blockchains will have grown exponentially, making it much easier for developers to build wide-scale mainstream Dapps on them.

And of course, Hao also touched on Bitcoin and its developments in terms of pricing. “Anything is possible” was his main narrative, urging caution towards bold and flat-out predictions.

He said that “we could realistically see a short-term burst of the DeFi bubble.” He also mentioned that if the global economic situation worsens, we can see another March-like event that could cause issues for Bitcoin as well.

Yet, he holds that even if it happens, this will be only temporary, and “the price will recover quickly to its current values.” His long-term outlook is bullish and “it’s not impossible that we see a Bitcoin price at least testing its 2017 highs in the next 12-18 months.”

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato