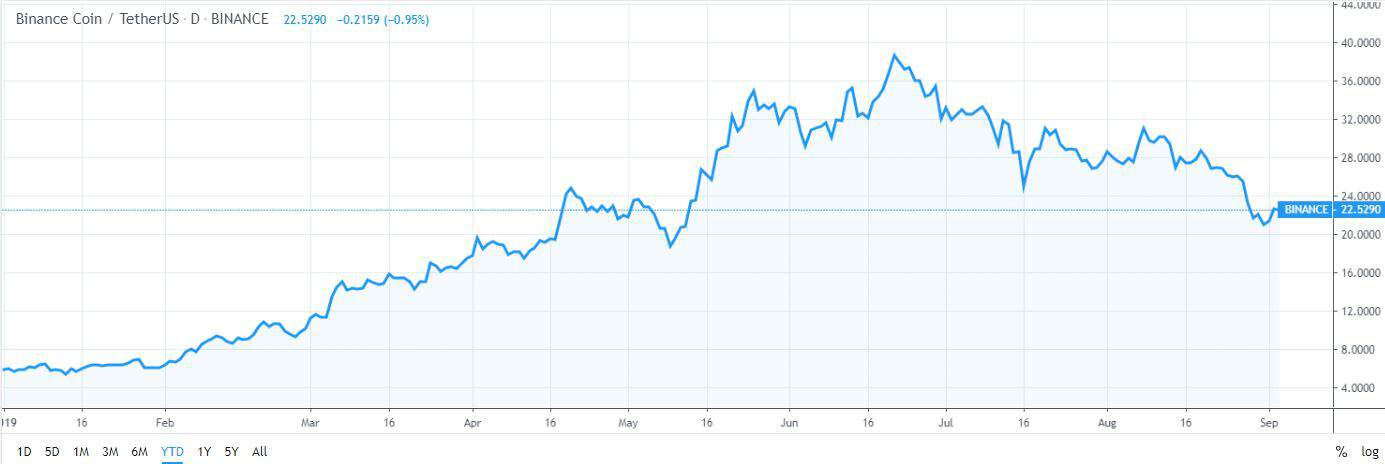

Binance is having a year to remember with major announcements every few months delivering more and more options to the end-user. Its own cryptocurrency BNB entered a notable uptrend at the beginning of the year with outstanding growth.

For the first four months, Binance Coin saw an increase of around 300%. The parabolic movement didn’t end there, as the cryptocurrency reached an all-time high of $39.68 on June 22nd, giving it a total increase of 566%.

Things went south from there, as BNB lost almost half of its value as it currently trades at around $22. Moreover, this happened despite Binance constantly adding new capabilities for its users, whereas at the beginning of the year the only things which seemingly drove the price up were the Initial Exchange Offerings (IEO) and the hype surrounding them.

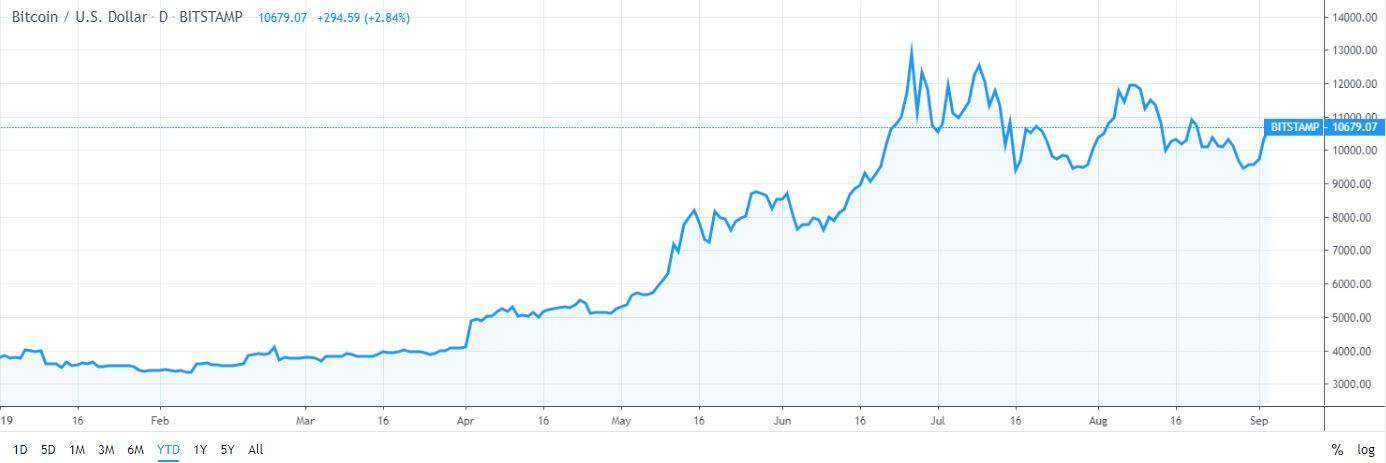

Amid all this, it’s hard not to notice that Bitcoin, the leading cryptocurrency, has managed to retain its value and to substantially increase its market dominance.

Massive Growth of BNB Without Substantial News

As mentioned above, the price of BNB spiked quickly to $22 from January to April. One of the only seemingly fundamental reason behind the prominent increase came in early January when the company announced a game-changing platform – Binance Launchpad. IEOs quickly became an extremely hyped way for startups to raise money and Binance Launchpad quickly established itself as a standard-setting market leader.

Since the launchpad only allowed users to purchase the newly issued tokens with Binance Coin (BNB), this created a substantial demand for the cryptocurrency. Back at the days, IEOs used to generate massive returns, and it wasn’t uncommon for the entire event to end in just a few seconds, with millions of BNB used to buy freshly launched tokens.

We saw that this had an immediate impact on the price.BNB went on to produce an all-time high against the USD, reaching almost $40 in June, representing a staggering increase upwards of 560% at the time.

But things went south from there.

BNB/USDT. Source: TradingView

Substantial News But a Notable Price Decline of BNB

Binance continued to showcase breaking announcements regularly. As it’s almost always the case, Changpeng Zhao, the CEO of the exchange, also contributed to spreading the word by being incredibly proactive within the cryptocurrency community. But for some reason, investors aren’t having it anymore.

The company added margin trading options, allowing users to trade cryptocurrencies with leverage. The news kept coming, as Binance announced that they intend to launch localized stablecoins resembling Facebook’s Libra.

Not that long after that, Binance also launched the so-called Binance Lending. This is an option which allows its users to lend BNB, USDT, and ETC for a pre-set period of time for a certain annualized interest rate, potentially allowing them to earn passively.

And if all of the above wasn’t enough, just yesterday the exchange announced the acquisition of a crypto asset derivatives trading platform JEX. The company’s direction appears to be clear – offering everything that a crypto investor might need.

Despite all those efforts and groundbreaking projects, however, Binance Coin’s price suffers constantly after its $40 USD run. As you can see on the above chart, ever since June 22nd, BNB appears to be in a severe downtrend, plummeting down to $21.14 USD on the 2nd of September. This marks a 47.2% decrease from its ATH value.

In other words, it appears that the fundamental factors for BNB’s price increase don’t seem to come into play. Seemingly, Binance is doing everything right and CZ continues to be as proactive as he has ever been but for some reason, this doesn’t seem to bring any good news for BNB holders.

Bitcoin Sits Unchallenged

The largest cryptocurrency is having a solid 2019 as well. Since January 1st, BTC is up approximately 180%.

It’s also worth noting that fundamentally, Bitcoin is looking stronger than ever.

The owner of the New York Stock Exchange (NYSE), the Intercontinental Exchange (ICE), has received regulatory clearance and has confirmed that it is on schedule to launch its physically-delivered Bitcoin futures trading platform on September 23rd. This move is intended to bring Bitcoin to institutional investors.

During tough times for the traditional markets due to the trading uncertainties between China and the U.S., Bitcoin’s price remained stable and it even demonstrated a negative correlation. As such, investors saw in it a safe haven amid the collapsing traditional markets.

BTC/USD. Source: TradingView

Bitcoin started the year trading at around $3,700 USD and hit a 2019 high of almost $14,000 USD. Even though the price is currently around $10,400 USD, it is still up more than 180% year-to-date. Comparing both Bitcoin’s and BNB’s price since their yearly ATHs, we can see that the former marked a more substantial decrease of 47% against only 25% for Bitcoin, despite the major and regular announcement coming from Binance.

It’s also important to note that BNB has been losing its value against BTC for the better half of 2019. Ever since April, despite all of the major announcement that we mentioned above, Binance Coin is down 54% against BTC since its ATH. It’s not just BNB, though, as other major cryptocurrencies are constantly seeing new lows in their trading against the market leader.

Bitcoin’s dominance has surpassed 70% for the first time in 27 months, further establishing the cryptocurrency as the predominant market leader.

More news for you:

The post appeared first on CryptoPotato