Abstract: We examine the idea of outsourcing stake to third party validators in the Proof of Stake process, which potentially decouples the coin holders from the consensus agents. We explain why such services are likely to be popular due to some attractive advantages for users, such as the issuance of tokens and higher yields. We examine Lido, a large staking service which currently accounts for around 18% of the Ethereum at stake and we speak to one of the main proponents of Lido’s staking pool. We conclude by arguing that critics of Proof of Stake systems are likely to focus on the popularity of these outsourced staking systems as one of their main concerns in the coming years.

Overview

This is part three in our recent series on Ethereum’s proof of stake system, following on from last month’s piece “Calculating Penalties & Rewards”.

Core to the idea of staking is to align the interests of coin holders and consensus agents by making them the same entities. However, a potential problem here exists: coin holders could outsource the staking process to a third party, thereby negating the alignment of incentives and somewhat undermining the staking process. A similar potential problem occurs for Proof of Work (PoW) mining, in the form of leasing the hashrate. You may have heard the argument that PoW miners would never do a large re-organisation and double spend attack, because this would undermine the capital investment they made into Bitcoin mining. Well if a significant proportion of the hashrate is leased, this apparent protection does not seem to exist. Therefore, we would argue that if a large and liquid hashrate leasing market exists, this could undermine some PoW security assumptions. This equivalent problem exists for the PoS process and in this report we explain why outsourcing could be more common in a PoS type system and therefore it could lead to more problems. However, you could also argue that PoW miners entering public markets via IPOs, presents a similiar potential problem for Bitcoin.

We have to admit that we were probably wrong in April 2018, when we overlooked this weakness of PoS systems in our comment below:

Another major problem with PoW based systems is that the interest of miners may not align with that of coin holders, for example miners could sell the coins they mine and then only care about the short term, not long term coin value. Another issue is that hashrate could be leased, with the lessee having little or no economic interest in the long term prospects of the system. PoS directly ties the consensus agents to an investment in the coin, theoretically aligning interests between investors and consensus agents.

Financialisation

Renting hashrate has certainly been a popular activity in the past and active markets still exist. However, in our view, it is still a reasonably specialised product. In contrast to this, outsourcing of the staking process feels almost like a mainstream financial product, for both retail and institutional investors. Staking is almost purely financial in nature, rather than hashrate leasing, which has some other operational characteristics. Most of the large crypto exchanges either offer or plan to offer custodial staking services. At the same time, staking seems quite suitable for an investment product. Why should anyone invest in a plain vanilla Ethereum fund or ETP when they could invest in a version with staking and earn a higher return? Of course many people actually need to use Ethereum to pay gas fees and these balances cannot be staked, however most holders of Ethereum are still speculators and investors. For these investors they are likely to want staking products and most mainstream investors and holders will not conduct the staking process themselves, it will be outsourced.

Tokenisation

The entities performing the outsourced staking as a service could also issue tokens to their clients, representing shares in the staking pool. Staking rewards could then be issued to these token holders. This activity may prove very popular in the Ethereum community, when users love being issued new tokens. These new tokens could be ERC-20 tokens on the Ethereum blockchain, just like Ethereum, except they have credit risk associated with the staking pools and you cannot pay gas fees with them.

The user advantages of this token approach are clear:

- It provides owners of the staking pool the ability to enter and exit more easily, without any lags.

- It mitigates one potential problem with staking on Ethereum, mainly that the staking yield would need to compete with other yields inside the system (for example yields you could earn on Defi). This could mean for instance the Ethereum staking returns are too low and Ethereum needs to inflate the supply further to ensure sufficient security. With this token approach, stakers can now earn two yields at the same time, thereby partially negating this problem. For example one could deploy the staking pool token into the Defi ecosystem and earn even more yield.

Some argue that the risks associated with tokenisation of staking pool shares could be mitigated when ETH 2.0 actually “properly” goes live. At the moment staked Ethereum is essentially locked and cannot be redeemed. Selling these tokens are therefore the only way to exit staking. Once ETH 2.0 is live, stakers will have another redemption mechanism. However, the staking pool tokens could still remain popular after ETH 2.0 launches, because the staking pool tokens would still have a faster redemption mechanism, making them appealing.

Lido

Lido is a project that already enables the tokenisation of Ethereum staking. At the time of writing the pool already has an c18% share of all the Ethereum at stake. This apparent centralisation problem is already concerning some in the Ethereum community.

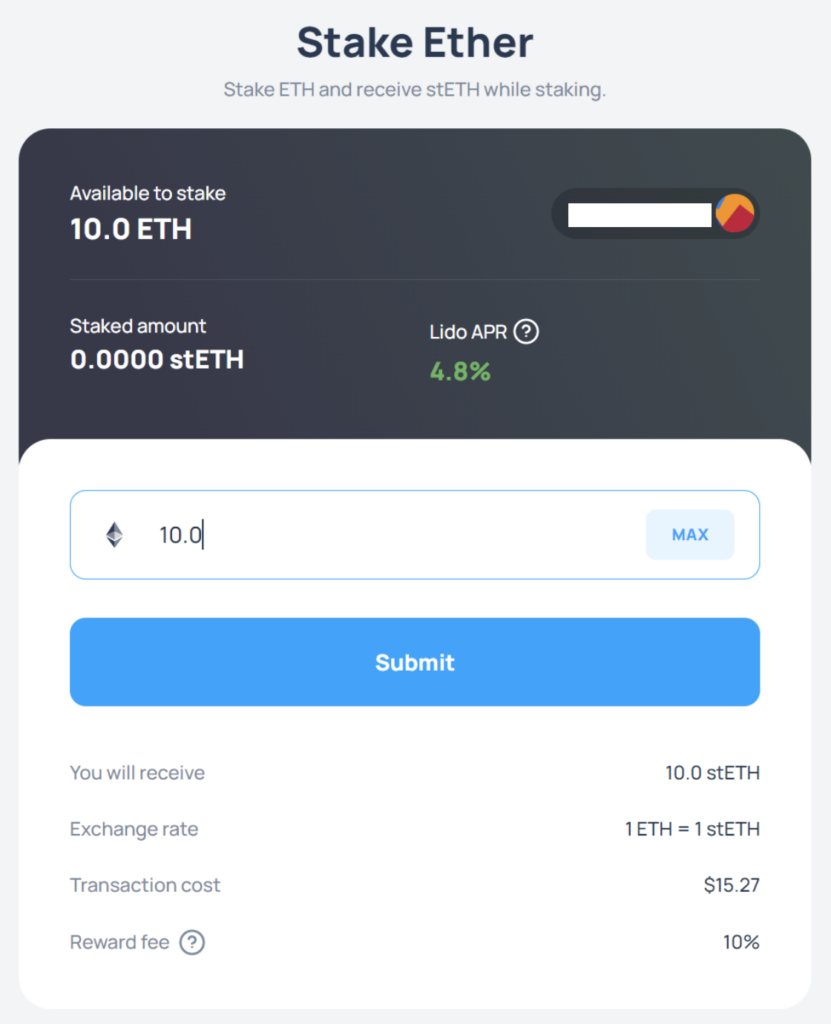

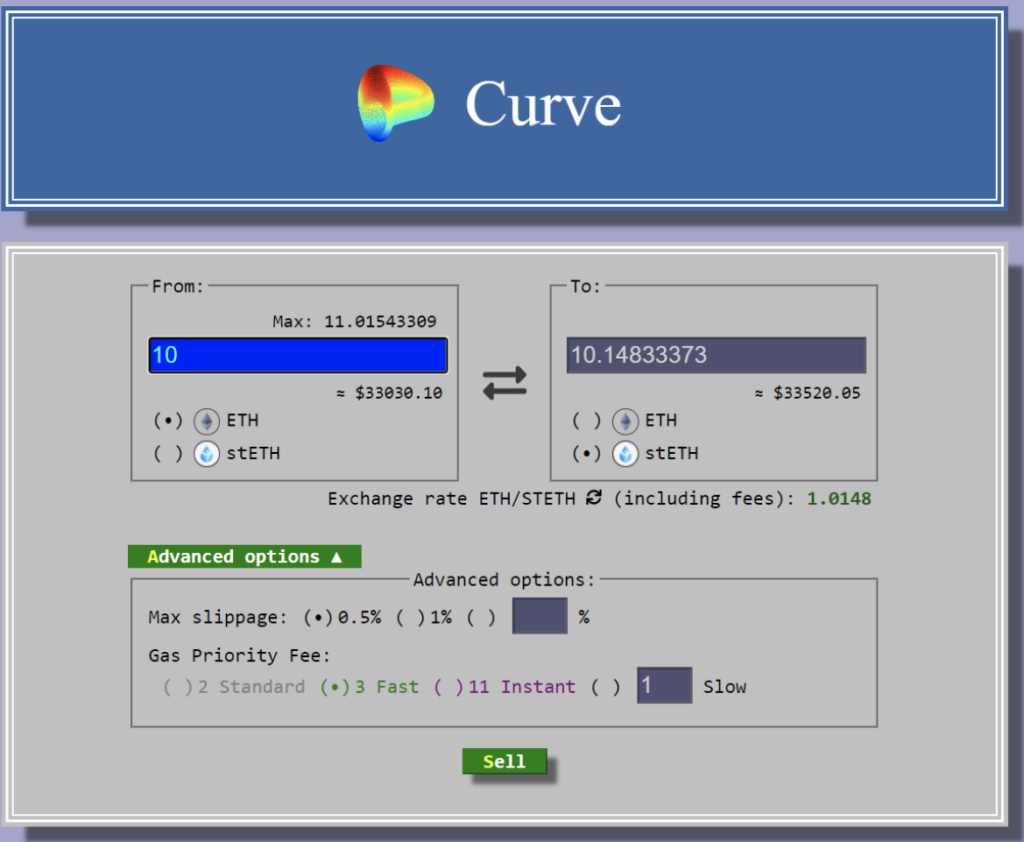

The Lido Ethereum staking token is called stETH and obtaining the coin is pretty easy, one can either have the coin issued by adding Ethereum to the staking pool on the Lido website or one can buy stETH in the open market, for example on curve.fi. In theory the value of stETH should never be worth more than one ETH, since it can always be created using Ethereum and a 1 to 1 ratio.

Source: https://stake.lido.fi/

Source: https://curve.fi/steth

When one holds stETH, investors recieve a daily staking reward, after fees have been deducted. There are numerous staking pools behind Lido, where the staking funds are allocated. Lido itself claims to be a decentralised DAO, with its own token and own governance process. One can argue that these more layers of decentralised systems merely obfuscate away the problems with complexity. On the other hand these layers and complexity can make the systems harder to censor, as the authorities may not know which element of the system to target. However, analysing the decentralisation characteristics of the Lido DAO is beyond the scope of our analysis.

Interview with Hasu

Below we conducted an interview with cryptocurrency researched and advocate of decentralized staking pools Hasu, about Lido:

- If there is no company and LIDO is decentralised, who runs the lido.fi website?

The Lido website and infrastructure are currently maintained by p2p.org and Chorus One, two founding members of the DAO. Another important question might be who owns the brand/trademark. So far, nobody does, but there are considerations around creating a neutral foundation that could own the trademark and other important assets.

- Who implements the decision to allocate funds to stakers? I get the decision is a vote, but is implementation of the vote centralised?

First, let me clarify some lingo: In Lido, “stakers” are the customers who deposit ETH with us to receive stETH. That ETH gets delegated to “node operators”, and “validators” are their individual nodes (each validator can stake exactly 32 ETH, no more no less).

When a staker deposits with Lido, they receive stETH immediately. Meanwhile the ETH first goes into a deposit pool. Once there is enough to spin up a new validator, it gets automatically allocated to a node operator by the smart contract. The potential to be allocated to is the so-called “white-listing” onto the node registry, which is subject to a DAO vote. The vote itself is the result of the proposal submitted by the Lido Node Operator Subgovernance Group. So far we’ve never had the DAO reject the proposed candidates, but it could happen.

Many Lido stakeholders recently co-published a post that is half mission statement, half long-term roadmap, called The Road to Decentralized Staking. It discusses the exact trust assumptions users have to make with Lido right now, and our plans for reducing them to an absolute minimum.

I think the opposite is true – in my article On Staking Pools and Staking Derivatives with Georgios Konstantopoulos we explain how the ability to issue derivatives on stake (which is much easier than in PoW) can create a large network effect for staking pools. This and other advantages put centralised exchanges into the best position to offer staking.

However, if too many people stake with centralised exchanges, the result can be economic and political centralisation in the consensus set, ultimately hurting the censorship resistance of the chain itself. Lido is an attempt at building a staking pool that is decentralised enough to minimize that risk, but scalable enough to compete with CEXs.

- Can stETH be used in Defi to earn even more yield?

The best thing to do right now is putting your stETH in an incentivized stETH/ETH pool on a decentralized exchange. As long a stETH trades close to 1:1 with ETH, there is no impermanent loss, only trading fees and incentives. Pools like that exist right now on Balancer and Curve.

Further, there are active proposals to allow stETH as collateral in lending markets such as Maker, Aave and Compound. I am optimistic that users can soon use their stETH in a wide variety of Defi applications.

- In the future, do you think that nobody will want to hold ETH, because stETH is better?

That would depend on two factors. First, can we execute on our roadmap to make stETH sufficiently trustless compared to ETH? And second, will stETH be accepted in many applications similar to how ETH is today?

Together, they determine the opportunity cost of holding stETH over ETH. If that cost is low enough, then I believe stETH could become to ETH what a US government bond is to a physical dollar – the quasi risk-free rate.

- Have you done any thinking into ETH staking Exchange traded products (ETPs)? Many ETP providers are becoming keen on the idea, since staking seems more suitable for ETPs and ETPs without staking could lose market share. Maybe stETH could be used to help make ETPs

Nothing explicitly on ETPs, but we are very interested in making stETH available to a more consersative audience. This could include products where the stETH are held in custody, such as an investment trust available through a traditional broker. But also on-chain products with lower risk, such as a way to stake stETH and give up some of the yield in exchange for an extra layer of insurance.

Another hurdle for traditional investors is a lack of tax clarity when depositing ETH and receiving stETH. We are currently exploring how to clarify this question for investors and give them the certainty they need.

- And finally, could go really meta, make a rollup sidechain where you pay fees in stETH

You could do that, but in my view rollup users will be able to pay the sequencer in any currency they want, including the token they are currently transferring or buying. Requiring specific tokens for fees is bad UX and not a design pattern that will exist long-term.

Conclusion

In our view, large amounts of outsourced stake are a significant potential problem for the ETH 2.0 network. Both in that it can be considered as centralisation, with a few dominant services such as Lido or large centralised custodians, but also because the validators may have less economic interest in the system and therefore a lower incentive to validate correctly. There are also some economic questions, if outsourcing becomes so easy and attractive, such that almost everyone stakes, then this resurrects one of the traditional criticisms of PoS, that the rewards are not “real” at all and it’s only the same as inflation.

In practise, in the medium term, the outsourcing issue may become a real issue, in terms of perceived centralisation on the network. If the percentage of coins staking inside these outsourced systems reaches over 50%, this is likely something that the critics will jump on. As for whether this potential problem causes actual network issues impacting users, for at least the next few years, perhaps not. However over the longer term, these weaknesses could add up.

Related

The post appeared first on Blog BitMex