The second-largest cryptocurrency by market cap has been enjoying a massive bull run as of late. Following the massive increase in its value over the past few months, over 90% of ETH holders are now in a state of profit, recent data revealed.

ETH’s Ongoing Bull Run

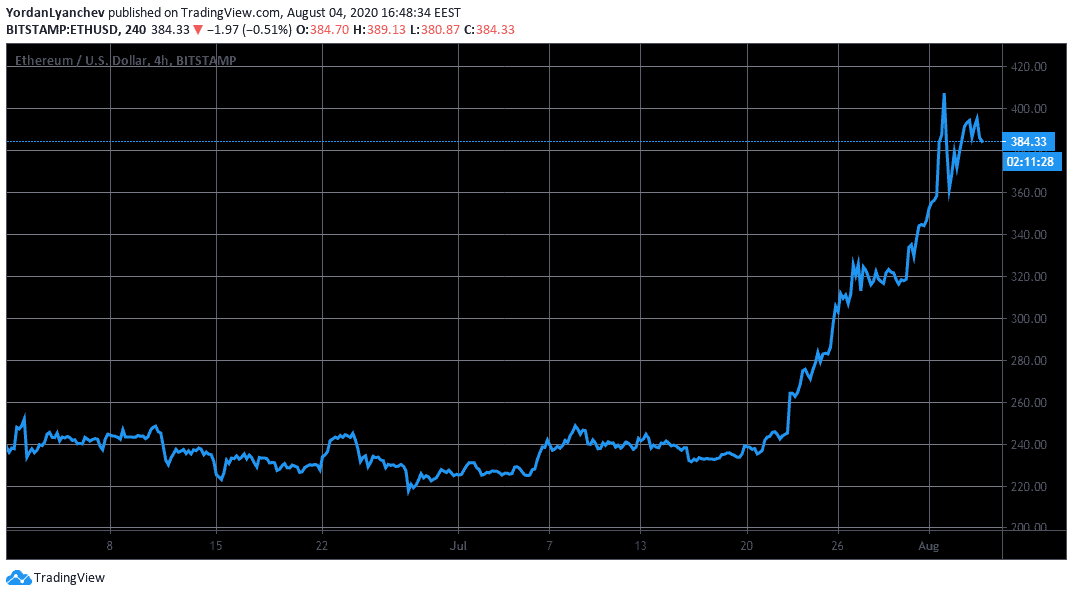

Ethereum’s price was stuck in a range between $200 and $250 for several months. Although its blockchain network is the underlying technology behind the recent DeFi boom, the asset’s price performance was lagging. In fact, multiple reports suggested that ETH is undervalued and may be long overdue for a substantial increase.

All that changed in late July. ETH traded at $240 on July 22nd, but in the following few weeks arrived the anticipated increase as its price skyrocketed by 70% and reached a yearly high of over $400. Despite retracing slightly since then, Ether is still trading at about $385 – a level not seen since August 2018.

90% Of ETH In Profit

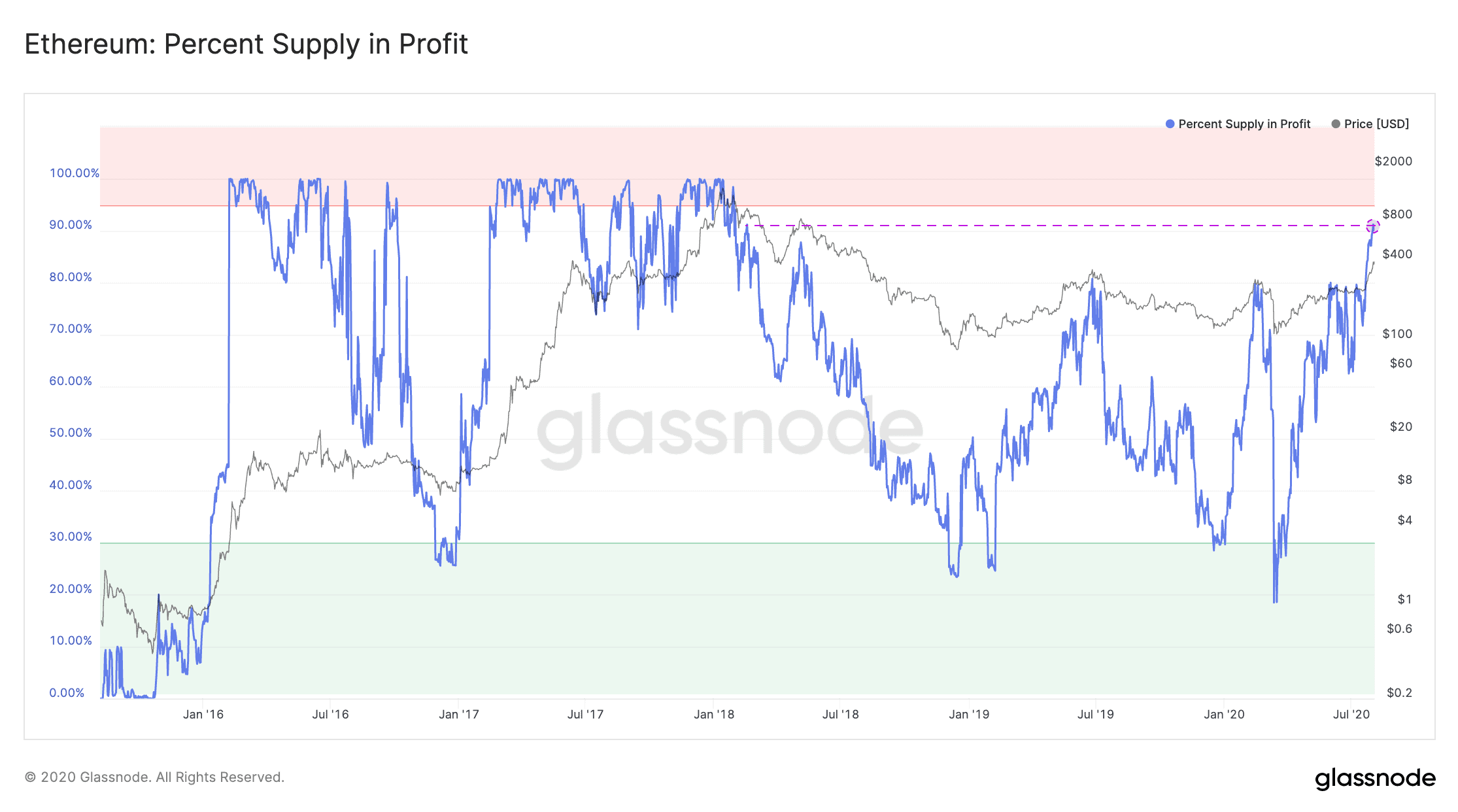

By increasing its value so rapidly, Ethereum has put the majority of its token holders in a state of profit, according to data from the cryptocurrency analytics company Glassnode. This means that 90% of all ETH HODLers have purchased their assets at a lower price than the current one.

Interestingly, the last time such a large percentage was in profit was over two years ago, after the parabolic price increase in late 2017/early 2018. Glassnode noted that it happened when ETH’s price was at $925. This only goes to show that despite the tanking price since then, investors remained interested in accumulating more of the ETH token.

Plausible Correction On The Way?

However, the graph could also raise a question whether or not Ethereum may be heading for a correction as its closing down to the “red area” of above 95%. Historically, after each case ETH went in that area followed a steep correction.

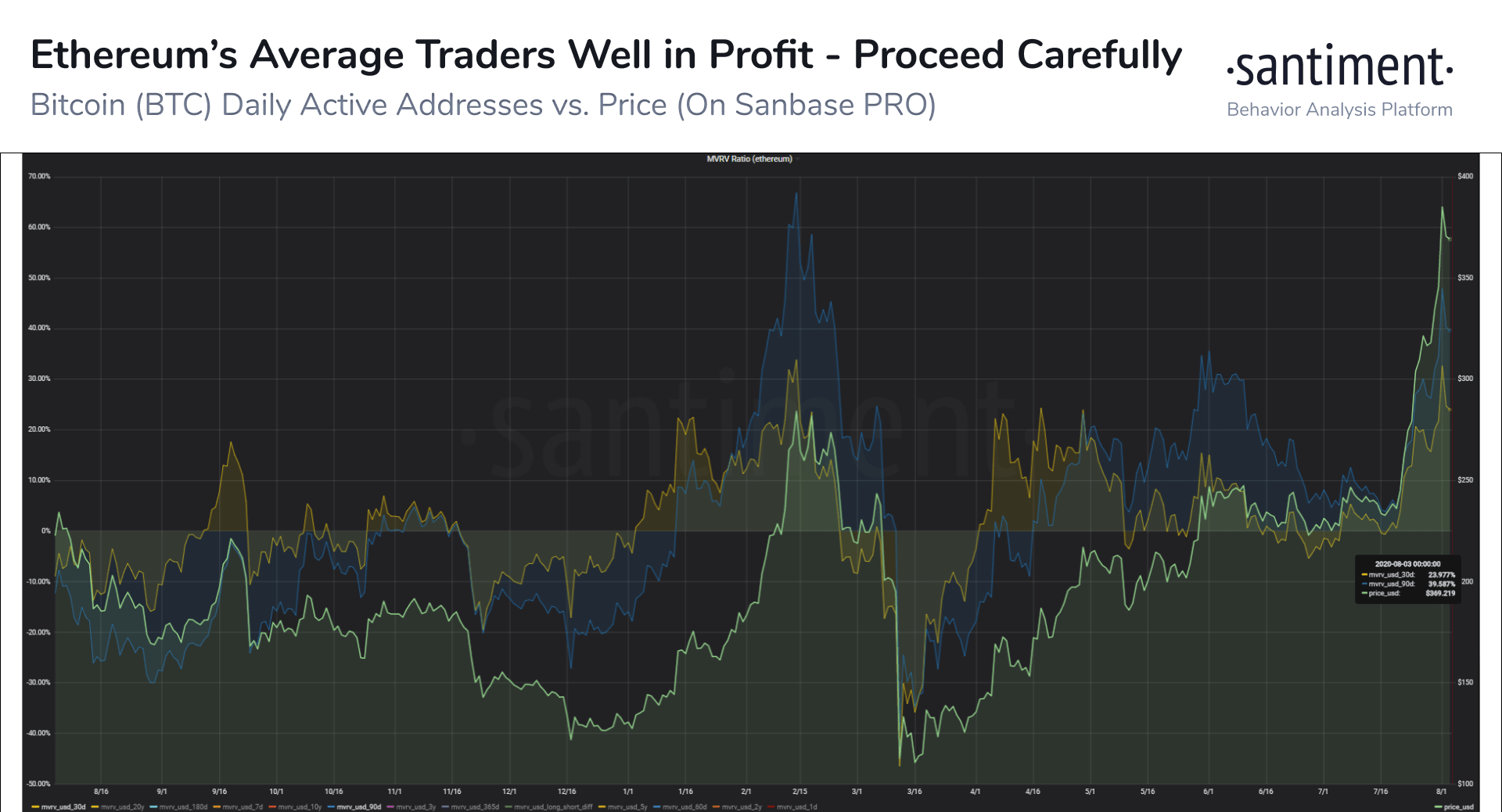

Additionally, data from Santiment highlighted that Ethereum’s “average returns for traders over the past month have been exceptional (+23.98%), as many would likely suspect. The problem is that they’ve almost been a bit too exceptional.”

Per the metric comparing the ratio of an asset’s market cap to its realized cap (MVRV), which could outline the fair value, Ethereum’s latest run may have attracted lots of FOMO and FUD. Consequently, the company noted that a “shake-out” frequently follows to remove the “weak hands.”

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato