Pepe (PEPE) the popular and third-biggest meme coin is gaining notable attention from traders and investors due to the ongoing dumps by whales. On August 30, 2024, the PEPE whale once again dumped over 330 billion tokens worth $2.53 million to the Kraken cryptocurrency exchange and booked a loss of over $3.13 million, as reported by Lookonchain.

PEPE Whale Bearish Outlook

Despite this dump, the whale still holds a significant 1 trillion PEPE tokens worth $7.57 million in its wallet. However, this whale purchased over 828.64 billion PEPE tokens worth $6.18 million on August 18, 2024.

The bearish market sentiment and notable dump by this whale signal a massive sell-off ahead.

PEPE Price Prediction

According to the expert technical analysis, PEPE is near a crucial support of $0.000007 level. It is trading below the 200 Exponential Moving Average (EMA) on a daily time frame, signaling a downtrend. However, the Relative Strength Index (RSI) is in the oversold territory, indicating a sign of potential price recovery.

Based on the historical price momentum, there is a high possibility that PEPE could see a significant price surge of 22% to the $0.00000938 level. Meanwhile, if PEPE fails to hold the support level and closes a daily candle below the $0.00000672 level, there is a high chance it could fall to the $0.000006 level, in the coming days.

Rising Open Interest and On-Chain Metrics

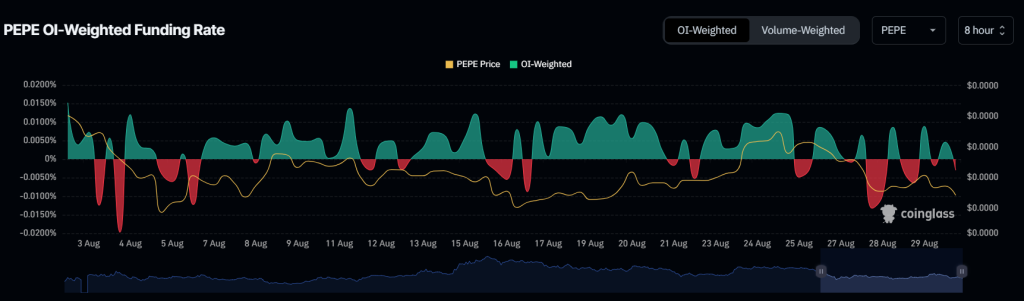

Coinglass’s PEPE OI-weighted funding rate indicates that short sellers are dominating the asset and have the potential to liquidate millions worth of long positions. According to the data, PEPE’s OI-weighted funding rate stands at -0.0030%, which is a bearish sign and suggests the token may see a price decline in the coming days.

At press time, PEPE is trading near the $0.0000076 level and has experienced a modest price decline of 0.6% in the last 24 hours. Meanwhile, its open interest has increased by 6% during the same period, indicating growing interest from traders and investors amid selling pressure.

The post appeared first on Coinpedia