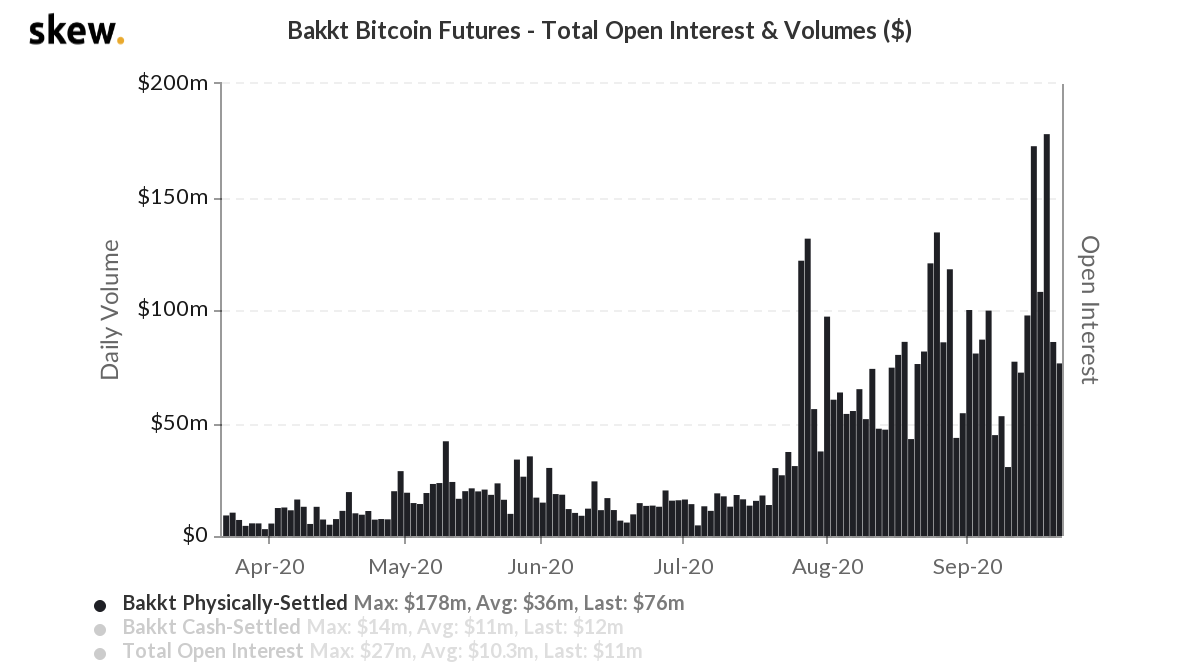

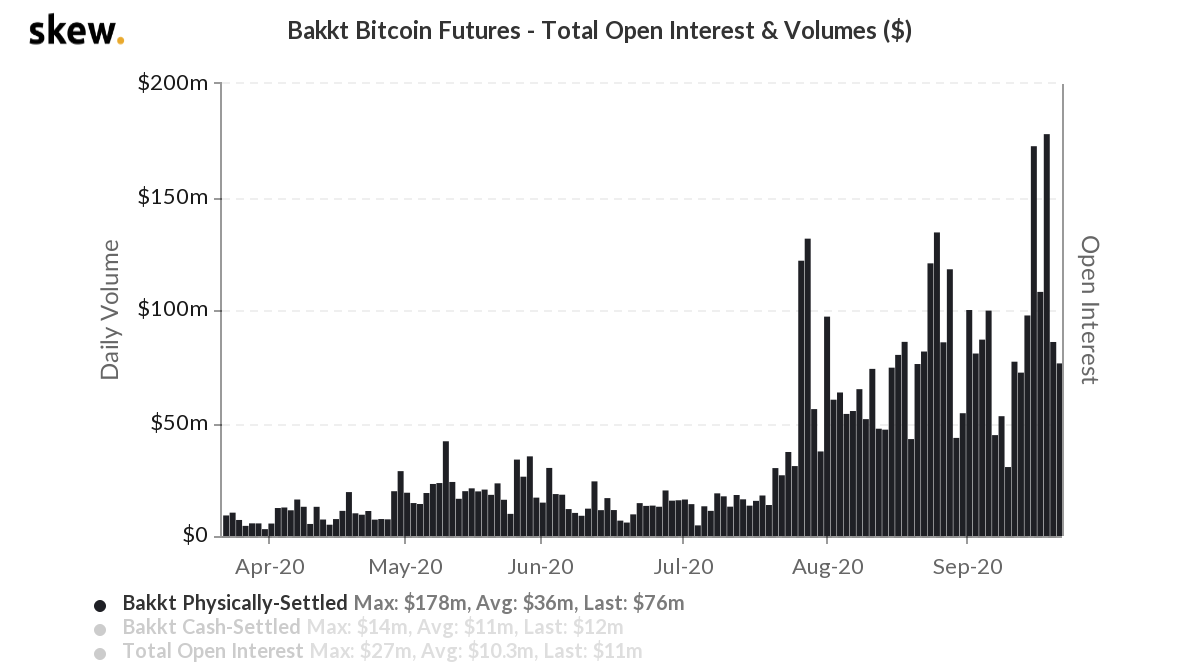

Physically settled BTC Futures on Bakkt are 322% higher relative to the July 2020 level. The average daily volume is $36 M.

Source: Skew

Open interest increased 197% over the past two months and the growth of physically settled BTC Futures is proportional to the same. Physically settled BTC futures on Bakkt were the first offering of Bakkt, launched in September 2019. On-chain analysts believe that physically settled contracts have a higher impact on Bitcoin’s price on spot exchanges.

When physically settled BTC contracts hit a high in mid-August 2020 and during the last week, the price on spot exchanges corresponded to it. However, apart from a direct impact on prices, physically settled BTC contracts are possibly representative of conservative day traders and new buyers on derivatives exchanges.

Source: Tradingview

As the risk and volatility associated with physically settled contracts are less, compared to cash-settled contracts, there is a possibility that demand for it will increase in the future as more traders explore derivatives. The other driving force for the demand for physically settled BTC futures is the possible manipulation involved in cash-settled BTC contracts.

It is challenging to point out exactly when and how spot exchanges are manipulated, however, the following instance will fill the gaps. Back in May 2019, there was an instance of manipulation in cash-settled contracts on BitMEX. On the 17th, the price of Bitcoin on Bitstamp started falling rapidly and dropped 11% in 10 minutes and hit $6178. This did not impact prices on other spot exchanges and the crash was caused by a large sell order.

Source: Tradingview

Dovey Wan, founder of Primitive Crypto tweeted about the incident and highlighted the fact that this was a deliberate scheme to book profits on a short on BitMEX.

Source: Twitter

While this is one incident of such manipulation, cash-settled BTC futures contracts have a reputation for the same. Physically settled futures protect the derivatives trader from the downside of ascertaining the settlement price based on the price of spot exchanges. While institutional investors aren’t big on it yet, with the rising interest from institutions like MicroStrategy, there is a high possibility that institutions may choose physically settled contracts over cash and this is a huge win for Bakkt.

The post appeared first on AMBCrypto